Time People Group AB (publ) (NGM:TPGR) Might Not Be As Mispriced As It Looks After Plunging 28%

Unfortunately for some shareholders, the Time People Group AB (publ) (NGM:TPGR) share price has dived 28% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 72% share price decline.

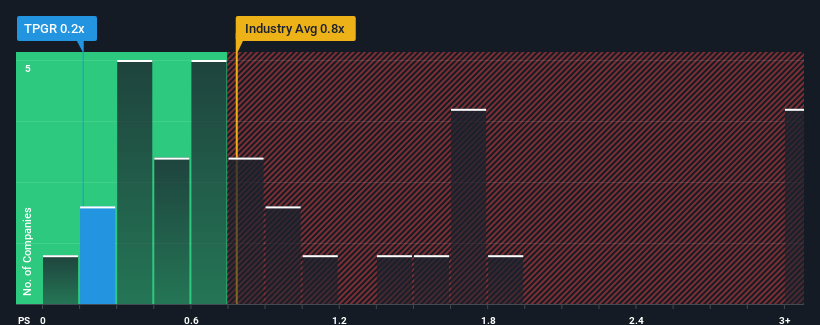

After such a large drop in price, it would be understandable if you think Time People Group is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in Sweden's IT industry have P/S ratios above 0.8x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 4 warning signs investors should be aware of before investing in Time People Group. Read for free now.Check out our latest analysis for Time People Group

What Does Time People Group's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Time People Group over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Time People Group will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Time People Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Time People Group would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 28%. The last three years don't look nice either as the company has shrunk revenue by 28% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

For that matter, there's little to separate that medium-term revenue trajectory on an annualised basis against the broader industry's one-year forecast for a contraction of 9.0% either.

In light of this, the fact Time People Group's P/S sits below the majority of other companies is unanticipated but certainly not shocking. In general, shrinking revenues are unlikely to lead to a stable P/S long-term, which could set up shareholders for future disappointment regardless. There is still potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Bottom Line On Time People Group's P/S

Time People Group's P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Time People Group revealed its three-year contraction in revenue is impacting its P/S more than we would have predicted, given the industry is set to shrink at a similar rate. When we see a revenue growth decline that is on par with its peers, we can only assume potential risks are what might be causing the P/S ratio to be lower than average. One major risk is whether the company can maintain its 'middle of the road' medium-termrevenue growth under these tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Time People Group you should know about.

If these risks are making you reconsider your opinion on Time People Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Time People Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:TPGR

Time People Group

Provides consulting services in IT and change management in Sweden.

Low risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026