- Germany

- /

- Metals and Mining

- /

- DB:02P

3 European Penny Stocks With Market Caps Under €30M

Reviewed by Simply Wall St

As European markets remain largely stable, with the STOXX Europe 600 Index showing minimal change, investors are closely watching interest rate policies and trade developments. For those looking beyond the major indices, penny stocks present intriguing possibilities. Despite being a term from earlier market eras, these smaller or newer companies can offer a blend of affordability and growth potential when backed by strong financials. In this article, we explore three European penny stocks that stand out for their financial resilience and potential for growth.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.112 | €1.42B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.01 | €15M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.35 | €44.5M | ✅ 5 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €225.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.83 | €39.16M | ✅ 3 ⚠️ 3 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.494 | RON16.71M | ✅ 2 ⚠️ 4 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.18 | €10.09M | ✅ 2 ⚠️ 5 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.505 | €398.17M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.04 | €281.97M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 330 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Pearl Gold (DB:02P)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pearl Gold AG is a holding company that invests in gold mining projects across Africa, with a market cap of €18.25 million.

Operations: No revenue segments are reported for this company.

Market Cap: €18.25M

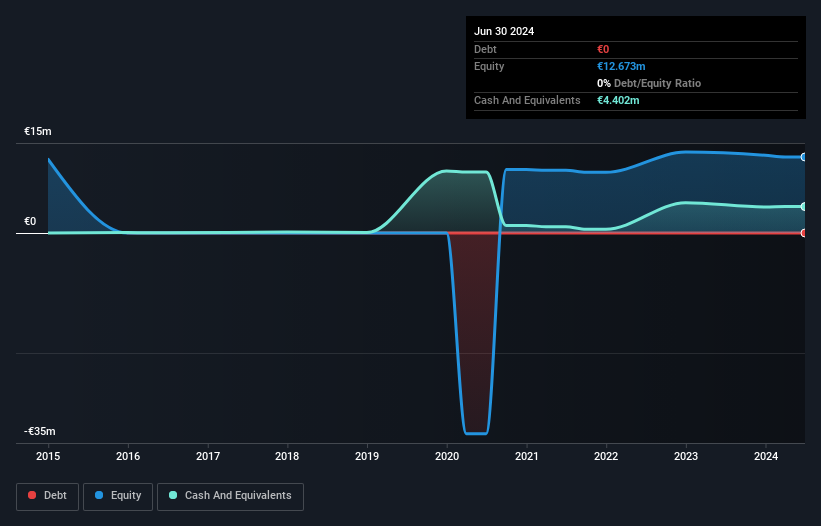

Pearl Gold AG, with a market cap of €18.25 million, is pre-revenue and currently unprofitable, having seen losses increase by 33% annually over the past five years. The company operates without debt, which eliminates concerns about interest coverage and debt repayment. Its short-term assets of €9.3 million comfortably cover both short-term (€265.2K) and long-term liabilities (€266.8K). However, the stock has experienced high volatility recently, with weekly fluctuations increasing from 19% to 24%. Despite these challenges, the board of directors is considered experienced with an average tenure of 7.7 years.

- Navigate through the intricacies of Pearl Gold with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Pearl Gold's track record.

Precise Biometrics (OM:PREC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Precise Biometrics AB (publ) is a company specializing in cybersecurity and biometric solutions, operating in Sweden, Taiwan, China, the United States, and internationally with a market cap of SEK255.35 million.

Operations: Precise Biometrics generates revenue from two main segments: Digital Identity, which contributes SEK21.47 million, and Biometric Technologies, accounting for SEK63.90 million.

