As global markets react to anticipated interest rate cuts and economic indicators show mixed signals, Sweden's Riksbank has also reduced borrowing costs, signaling potential opportunities in the tech sector. In this environment, identifying high-growth tech stocks in Sweden requires a focus on companies with strong innovation capabilities and resilience to market fluctuations.

Top 10 High Growth Tech Companies In Sweden

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Truecaller | 20.32% | 21.61% | ★★★★★★ |

| Fortnox | 20.18% | 22.60% | ★★★★★★ |

| Bonesupport Holding | 33.76% | 31.20% | ★★★★★★ |

| Xbrane Biopharma | 55.06% | 105.36% | ★★★★★★ |

| Skolon | 31.76% | 121.72% | ★★★★★★ |

| Scandion Oncology | 40.75% | 72.15% | ★★★★★★ |

| Hemnet Group | 20.13% | 25.41% | ★★★★★★ |

| BioArctic | 39.48% | 100.98% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Yubico | 20.43% | 42.51% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

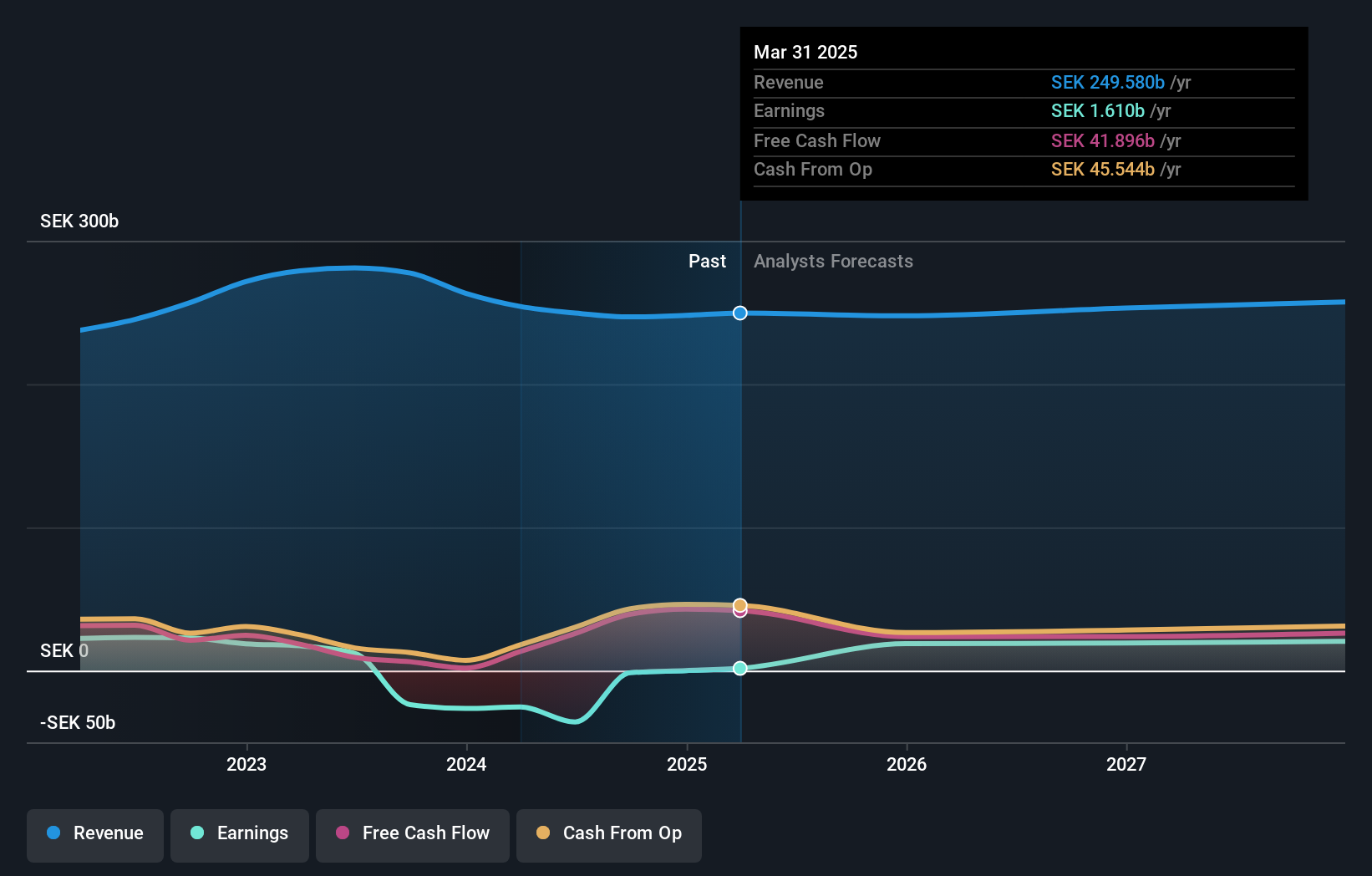

Telefonaktiebolaget LM Ericsson (OM:ERIC B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Telefonaktiebolaget LM Ericsson (publ), together with its subsidiaries, provides mobile connectivity solutions for telecom operators and enterprise customers across multiple regions including North America, Europe, Latin America, the Middle East, Africa, North East Asia, South East Asia, Oceania, and India with a market cap of SEK253.59 billion.

Operations: Ericsson's revenue streams are primarily derived from Networks (SEK157.93 billion), Enterprise (SEK25.83 billion), and Cloud Software and Services (SEK63.35 billion). The company focuses on providing mobile connectivity solutions to telecom operators and enterprise customers across various global regions.

Ericsson's recent collaboration with NRTC, Southern Linc, and Anterix highlights its commitment to delivering advanced private network solutions for U.S. electric cooperatives. This partnership leverages Ericsson's expertise in cellular and microwave communications, aiming to enhance grid infrastructure resilience and security. Despite a 2.7% annual revenue growth forecast, Ericsson's earnings are expected to grow 101.6% per year over the next three years as it becomes profitable. The company also invested SEK 20.5 million in share repurchases this year, reflecting confidence in its strategic direction amidst industry challenges.

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fortnox AB (publ) offers financial and administrative applications tailored for small and medium-sized businesses, accounting firms, and organizations, with a market cap of SEK36.64 billion.

Operations: The company generates revenue primarily from Core Products (SEK734 million), Businesses (SEK378 million), Marketplaces (SEK160 million), Accounting Firms (SEK352 million), and Financial Services (SEK249 million). Gross profit margin stands at 84.67%.

Fortnox's impressive growth trajectory is evident in its recent earnings, with Q2 revenue reaching SEK 521 million, up from SEK 413 million a year ago. The company's R&D expenses have been instrumental in driving innovation, with a notable increase to SEK 20.5 million this year. Fortnox's earnings are forecasted to grow at an annual rate of 22.6%, significantly outpacing the Swedish market's average of 16%. This strong performance is further supported by their strategic move towards SaaS models, ensuring recurring revenue streams and robust client retention.

- Navigate through the intricacies of Fortnox with our comprehensive health report here.

-

Evaluate Fortnox's historical performance by accessing our past performance report.

Swedish Orphan Biovitrum (OM:SOBI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Swedish Orphan Biovitrum AB (publ) is an integrated biotechnology company that researches, develops, manufactures, and sells pharmaceuticals in haematology, immunology, and specialty care across Europe, North America, the Middle East, Asia, and Australia with a market cap of SEK109.47 billion.

Operations: Swedish Orphan Biovitrum AB (publ) generates revenue primarily from three segments: Hematology (SEK15.07 billion), Immunology (SEK7.49 billion), and Specialty Care (SEK1.15 billion). The company operates across Europe, North America, the Middle East, Asia, and Australia.

Swedish Orphan Biovitrum (Sobi) has demonstrated significant growth potential, with earnings forecasted to increase by 25.8% annually, outpacing the Swedish market's average of 16%. Recent advancements include positive Phase 3 results for pegcetacoplan in treating rare kidney diseases and a notable reduction in proteinuria by 68% (p < 0.0001). The company's commitment to innovation is evident with SEK 1.24 billion allocated to R&D last year, driving breakthroughs like ALTUVOCT® for haemophilia A.

- Dive into the specifics of Swedish Orphan Biovitrum here with our thorough health report.

-

Learn about Swedish Orphan Biovitrum's historical performance.

Taking Advantage

- Discover the full array of 82 Swedish High Growth Tech and AI Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St , where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FNOX

Fortnox

Provides products, packages, and integrations for financial and administration applications in small and medium sized businesses, accounting firms, and organizations.

Exceptional growth potential with outstanding track record.