- Sweden

- /

- Capital Markets

- /

- OM:K33

Market Cool On Arcario AB's (STO:ARCA) Revenues Pushing Shares 31% Lower

The Arcario AB (STO:ARCA) share price has softened a substantial 31% over the previous 30 days, handing back much of the gains the stock has made lately. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 40% share price drop.

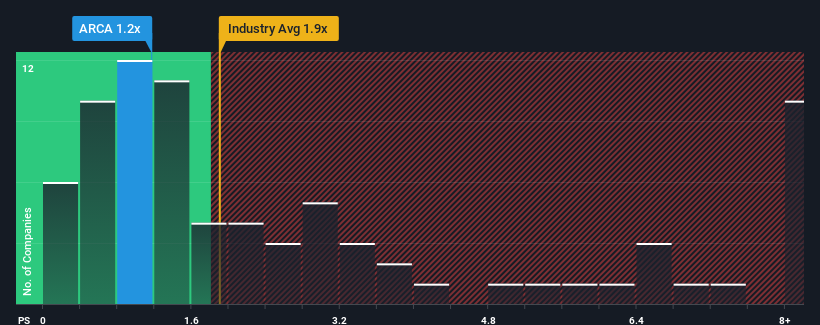

Since its price has dipped substantially, Arcario's price-to-sales (or "P/S") ratio of 1.2x might make it look like a buy right now compared to the Software industry in Sweden, where around half of the companies have P/S ratios above 1.9x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Arcario

How Arcario Has Been Performing

As an illustration, revenue has deteriorated at Arcario over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Arcario will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Arcario?

In order to justify its P/S ratio, Arcario would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 63% decrease to the company's top line. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 16% shows it's noticeably more attractive.

With this in mind, we find it intriguing that Arcario's P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

Arcario's P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Arcario revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Arcario (2 can't be ignored) you should be aware of.

If you're unsure about the strength of Arcario's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if K33 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:K33

K33

Through its subsidiaries, invests in digital assets in Sweden and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026