Clavister Holding AB (publ.) (STO:CLAV) Is Making Moderate Use Of Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Clavister Holding AB (publ.) (STO:CLAV) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Clavister Holding AB (publ.)

How Much Debt Does Clavister Holding AB (publ.) Carry?

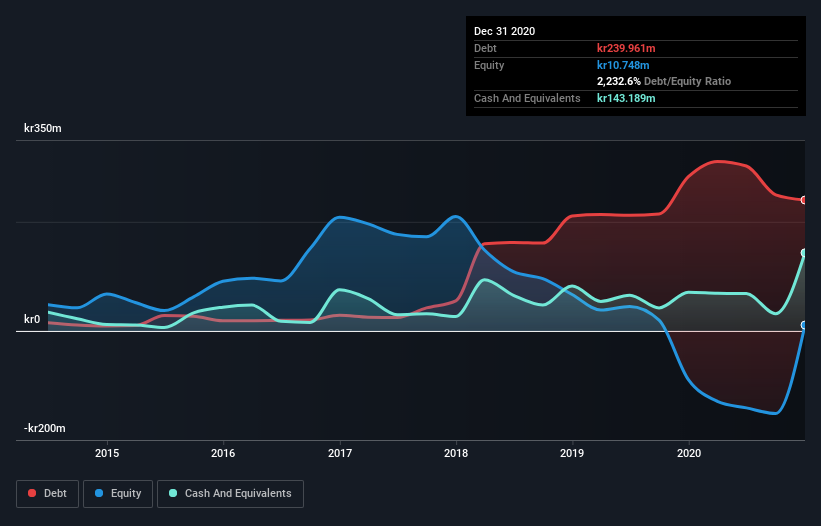

You can click the graphic below for the historical numbers, but it shows that Clavister Holding AB (publ.) had kr240.0m of debt in December 2020, down from kr282.7m, one year before. However, it does have kr143.2m in cash offsetting this, leading to net debt of about kr96.8m.

How Strong Is Clavister Holding AB (publ.)'s Balance Sheet?

According to the last reported balance sheet, Clavister Holding AB (publ.) had liabilities of kr139.4m due within 12 months, and liabilities of kr250.3m due beyond 12 months. Offsetting these obligations, it had cash of kr143.2m as well as receivables valued at kr53.4m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by kr193.1m.

Clavister Holding AB (publ.) has a market capitalization of kr460.3m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Clavister Holding AB (publ.)'s ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Clavister Holding AB (publ.) reported revenue of kr140m, which is a gain of 13%, although it did not report any earnings before interest and tax. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Importantly, Clavister Holding AB (publ.) had an earnings before interest and tax (EBIT) loss over the last year. Its EBIT loss was a whopping kr57m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. However, it doesn't help that it burned through kr46m of cash over the last year. So in short it's a really risky stock. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example Clavister Holding AB (publ.) has 3 warning signs (and 2 which are significant) we think you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Clavister Holding AB (publ.), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:CLAV

Clavister Holding AB (publ.)

Develops, produces, and sells cybersecurity solutions in Sweden, rest of Europe, Asia, and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives