3 European Growth Companies With High Insider Ownership Expecting Up To 65% Earnings Growth

Reviewed by Simply Wall St

As the European market navigates mixed performances with a recent dip in the pan-European STOXX Europe 600 Index and stable interest rates from the ECB, investors are paying close attention to growth opportunities amidst these fluctuations. In such an environment, companies with high insider ownership often stand out as they may signal confidence in future prospects, making them appealing candidates for those seeking potential earnings growth.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 58.2% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 95.9% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 69.2% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 81.8% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.5% |

| CD Projekt (WSE:CDR) | 29.7% | 49.6% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 51.4% |

We'll examine a selection from our screener results.

Lime Technologies (OM:LIME)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lime Technologies AB (publ) offers SaaS-based CRM solutions in the Nordic region, with a market capitalization of approximately SEK4.86 billion.

Operations: The company's revenue segment primarily comprises selling and implementing CRM software systems, generating approximately SEK731.63 million.

Insider Ownership: 10.4%

Earnings Growth Forecast: 22.2% p.a.

Lime Technologies is poised for significant growth, with earnings expected to rise 22.18% annually over the next three years, outpacing the Swedish market's 12.9%. Despite trading at a discount to its estimated fair value, Lime shows strong financial performance with recent Q3 revenue of SEK 175.27 million and net income of SEK 25.41 million, reflecting year-on-year improvements. High insider ownership aligns management interests with shareholders, enhancing long-term growth prospects.

- Take a closer look at Lime Technologies' potential here in our earnings growth report.

- Our valuation report unveils the possibility Lime Technologies' shares may be trading at a premium.

Kuros Biosciences (SWX:KURN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kuros Biosciences AG focuses on the commercialization and development of biologic technologies for musculoskeletal care globally, with a market cap of CHF1.17 billion.

Operations: The company generates revenue of CHF103.35 million from its Medical Devices segment.

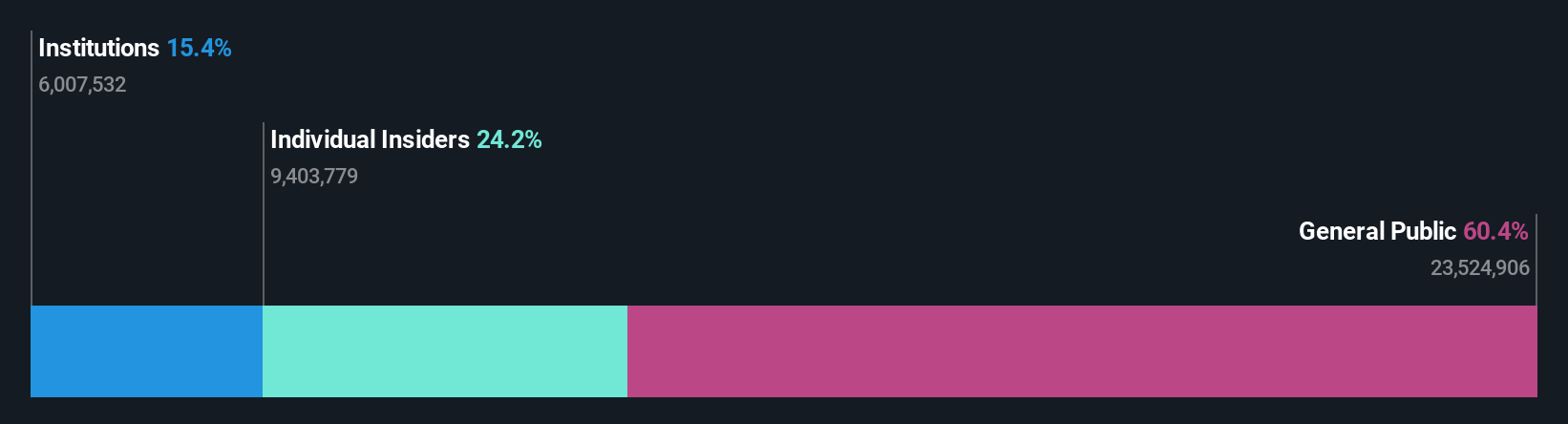

Insider Ownership: 24.2%

Earnings Growth Forecast: 60.9% p.a.

