Clavister Holding AB (publ.)'s (STO:CLAV) 33% Price Boost Is Out Of Tune With Revenues

Clavister Holding AB (publ.) (STO:CLAV) shares have continued their recent momentum with a 33% gain in the last month alone. The last month tops off a massive increase of 183% in the last year.

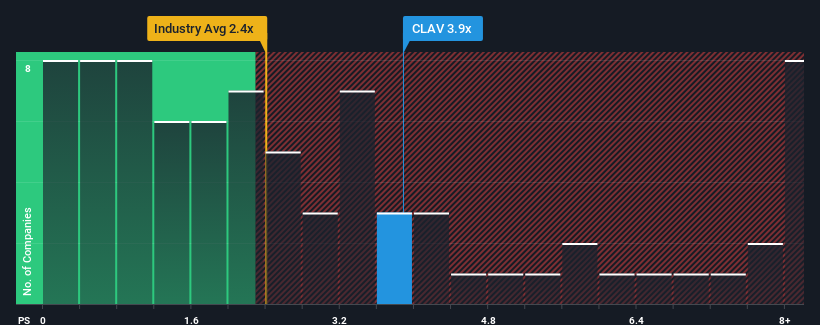

After such a large jump in price, when almost half of the companies in Sweden's Software industry have price-to-sales ratios (or "P/S") below 2.4x, you may consider Clavister Holding AB (publ.) as a stock probably not worth researching with its 3.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Clavister Holding AB (publ.)

How Clavister Holding AB (publ.) Has Been Performing

Recent revenue growth for Clavister Holding AB (publ.) has been in line with the industry. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Clavister Holding AB (publ.)'s future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Clavister Holding AB (publ.) would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 48% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 14% per annum during the coming three years according to the lone analyst following the company. That's shaping up to be materially lower than the 19% per year growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Clavister Holding AB (publ.)'s P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Clavister Holding AB (publ.) shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've concluded that Clavister Holding AB (publ.) currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

You should always think about risks. Case in point, we've spotted 4 warning signs for Clavister Holding AB (publ.) you should be aware of, and 1 of them doesn't sit too well with us.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CLAV

Clavister Holding AB (publ.)

Develops, produces, and sells cybersecurity solutions in Sweden, rest of Europe, Asia, and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives