A Piece Of The Puzzle Missing From Thinc Collective AB (publ)'s (NGM:THINC) 34% Share Price Climb

Those holding Thinc Collective AB (publ) (NGM:THINC) shares would be relieved that the share price has rebounded 34% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 20% in the last twelve months.

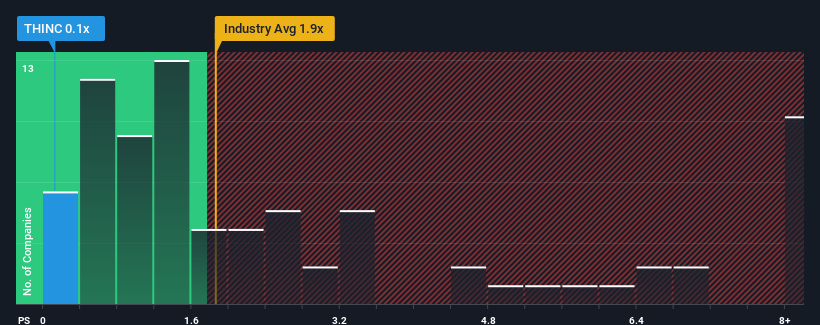

Although its price has surged higher, Thinc Collective may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Software industry in Sweden have P/S ratios greater than 1.9x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Thinc Collective

How Has Thinc Collective Performed Recently?

The revenue growth achieved at Thinc Collective over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Thinc Collective, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Thinc Collective?

Thinc Collective's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 28%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 16% shows it's noticeably more attractive.

In light of this, it's peculiar that Thinc Collective's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

Despite Thinc Collective's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Thinc Collective currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Thinc Collective (of which 2 are potentially serious!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Thinc Collective might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:THINC

Thinc Collective

Offers systems, communication, and structure services in Sweden and internationally.

Fair value with acceptable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026