Kuros Biosciences is experiencing robust growth, with revenue projected to increase by 24.5% annually, surpassing the Swiss market average. The company recently raised its earnings guidance for 2025, expecting sales growth of at least 70%. Despite a net loss of CHF 2.01 million in the first half of 2025, Kuros' innovations like the MagnetOs MIS Delivery System are expanding market reach. High insider ownership aligns management interests with shareholders, supporting long-term value creation.

- Dive into the specifics of Kuros Biosciences here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Kuros Biosciences' current price could be inflated.

Circus (XTRA:CA1)

Simply Wall St Growth Rating: ★★★★★★

Overview: Circus SE is a technology company that develops and delivers autonomous solutions for the food service market, with a market cap of €542.37 million.

Operations: Circus SE generates revenue from its Industrial Automation & Controls segment, amounting to €0.98 million.

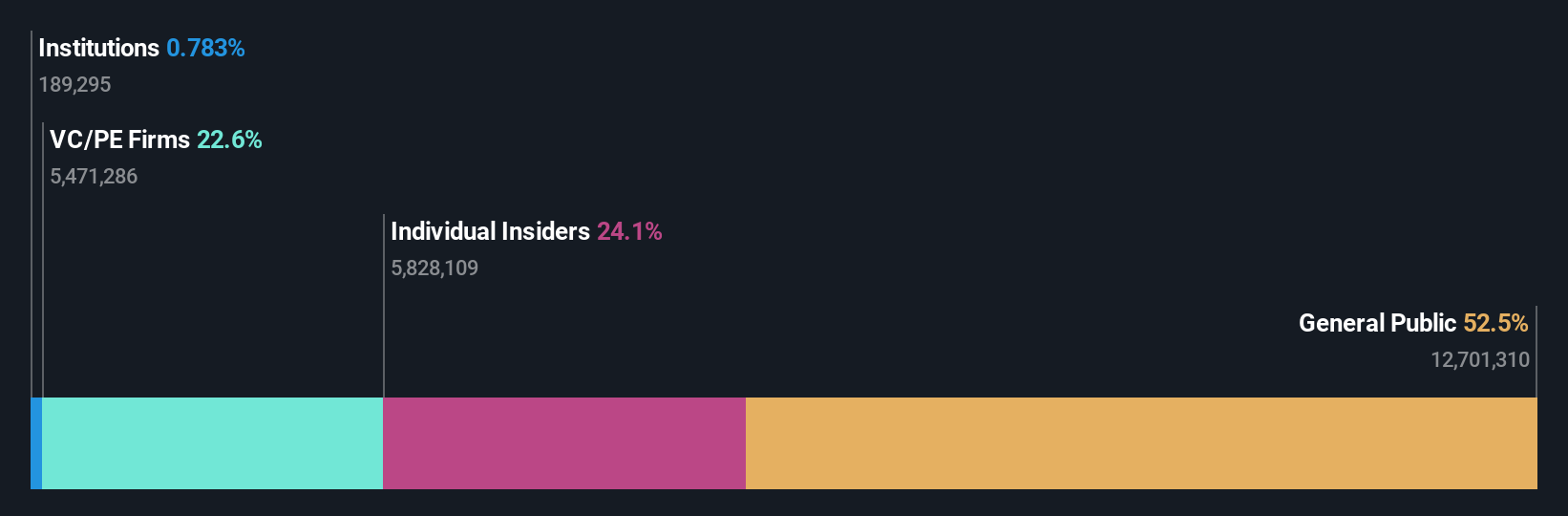

Insider Ownership: 24.1%

Earnings Growth Forecast: 65.5% p.a.

Circus SE is advancing rapidly with its AI robotics systems, notably the CA-1 and CA-M, targeting both commercial and defense sectors. Recent expansions include a partnership with REWE for autonomous retail solutions and strategic moves in Kyiv for defense logistics. Despite revenue of €979K, high growth forecasts anticipate a 49.4% annual increase, outpacing the German market. Insider ownership remains substantial, aligning management interests with shareholders as Circus navigates volatile share prices and positions itself within NATO procurement channels.

- Click here to discover the nuances of Circus with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Circus is trading beyond its estimated value.

Seize The Opportunity

- Take a closer look at our Fast Growing European Companies With High Insider Ownership list of 191 companies by clicking here.

- Curious About Other Options? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:CA1

Circus

A technology company, develops and delivers autonomous solutions for the food service market.

Exceptional growth potential and slightly overvalued.

Market Insights

Community Narratives