As European markets experience a positive upswing, with the pan-European STOXX Europe 600 Index climbing 2.77% amid easing trade tensions and rising major stock indexes like Germany's DAX and France's CAC 40, investors are keenly observing the tech sector for high-growth opportunities. In such a dynamic environment, identifying promising tech stocks involves looking at companies that not only demonstrate robust innovation and adaptability but also have the potential to capitalize on favorable market conditions and economic shifts.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Bonesupport Holding | 28.41% | 48.06% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Ascelia Pharma | 46.06% | 66.78% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| Yubico | 20.08% | 25.52% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Xbrane Biopharma | 33.71% | 82.67% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Pexip Holding (OB:PEXIP)

Simply Wall St Growth Rating: ★★★★☆☆

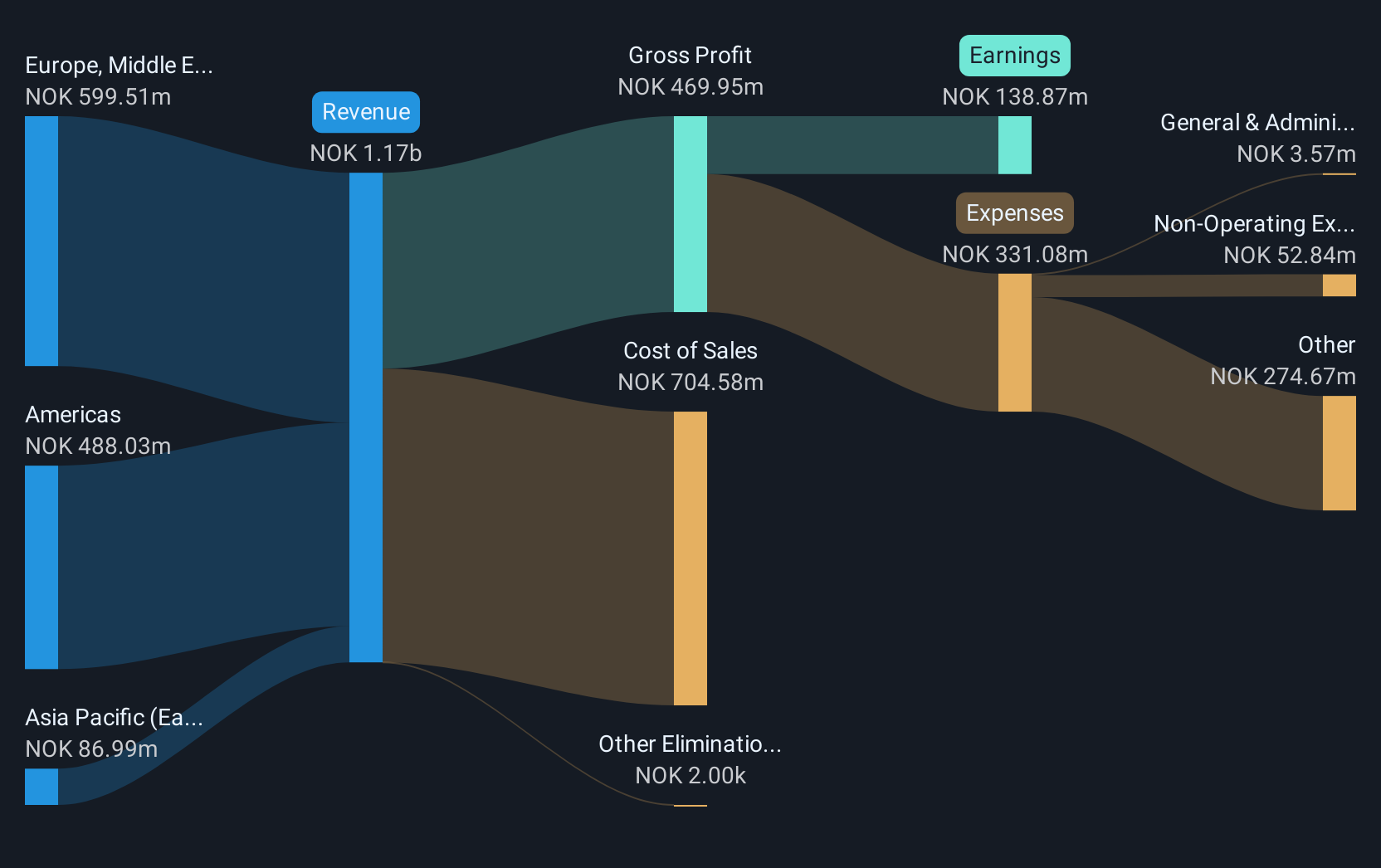

Overview: Pexip Holding ASA is a video technology company that offers an end-to-end video conferencing platform and digital infrastructure across various regions including the Americas, Europe, the Middle East, Africa, and Asia Pacific; it has a market cap of NOK4.24 billion.

Operations: Pexip generates revenue primarily through the sale of collaboration services, amounting to NOK1.12 billion. The company's operations span multiple regions, providing a comprehensive video conferencing platform and digital infrastructure solutions.

Pexip Holding's recent strides in the tech sector underscore its robust growth trajectory, particularly through its enhanced partnership with Google. By integrating Pexip Connect for Google Meet hardware, the company now allows seamless interoperability across various video conferencing platforms like Microsoft Teams and Zoom, a significant step since their collaboration began in 2018. This innovation not only expands their market reach but also solidifies their position in providing versatile communication solutions. Financially, Pexip has turned a corner with a notable transition from a net loss to profitability this year; annual revenue grew by 10.9% to NOK 1.12 billion while net income reached NOK 117.91 million, reflecting an earnings growth of 26.9%. These figures highlight Pexip's effective strategy and operational execution amidst competitive pressures within the software industry.

- Click here to discover the nuances of Pexip Holding with our detailed analytical health report.

Evaluate Pexip Holding's historical performance by accessing our past performance report.

Knowit (OM:KNOW)

Simply Wall St Growth Rating: ★★★★☆☆

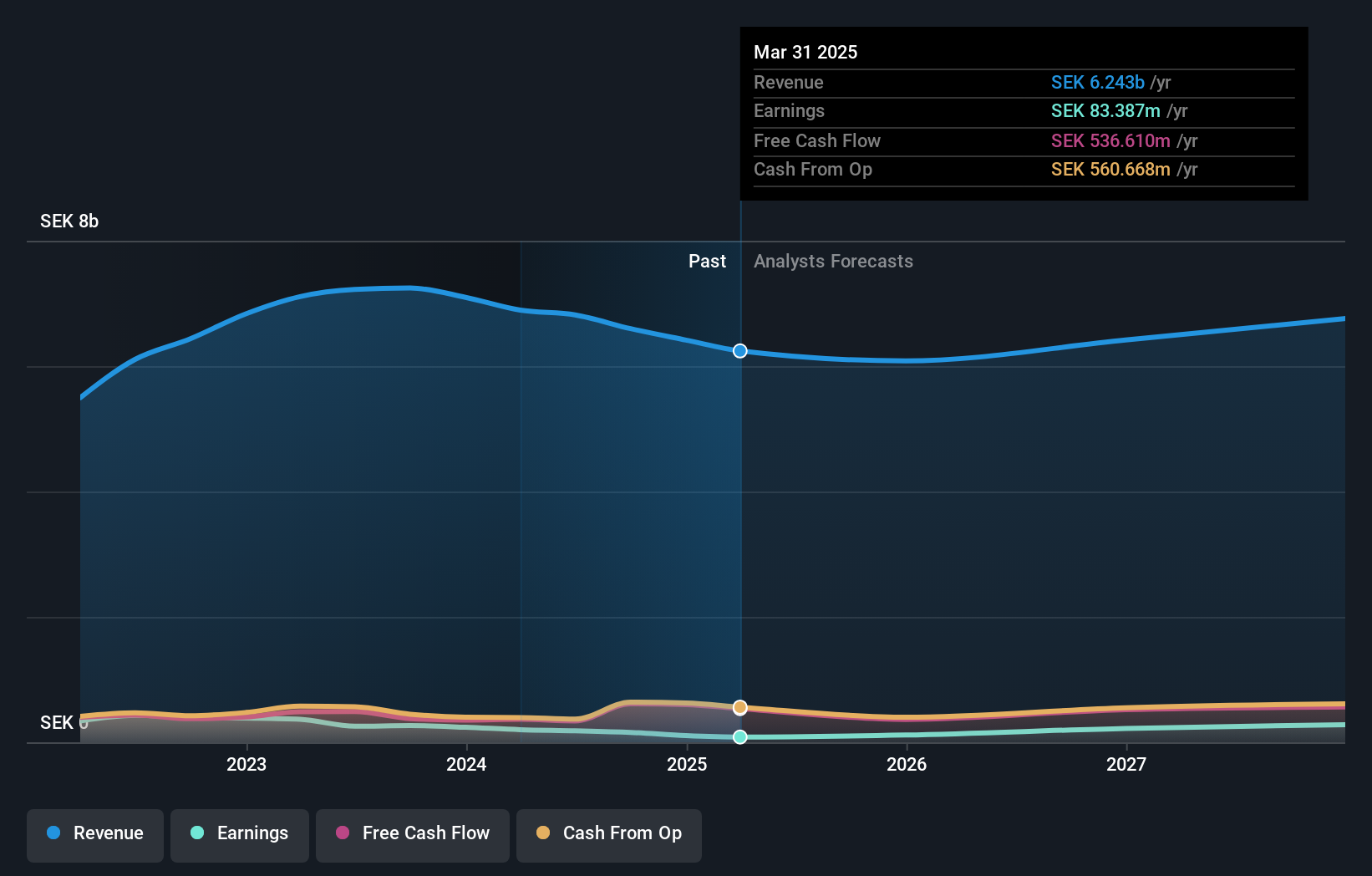

Overview: Knowit AB (publ) is a consultancy company focused on developing digital transformation solutions, with a market cap of SEK3.99 billion.

Operations: The consultancy firm generates revenue primarily through its Solutions segment, contributing SEK3.59 billion, followed by Experience at SEK1.18 billion and Insight at SEK859.90 million. Connectivity adds another SEK827 million to its revenue streams.

Knowit's recent engagement with TET Digital as a cloud partner underscores its strategic positioning in the technology sector, particularly in scalable cloud solutions. This partnership, set to potentially extend over a decade, reflects Knowit's deepening foothold in digital transformation services and aligns with industry shifts towards more integrated and flexible technological infrastructures. Despite facing a challenging year with revenue dropping to SEK 6.42 billion from SEK 7.10 billion and net income falling significantly to SEK 106.1 million from SEK 239.6 million, Knowit is poised for recovery with expected annual earnings growth of 26%. This potential rebound is supported by its robust involvement in sectors demanding high adaptability and innovation, marking it as a resilient player amidst tech fluctuations.

- Delve into the full analysis health report here for a deeper understanding of Knowit.

Examine Knowit's past performance report to understand how it has performed in the past.

Shoper (WSE:SHO)

Simply Wall St Growth Rating: ★★★★★☆

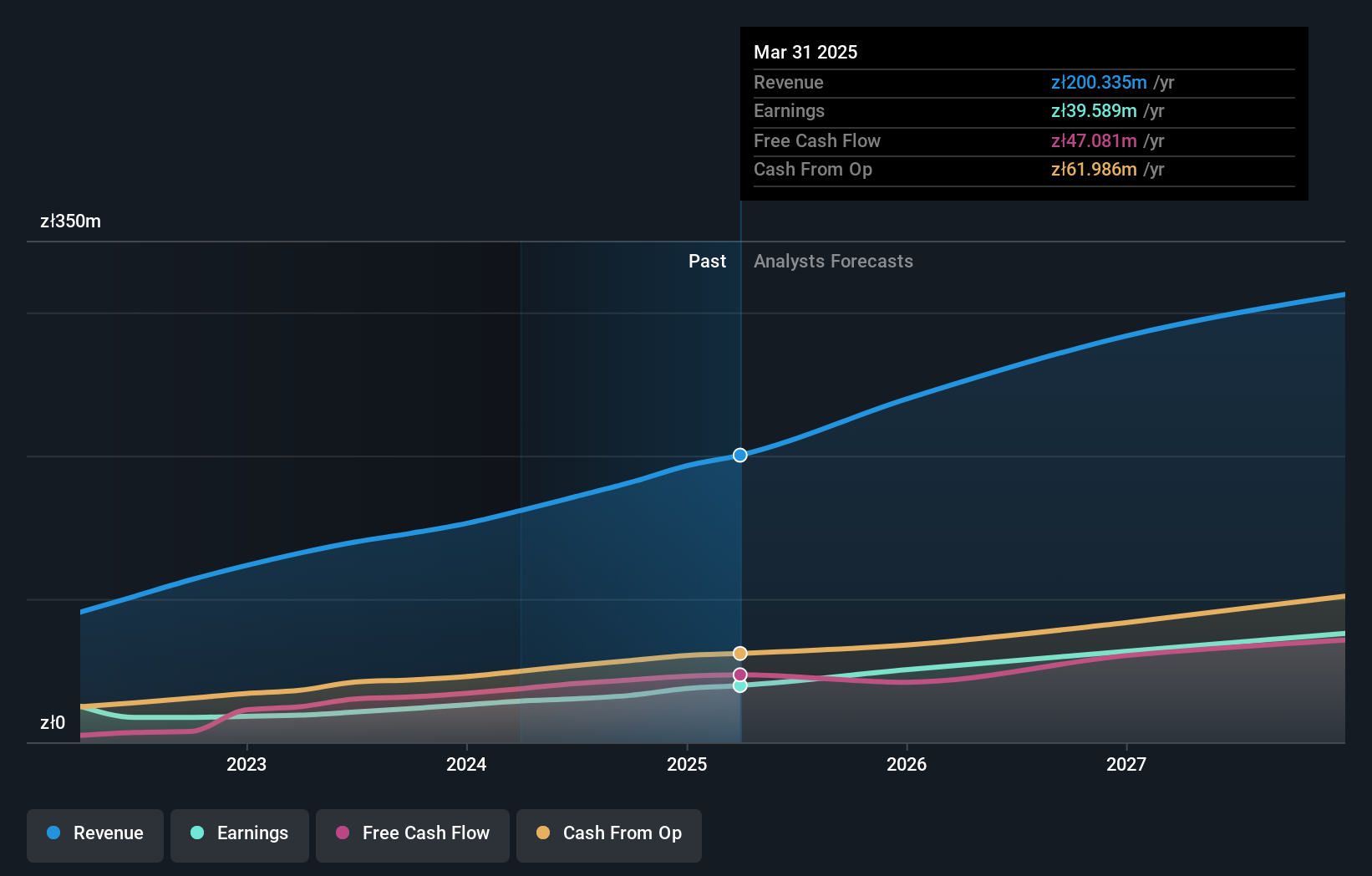

Overview: Shoper SA offers Software as a Service solutions tailored for e-commerce in Poland, with a market capitalization of PLN1.26 billion.

Operations: Shoper SA generates revenue primarily through its Solutions segment, contributing PLN151.13 million, and Subscriptions segment, adding PLN41.67 million.

Shoper S.A. is distinguishing itself in the European tech landscape, notably with a robust annual revenue increase to PLN 192.8 million, up from PLN 152.6 million, reflecting a growth rate of 13.9%. This performance is complemented by an earnings surge to PLN 37.51 million from PLN 26.09 million last year, marking a significant uptick of 43.8%. These financial achievements are underpinned by strategic decisions that resonate well with market demands and future-oriented business models, such as their recent dividend announcement and shareholder engagements which reflect confidence in sustained profitability and growth potential.

- Click to explore a detailed breakdown of our findings in Shoper's health report.

Explore historical data to track Shoper's performance over time in our Past section.

Key Takeaways

- Get an in-depth perspective on all 223 European High Growth Tech and AI Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:SHO

Shoper

Provides Software as a Service solutions for e-commerce in Poland.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives