The 12% return this week takes Briox's (NGM:BRIX) shareholders one-year gains to 380%

While stock picking isn't easy, for those willing to persist and learn, it is possible to buy shares in great companies, and generate wonderful returns. When you buy and hold the right company, the returns can make a huge difference to both you and your family. For example, Briox AB (publ) (NGM:BRIX) has generated a beautiful 380% return in just a single year. It's also good to see the share price up 86% over the last quarter. And shareholders have also done well over the long term, with an increase of 141% in the last three years.

Since the stock has added kr83m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Because Briox made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Briox saw its revenue shrink by 23%. So it's very confusing to see that the share price gained a whopping 380%. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. To us, a gain like this looks like speculation, but there might be historical trends to back it up.

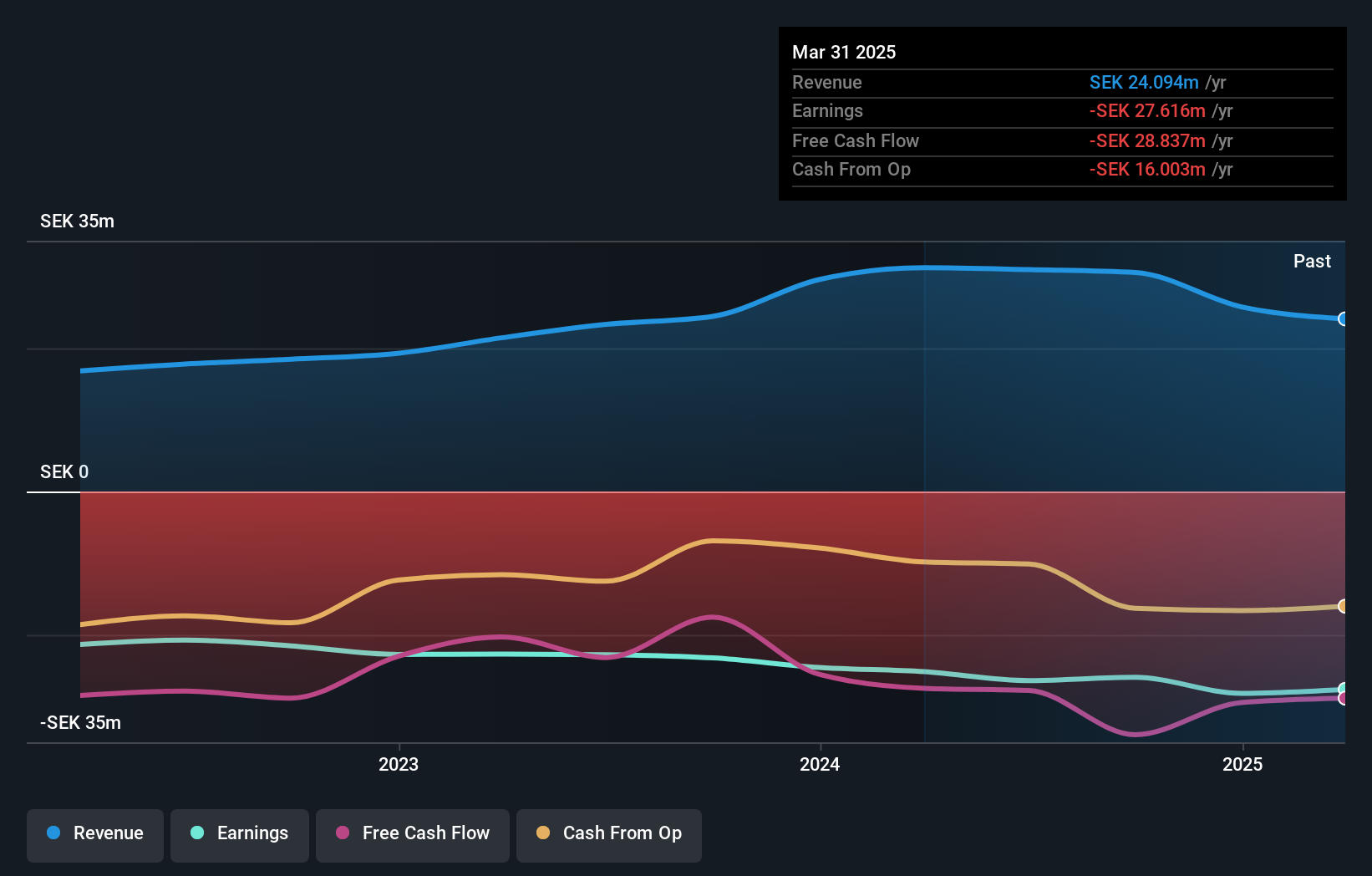

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Briox's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Briox shareholders have received a total shareholder return of 380% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 4% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Briox better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Briox (of which 2 shouldn't be ignored!) you should know about.

But note: Briox may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Briox might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:BRIX

Briox

Develops and sells cloud-based business software primarily in Germany, Great Britain, Finland, and Poland The company provides software for Accounting, Invoicing, Orders, Purchase Orders, Filing, Linked Documents, Time Accounting, and CRM.

Moderate with mediocre balance sheet.

Market Insights

Community Narratives