Market Cap: SEK255.35M

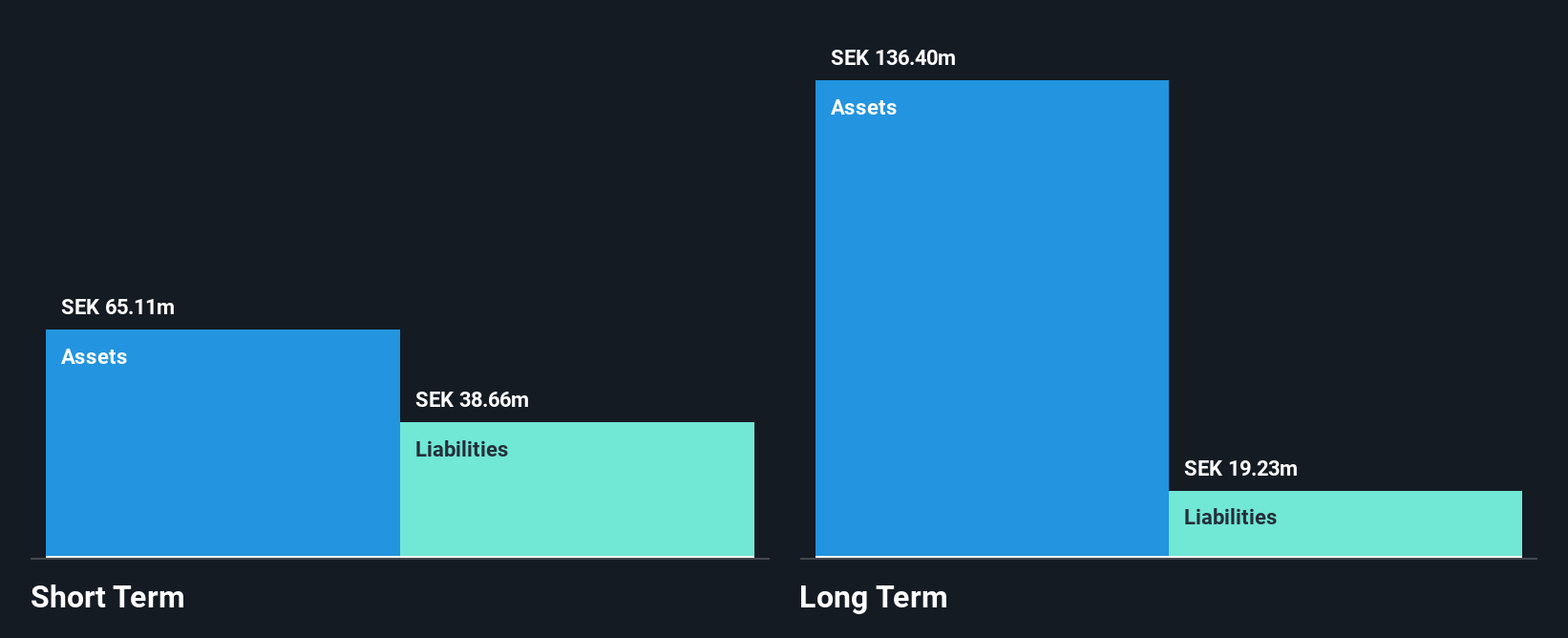

Precise Biometrics, with a market cap of SEK255.35 million, operates in cybersecurity and biometric solutions across multiple regions. Despite being unprofitable, it has maintained a debt-free status for five years and possesses sufficient cash runway exceeding three years due to positive free cash flow. Its short-term assets of SEK55.7 million surpass both short-term liabilities (SEK33.6 million) and long-term liabilities (SEK18.6 million). Recent earnings reports indicate stable sales but persistent net losses; Q2 2025 sales were SEK20.78 million with a net loss of SEK5.77 million, highlighting ongoing profitability challenges amidst declining earnings over the past five years by 18.2% annually.

- Click here and access our complete financial health analysis report to understand the dynamics of Precise Biometrics.

- Evaluate Precise Biometrics' historical performance by accessing our past performance report.

q.beyond (XTRA:QBY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: q.beyond AG operates in the cloud, applications, artificial intelligence (AI), and security sectors both in Germany and internationally, with a market cap of €109.13 million.

Operations: The company's revenue is derived from two main segments: Consulting, which contributes €59.48 million, and Managed Services, generating €129.52 million.

Market Cap: €109.13M

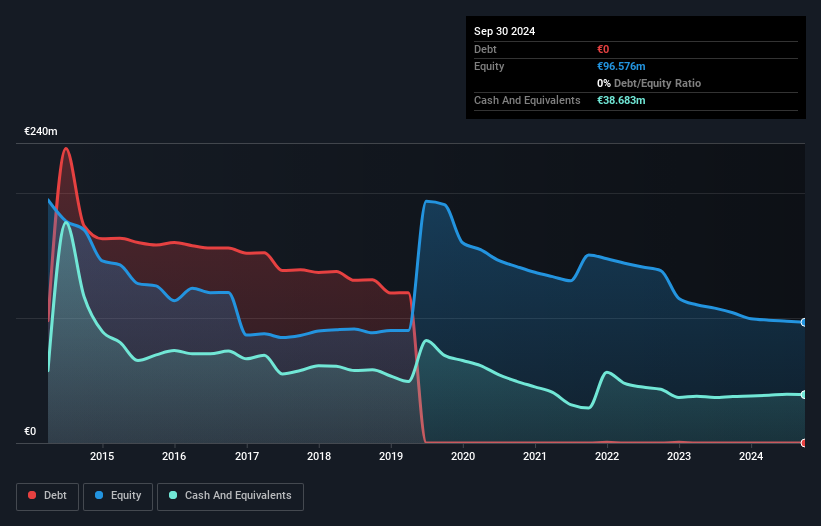

q.beyond AG, with a market cap of €109.13 million, is engaged in cloud and AI services. Despite being unprofitable, it has shown progress by reducing net losses over the past five years at a rate of 14% annually and maintaining a debt-free status. The company has sufficient cash runway for over three years based on its current free cash flow. Recent collaborations with Microsoft and SAP enhance its AI offerings, while client projects like the ERP implementation for Sauels demonstrate operational capabilities. Analysts anticipate earnings growth of 67.12% per year, reflecting potential value compared to peers and industry standards.

- Click here to discover the nuances of q.beyond with our detailed analytical financial health report.

- Review our growth performance report to gain insights into q.beyond's future.

Make It Happen

- Reveal the 330 hidden gems among our European Penny Stocks screener with a single click here.

- Seeking Other Investments? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:02P

Pearl Gold

A holding company, focuses on investments in gold mining projects in Africa.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives