Prevas (OM:PREV B) Margin Falls to 4% on SEK29.3m Loss, Challenging Bullish Narratives

Reviewed by Simply Wall St

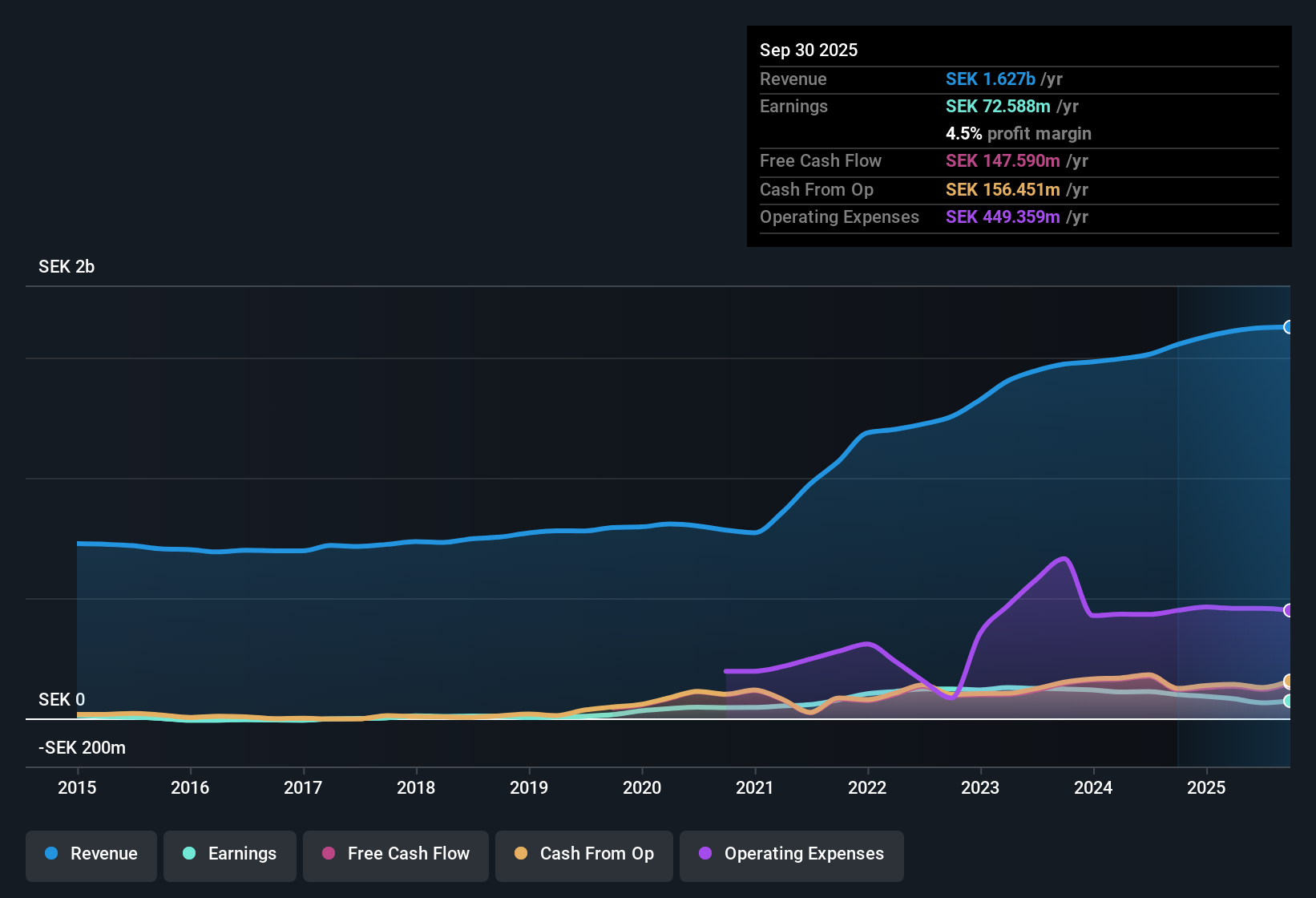

Prevas (OM:PREV B) is forecast to deliver revenue growth of 5.7% per year and a robust 29.3% annual expansion in EPS, both outpacing the Swedish market averages of 3.9% and 12.6% respectively. Despite an 8.3% per year earnings growth over the past five years and favorable valuation multiples, recent profitability has come under pressure. The net profit margin fell to 4% from last year's 7.4%, and a one-off SEK29.3 million loss weighed on the latest results. Even so, investors are likely to focus on the company’s competitive growth profile and value compared to peers and the broader European IT sector.

See our full analysis for Prevas.Next, we will see how these headline results stack up against the wider narratives that are shaping opinions about Prevas’s future prospects.

See what the community is saying about Prevas

Strategic Sectors Power Revenue Visibility

- Prevas is seeing increased demand from the defense and energy sectors, with turnover shares climbing to 15% and 12% respectively for the first half of 2025. Both are up compared to previous years, highlighting a growing reliance on long-term, recurring contracts.

- According to the analysts' consensus view, the company's focus on automation, AI, and cybersecurity in high-value projects is expected to reinforce margin potential and support contract longevity.

- Consensus narrative notes that integration of recent acquisitions and deeper partnerships like those with Hexagon position Prevas to capture larger digital transformation budgets from these sectors.

- This combination is anticipated to drive multi-year revenue and margin expansion, despite ongoing talent scarcity in the Nordics.

- For a deeper dive into how analysts weigh sector strength against operational challenges, check out the full consensus narrative for Prevas. 📊 Read the full Prevas Consensus Narrative.

Margin Recovery Hinges on Turnaround

- The net profit margin, now 4%, remains well below last year’s 7.4%, held back by a one-off SEK29.3 million non-recurring loss that notably impacted recent earnings quality.

- Analysts' consensus view highlights ongoing restructuring and talent retention efforts.

- Tighter operational efficiency and regional restructuring are expected to help restore margins to a forecast 9.6% over the next three years,

- but the risk remains that continued labor shortages or delayed customer projects could stall the margin rebound and restrict earnings growth.

Valuation Gap versus Peers and Targets

- Prevas trades on a Price-to-Earnings ratio of 15.5x, below both local peers (16.1x) and the broader European IT industry average (19x). The current share price of SEK 78.00 sits 41% under the analyst price target of SEK 132.50.

- Analysts' consensus view connects these multiples to investor appeal.

- Consensus sees the current pricing as reflecting short-term margin concerns but offering compelling upside if forecast revenue and margin growth are delivered.

- However, heavy regional concentration and competitive headwinds could justify the discount if execution on growth or turnaround falls short.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Prevas on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a distinct interpretation of the figures? Share your perspective and shape a fresh narrative in just a few minutes. Do it your way.

A great starting point for your Prevas research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite strong long-term forecasts, Prevas faces ongoing margin pressure and uncertainty from non-recurring losses and operational restructuring. These factors could slow its earnings rebound.

If you prefer consistent financial performance, use our stable growth stocks screener (2099 results) to find companies that deliver reliable revenue and earnings growth across changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:PREV B

Prevas

Provides technical consultancy services in Sweden and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives