Enea (OM:ENEA) Discounted Valuation Reinforces Bullish Narratives Despite One-Off Profit Hit

Reviewed by Simply Wall St

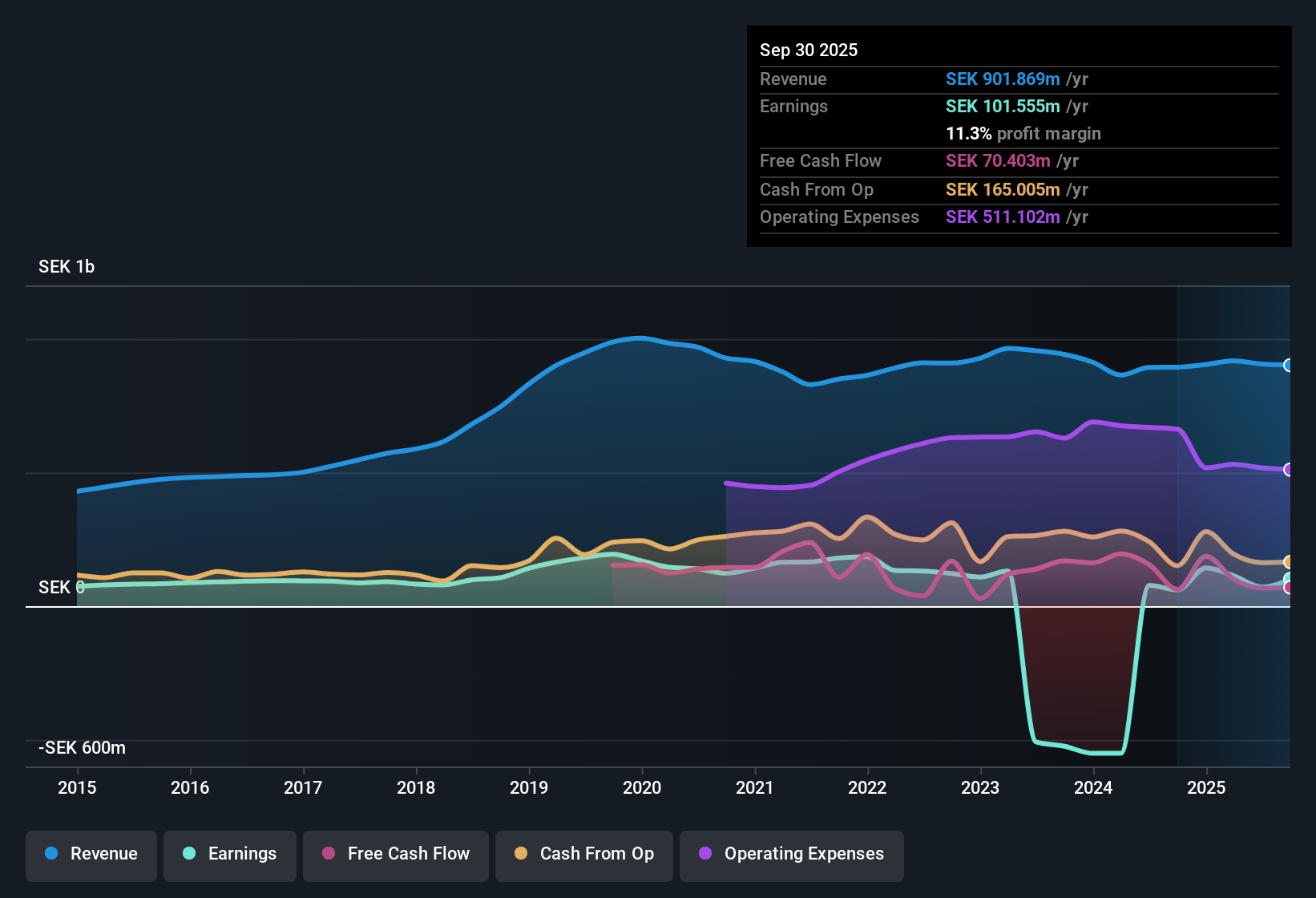

Enea (OM:ENEA) posted forecast-beating growth numbers, with earnings expected to climb 17.5% per year and revenue anticipated to rise at 6.5% annually, both outpacing the broader Swedish market’s projected rates. However, the company’s net profit margin dipped to 7.8% from last year’s 8.7%, and earnings have declined by 29.9% on average over the past five years, impacted by a significant one-off loss of SEK84.8 million. Despite recent margin softness, ENEA’s share price of SEK69.8 trades well below an independently estimated fair value of SEK179.78. Its price-to-earnings ratio of 18.9x sits below both industry and peer averages, highlighting notable value for investors considering growth forecasts.

See our full analysis for Enea.Next, we’ll see how the latest earnings stack up against the major narratives that investors follow most closely. This will help identify where expectations align and where the new data just might shake things up.

See what the community is saying about Enea

Recurring Revenues Hit 69%

- Recurring revenues now make up 69% of Enea's total sales, providing a solid earnings foundation and reducing revenue swings that worried investors in earlier years.

- Analysts' consensus view highlights that this shift to a term-based and recurring income model supports steadier net margins and improves predictability.

- With recurring contracts giving greater visibility, consensus narrative notes Enea's business model looks less reliant on unpredictable, lumpy one-off deals than in the past.

- However, cost pressures remain a watchpoint since operational expenses, including one-off items, are noted as a factor that could still squeeze profits unless carefully managed.

- Consensus expectations for future growth now lean on the company's ability to scale existing contracts and upsell in security and network solutions, where major new deals such as the USD 27 million agreement are expected to contribute further to long-term revenues.

Margin Potential Outshines Past Volatility

- Profit margins are projected to nearly double, rising from 7.8% today to 15.1% in three years, pointing to stronger underlying business economics ahead even though recent one-off losses drove margins below long-term averages.

- Consensus narrative emphasizes that AI adoption and a focus on high-growth segments like security may accelerate margin recovery.

- While EBIT was weighed down by the SEK84.8 million one-off loss, analysts argue that future margin expansion depends on winning more term-based deals in higher-growth areas.

- Despite no dividend, which some see as a drawback, this allows Enea to direct resources into expansion and strategic acquisitions, an area flagged as a major driver for future margin improvement.

Discounted Valuation Versus Peers

- Enea’s current P/E ratio of 18.9x is lower than both the European IT sector average (19.1x) and the peer group (25x), and its SEK69.8 share price sits far below the DCF fair value estimate of SEK179.78 and analyst price target of SEK90.0.

- Analysts' consensus view argues that this discount versus peer valuations and DCF suggests investors are still weighing uncertainty from recent profit declines, but are pricing in expectations of a return to steadier, higher-margin growth.

- The present market rate leaves open significant upside if the company’s forecasted improvement in margins and continued revenue growth are realized.

- However, some skepticism persists until new stability and cost discipline are consistently demonstrated, especially after the recent steep earnings decline driven by unusual expenses.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Enea on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? In just a few minutes, you can shape your own perspective and craft a narrative that stands out. Do it your way

A great starting point for your Enea research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Enea’s earnings have been volatile, with recent sharp profit declines and no dividend. This raises questions about the consistency of its future performance.

If steady growth and less earnings unpredictability are important to you, consider searching for companies that deliver more consistent results through stable growth stocks screener (2090 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enea might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ENEA

Enea

Provides software products for telecom and cybersecurity industries worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives