Proact IT Group (OM:PACT) Margin Decline Reinforces Investor Focus on Dividend Sustainability

Reviewed by Simply Wall St

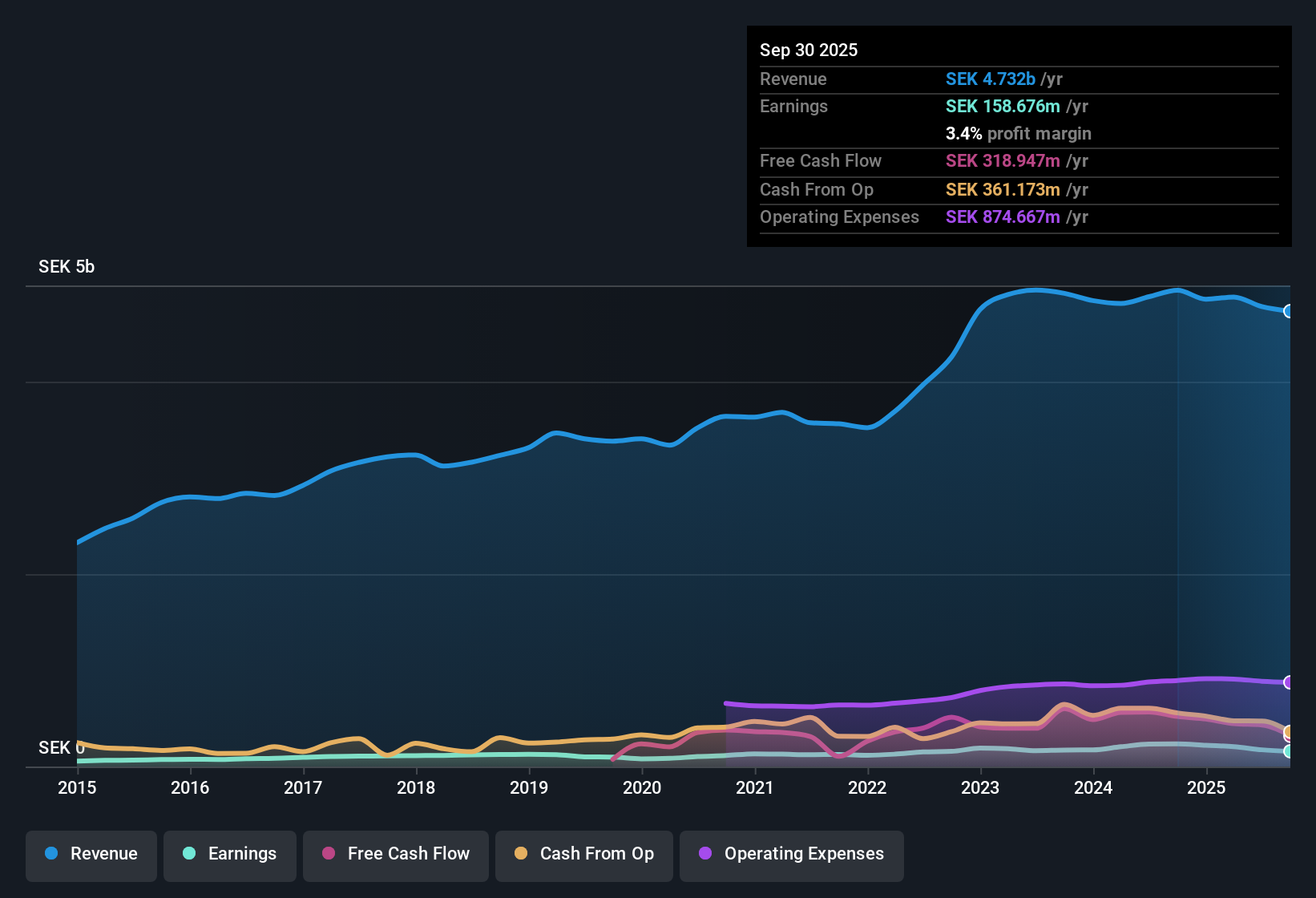

Proact IT Group (OM:PACT) posted net profit margins of 3.6% this year, narrowing from 4.8% a year ago. Earnings growth declined over the past year, despite a strong five-year track record of 13.8% average annual earnings growth. Revenue is forecast to grow at 3.6% per year, slightly below the Swedish market average of 3.9%. The company’s earnings are expected to rise by a robust 18.89% per year. Investors are watching the solid longer-term profit momentum and attractive valuation metrics closely, but recent margin compression and the sustainability of the dividend remain key concerns.

See our full analysis for Proact IT Group.Next, we will see how these financial figures compare to the key narratives discussed among investors. Some expectations might be confirmed, while others could be up for debate.

See what the community is saying about Proact IT Group

Profit Margins Set to Recover

- Analysts expect profit margins to rise from 4.5% today to 5.0% in three years, following a recent dip to 3.6% compared to last year's 4.8%. This points to a potential return to healthier profitability levels if forecasts are accurate.

- The consensus among analysts is positive regarding margin recovery, but they note that achieving this will require Proact IT Group to successfully convert its emphasis on cloud services and AI into higher recurring revenue streams.

- They comment that recurring revenue from cloud service contracts could offer a steadier margin base, which supports the outlook for margin improvement.

- However, recent declines in system sales and increased integration costs in certain regions, such as Central, remain a significant risk that could delay or diminish this upward margin trend.

- See how recent margin shifts challenge analyst consensus in the full narrative. 📊 Read the full Proact IT Group Consensus Narrative.

Valuation Metrics Signal Discount

- Proact IT Group’s price-to-earnings ratio is 16.2x, which is lower than the peer average of 26.4x and below the European IT industry benchmark of 19x. The DCF fair value is 258.53 SEK, which is significantly higher than the current share price of 105.6 SEK.

- The analyst consensus frames this valuation gap as a potential opportunity, linking the below-market PE ratio and notable DCF fair value discount to Proact's record of 13.8% annual earnings growth over five years.

- The consensus currently sets a price target marginally below the market price, indicating that they consider the stock fairly valued for the time being, despite more optimistic signals from the DCF model.

- This contrast highlights the need for investors to carefully assess fair value estimates and consider their own earnings outlook for the company.

Growth Burnished by Market Position

- Revenue growth is projected at 3.6% per year, just under Sweden’s broader market forecast of 3.9%. Earnings are expected to increase at nearly 19% annually, reflecting the company’s expansion into areas such as cybersecurity and AI-driven solutions.

- The consensus view emphasizes that Proact IT Group’s decentralized model and strategic investments in high-growth sectors could help offset slower M&A activity and support longer-term growth momentum.

- Consensus suggests that the company’s ability to respond to regional demand and leverage acquisitions will contribute to earnings resilience, particularly as cloud contracts form a larger part of overall revenue.

- Nonetheless, reliance on certain regions and ongoing market sluggishness, especially in Germany, underscore a cautious perspective regarding uneven growth rates in the coming years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Proact IT Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data through a different lens? Share your insights and craft a unique narrative in just a few minutes with Do it your way.

A great starting point for your Proact IT Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Proact IT Group’s recent margin declines and uneven growth across key regions raise concerns about the consistency and stability of its earnings performance.

If steady performance is your priority, use our stable growth stocks screener (2098 results) to target companies that consistently deliver reliable revenue and earnings regardless of market swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:PACT

Proact IT Group

Provides data and information management services with cloud services and data center solutions in Sweden, the United Kingdom, the Netherlands, Germany, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives