Swedish Exchange Stocks That May Be Undervalued In October 2024

Reviewed by Simply Wall St

As global markets react to China's robust stimulus measures, the Swedish stock market has seen a mix of cautious optimism and strategic recalibrations. With interest rate cuts by the Riksbank and signs of economic stabilization, investors are keenly eyeing potential undervalued opportunities. In this context, identifying stocks that may be trading below their intrinsic value can offer promising investment prospects. Here are three Swedish exchange stocks that might be undervalued in October 2024.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| CTT Systems (OM:CTT) | SEK272.00 | SEK492.37 | 44.8% |

| Concentric (OM:COIC) | SEK219.00 | SEK406.45 | 46.1% |

| Svedbergs Group (OM:SVED B) | SEK42.75 | SEK77.35 | 44.7% |

| Biotage (OM:BIOT) | SEK186.70 | SEK364.36 | 48.8% |

| Lindab International (OM:LIAB) | SEK283.60 | SEK529.84 | 46.5% |

| Mentice (OM:MNTC) | SEK27.90 | SEK50.89 | 45.2% |

| Svedbergs Group (OM:SVED BTA B) | SEK36.30 | SEK65.51 | 44.6% |

| Nexam Chemical Holding (OM:NEXAM) | SEK4.35 | SEK7.93 | 45.2% |

| MilDef Group (OM:MILDEF) | SEK85.30 | SEK160.61 | 46.9% |

| Lyko Group (OM:LYKO A) | SEK118.60 | SEK217.00 | 45.3% |

Let's uncover some gems from our specialized screener.

Billerud (OM:BILL)

Overview: Billerud AB (publ) is a global provider of paper and packaging materials with a market cap of SEK28.97 billion.

Operations: Billerud generates revenue from Region Europe (SEK27.08 billion), Region North America (SEK11.35 billion), and Solution & Other (excluding Currency Hedging, etc.) with SEK2.77 billion.

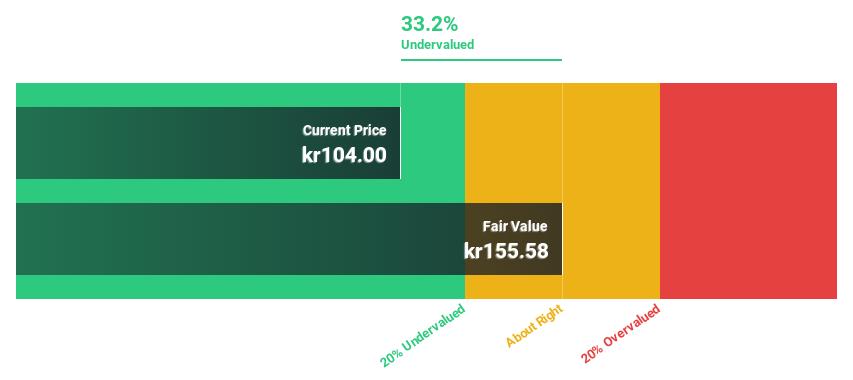

Estimated Discount To Fair Value: 33.1%

Billerud is trading at SEK 116.5, significantly below its estimated fair value of SEK 174.14, indicating it may be undervalued based on cash flows. Despite a recent improvement in net income to SEK 63 million for Q2 2024 from a net loss of SEK 481 million last year, profit margins have declined to 1.7%. However, earnings are forecast to grow significantly at over 31% annually, outpacing the Swedish market's growth rate.

- Insights from our recent growth report point to a promising forecast for Billerud's business outlook.

- Get an in-depth perspective on Billerud's balance sheet by reading our health report here.

Lindab International (OM:LIAB)

Overview: Lindab International AB (publ) manufactures and sells ventilation system products and solutions in Europe, with a market cap of SEK21.80 billion.

Operations: Lindab International AB's revenue segments include SEK9.95 billion from Ventilation Systems and SEK3.28 billion from Profile Systems.

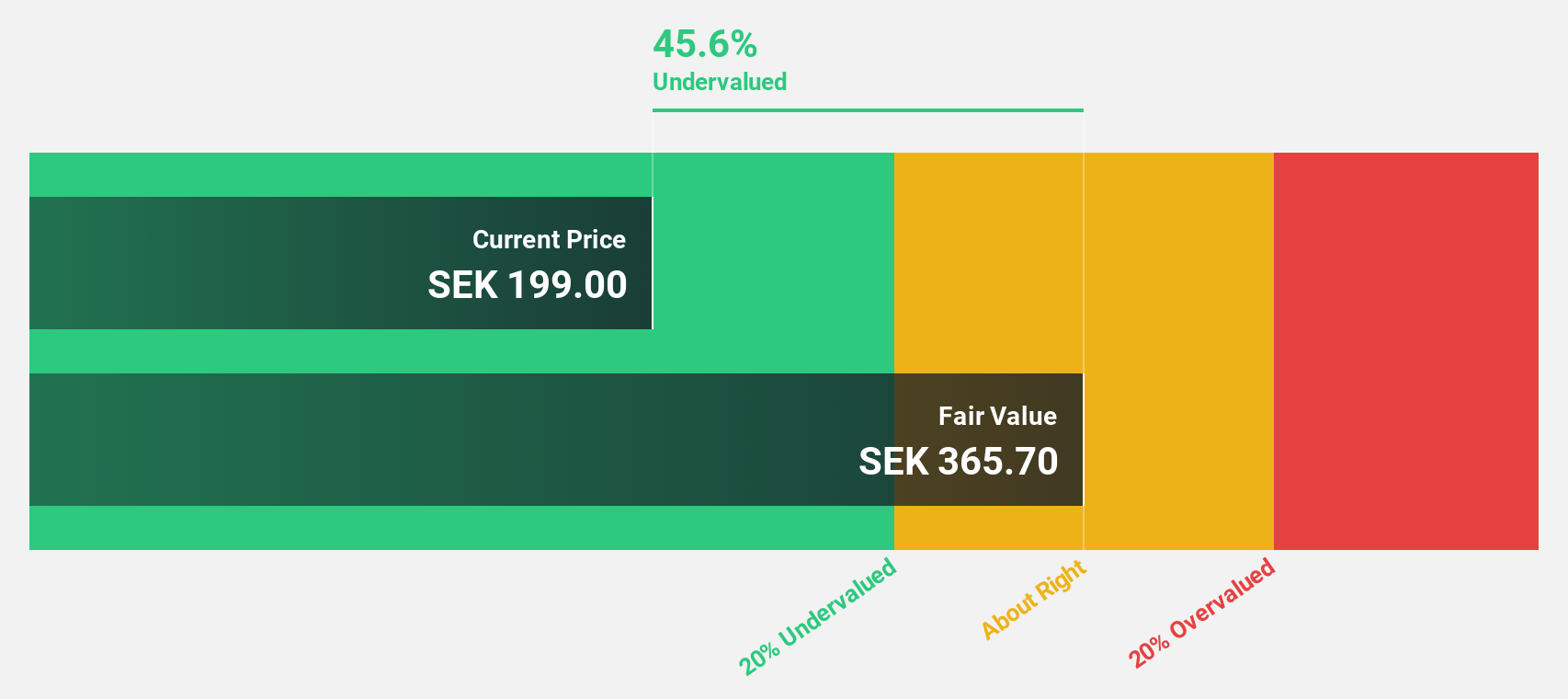

Estimated Discount To Fair Value: 46.5%

Lindab International is trading at SEK 283.6, significantly below its estimated fair value of SEK 529.84, suggesting it is undervalued based on cash flows. Despite a slight decline in net income to SEK 213 million for Q2 2024 from SEK 240 million last year, earnings are forecast to grow substantially at over 25% annually. Revenue growth is expected to outpace the Swedish market at 6.5% per year, reinforcing its potential as an undervalued stock based on cash flows.

- Our earnings growth report unveils the potential for significant increases in Lindab International's future results.

- Navigate through the intricacies of Lindab International with our comprehensive financial health report here.

Lime Technologies (OM:LIME)

Overview: Lime Technologies AB (publ) offers SaaS-based CRM solutions in the Nordic region and has a market cap of SEK4.55 billion.

Operations: The company's revenue from selling and implementing CRM software systems amounts to SEK631.84 million.

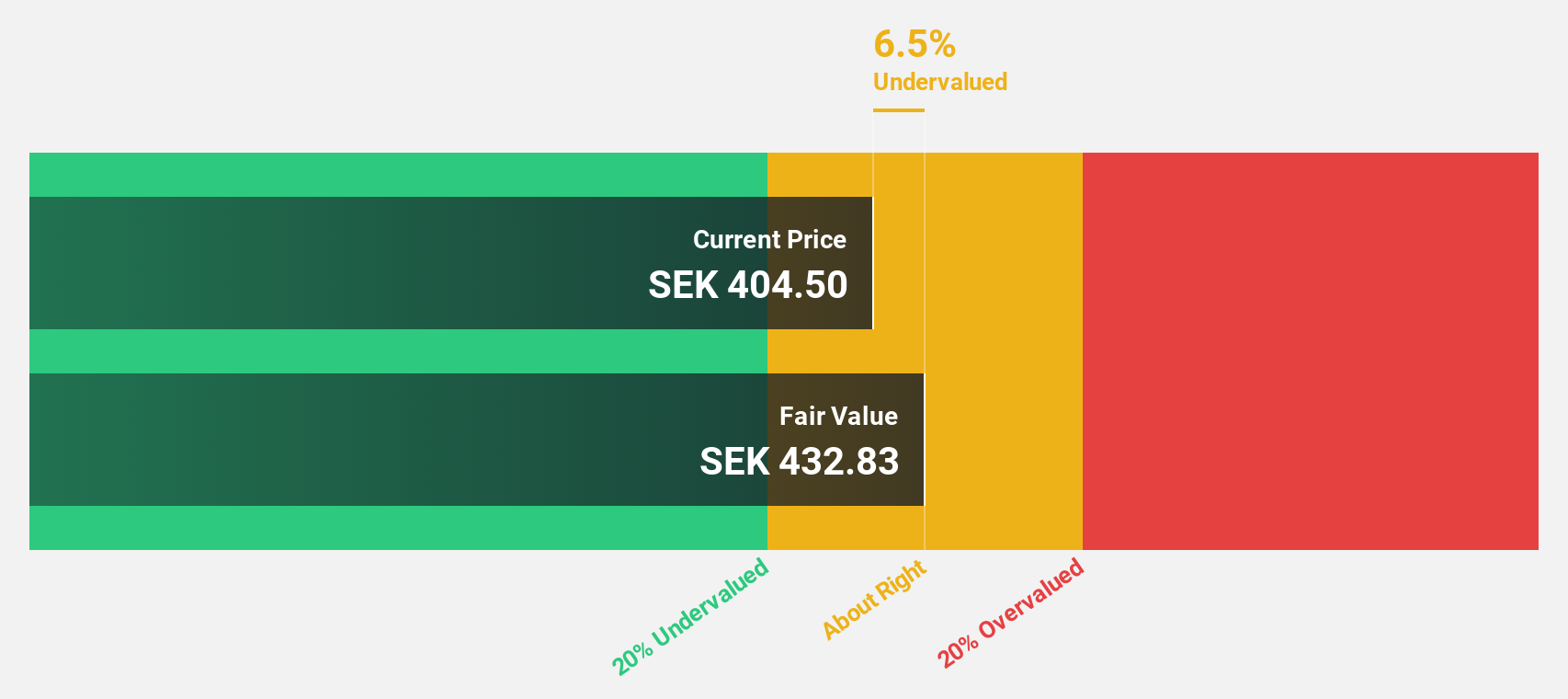

Estimated Discount To Fair Value: 27.2%

Lime Technologies is trading at SEK 342.5, significantly below its estimated fair value of SEK 470.27, indicating it is undervalued based on cash flows. Recent earnings reports show stable net income despite increased sales and revenue for Q2 2024. Earnings are forecast to grow significantly at 22.44% per year, outpacing the Swedish market's growth rate of 15.1%. However, Lime carries a high level of debt which investors should consider.

- According our earnings growth report, there's an indication that Lime Technologies might be ready to expand.

- Click to explore a detailed breakdown of our findings in Lime Technologies' balance sheet health report.

Next Steps

- Embark on your investment journey to our 43 Undervalued Swedish Stocks Based On Cash Flows selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LIME

Lime Technologies

Provides software as a service (SaaS) based customer relationship management (CRM) solutions in the Nordic region.

High growth potential with acceptable track record.