Here's Why I Think Generic Sweden (STO:GENI) Might Deserve Your Attention Today

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Generic Sweden (STO:GENI). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Generic Sweden

How Fast Is Generic Sweden Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Who among us would not applaud Generic Sweden's stratospheric annual EPS growth of 39%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

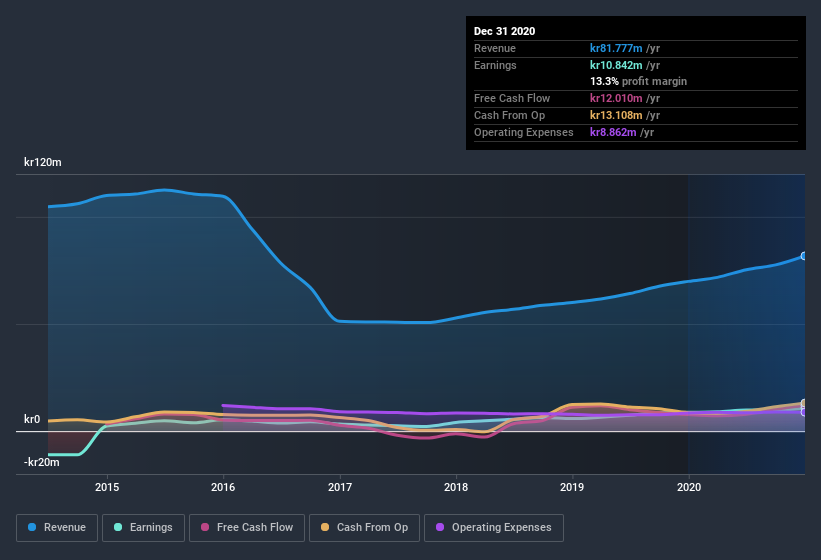

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Generic Sweden maintained stable EBIT margins over the last year, all while growing revenue 17% to kr82m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Since Generic Sweden is no giant, with a market capitalization of kr494m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Generic Sweden Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Like a sturdy phalanx Generic Sweden insiders have stood united by refusing to sell shares over the last year. But my excitement comes from the kr644k that Owner & Member of the board Fredrik Svedberg spent buying shares (at an average price of about kr27.84).

On top of the insider buying, we can also see that Generic Sweden insiders own a large chunk of the company. In fact, they own 36% of the shares, making insiders a very influential shareholder group. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. In terms of absolute value, insiders have kr176m invested in the business, using the current share price. That's nothing to sneeze at!

Is Generic Sweden Worth Keeping An Eye On?

Generic Sweden's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The cherry on top is that insiders own a bunch of shares, and one has been buying more. Because of the potential that it has reached an inflection point, I'd suggest Generic Sweden belongs on the top of your watchlist. We should say that we've discovered 2 warning signs for Generic Sweden that you should be aware of before investing here.

As a growth investor I do like to see insider buying. But Generic Sweden isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Generic Sweden or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:GENI

Generic Sweden

A technology company, provides messaging services for all applications.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives