As European markets react to higher-than-expected U.S. tariffs, major indices like the STOXX Europe 600 have experienced their steepest declines in five years, highlighting the growing uncertainty in global trade policies. Amid these turbulent times, investors often look beyond well-established names to discover opportunities among penny stocks—smaller or newer companies that can offer unique potential. While the term "penny stocks" might seem outdated, it remains relevant for those seeking affordable entry points into companies with robust financials and promising growth prospects. In this article, we explore three European penny stocks that stand out for their financial resilience and potential upside.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK1.904 | SEK1.82B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.39 | SEK220.12M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.42 | SEK256.45M | ✅ 4 ⚠️ 3 View Analysis > |

| IMS (WSE:IMS) | PLN3.37 | PLN114.22M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.43 | €51.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.95 | €31.81M | ✅ 3 ⚠️ 3 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.00 | €23.16M | ✅ 3 ⚠️ 3 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.994 | €80.07M | ✅ 2 ⚠️ 4 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.70 | €17.56M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.03 | €280.27M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 437 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Lightning Group (NGM:LIGR)

Simply Wall St Financial Health Rating: ★★★★★☆

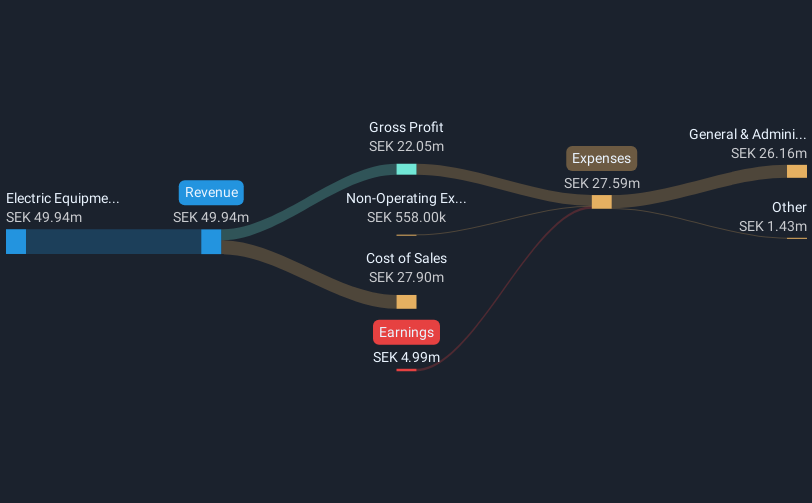

Overview: Lightning Group AB, with a market cap of SEK16.36 million, develops, designs, and sells lighting control solutions for large and wireless projects in Sweden.

Operations: The company's revenue is primarily generated from its Electric Equipment segment, totaling SEK49.94 million.

Market Cap: SEK16.36M

Lightning Group AB, with a market cap of SEK16.36 million, operates in the lighting control solutions sector in Sweden. The company reported revenue of SEK50.34 million for 2024 but remains unprofitable with a net loss of SEK4.99 million. Despite its volatility and lack of profitability, Lightning Group's short-term assets exceed both its short and long-term liabilities, indicating financial stability in covering obligations. Shareholders haven't faced significant dilution recently, and the board is experienced with an average tenure of 9.3 years. The company's cash runway is sufficient for over three years at current free cash flow levels.

- Unlock comprehensive insights into our analysis of Lightning Group stock in this financial health report.

- Explore historical data to track Lightning Group's performance over time in our past results report.

Windon Energy Group (NGM:WEG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Windon Energy Group AB operates in the energy sector and has a market cap of SEK30.40 million.

Operations: Windon Energy Group AB has not reported any specific revenue segments.

Market Cap: SEK30.4M

Windon Energy Group AB, with a market cap of SEK30.40 million, operates in the energy sector and is currently unprofitable. The company reported 2024 revenue of SEK22.64 million but experienced a significant decline from the previous year. Despite having no debt and short-term assets (SEK14.1M) exceeding liabilities, Windon has less than a year of cash runway based on current free cash flow trends. Its share price has been highly volatile recently, and its negative return on equity reflects ongoing financial challenges amid limited historical data for comprehensive analysis.

- Take a closer look at Windon Energy Group's potential here in our financial health report.

- Review our historical performance report to gain insights into Windon Energy Group's track record.

Kancera (OM:KAN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kancera AB (publ) is a Swedish company that develops drugs for inflammatory diseases and cancer, with a market cap of SEK151.24 million.

Operations: Kancera AB (publ) currently does not report any revenue segments.

Market Cap: SEK151.24M

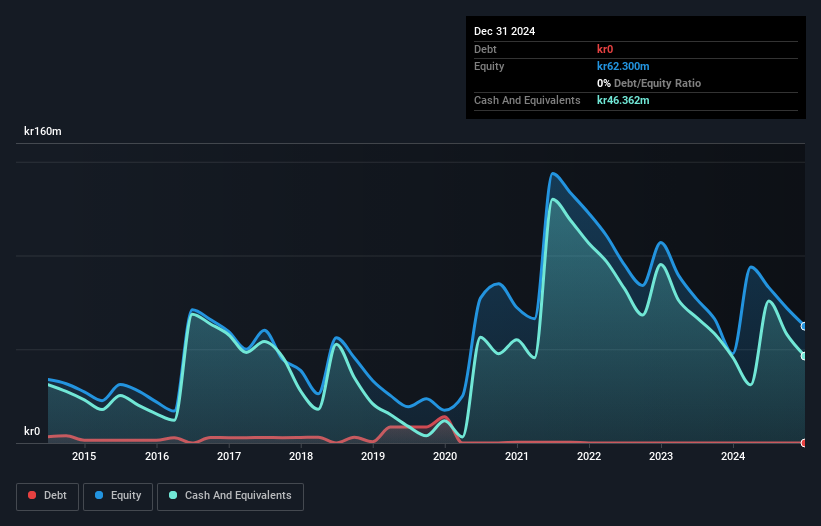

Kancera AB, with a market cap of SEK151.24 million, is currently pre-revenue and focused on drug development for inflammatory diseases and cancer. The company recently announced the completion of patient visits for its KANDOVA study in ovarian cancer, with results expected in Q3 2025. Kancera's strategic alliance with Recardio Inc. aims to combine assets for cardiovascular treatments, potentially enhancing its pipeline value. Despite having no debt and sufficient short-term assets to cover liabilities, Kancera faces challenges with a limited cash runway under a year and high share price volatility amid ongoing financial losses without near-term profitability forecasts.

- Dive into the specifics of Kancera here with our thorough balance sheet health report.

- Gain insights into Kancera's outlook and expected performance with our report on the company's earnings estimates.

Summing It All Up

- Click here to access our complete index of 437 European Penny Stocks.

- Want To Explore Some Alternatives? Uncover 14 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novakand Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NOVKAN

Novakand Pharma

Develops drugs for inflammatory diseases and cancer in Sweden and internationally.

Medium-low risk with adequate balance sheet.

Market Insights

Community Narratives