- Sweden

- /

- Specialty Stores

- /

- OM:HM B

H&M (OM:HM B): Assessing Valuation After Style Shop Launch and Perfect Moment Winter Collaboration

Reviewed by Simply Wall St

H & M Hennes & Mauritz (OM:HM B) is making headlines with its latest moves to capture attention this holiday season. The company is rolling out a ski-inspired capsule with Perfect Moment and is spotlighting Black designers in select stores.

See our latest analysis for H & M Hennes & Mauritz.

These new initiatives come after a strong run for H & M Hennes & Mauritz’s shares, which have climbed 28% over the past 90 days and delivered a 24% total shareholder return in the last year. The stock’s momentum appears to be building as recent creative partnerships and inclusivity efforts help drive renewed interest from investors and shoppers.

If you're interested in where market momentum and insider confidence align, it's a great moment to explore fast growing stocks with high insider ownership.

With such strong recent gains, investors are left to wonder if H & M Hennes & Mauritz is still trading at an attractive price, or if the company’s future growth is already fully reflected in the stock price.

Most Popular Narrative: 22.8% Overvalued

H & M Hennes & Mauritz’s most widely followed narrative points to a fair value considerably below its recent market price, creating a clear divergence between market optimism and valuation fundamentals.

“Rising inventory and purchasing costs, weaker key market sales, and global trade challenges may pressure H&M's margins and hinder future growth.”

Can the company’s strategic bets, slow but steady sales growth, and margin forecasts justify a valuation above its industry peers? Analysts used tougher profit assumptions and a future earnings multiple that may surprise you. Uncover the full narrative to see what is fueling this price target.

Result: Fair Value of $149.78 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising inventory levels and continued weak sales in key markets could quickly challenge the current optimism around H & M Hennes & Mauritz’s outlook.

Find out about the key risks to this H & M Hennes & Mauritz narrative.

Another View: Discounted Cash Flow Signals Opportunity

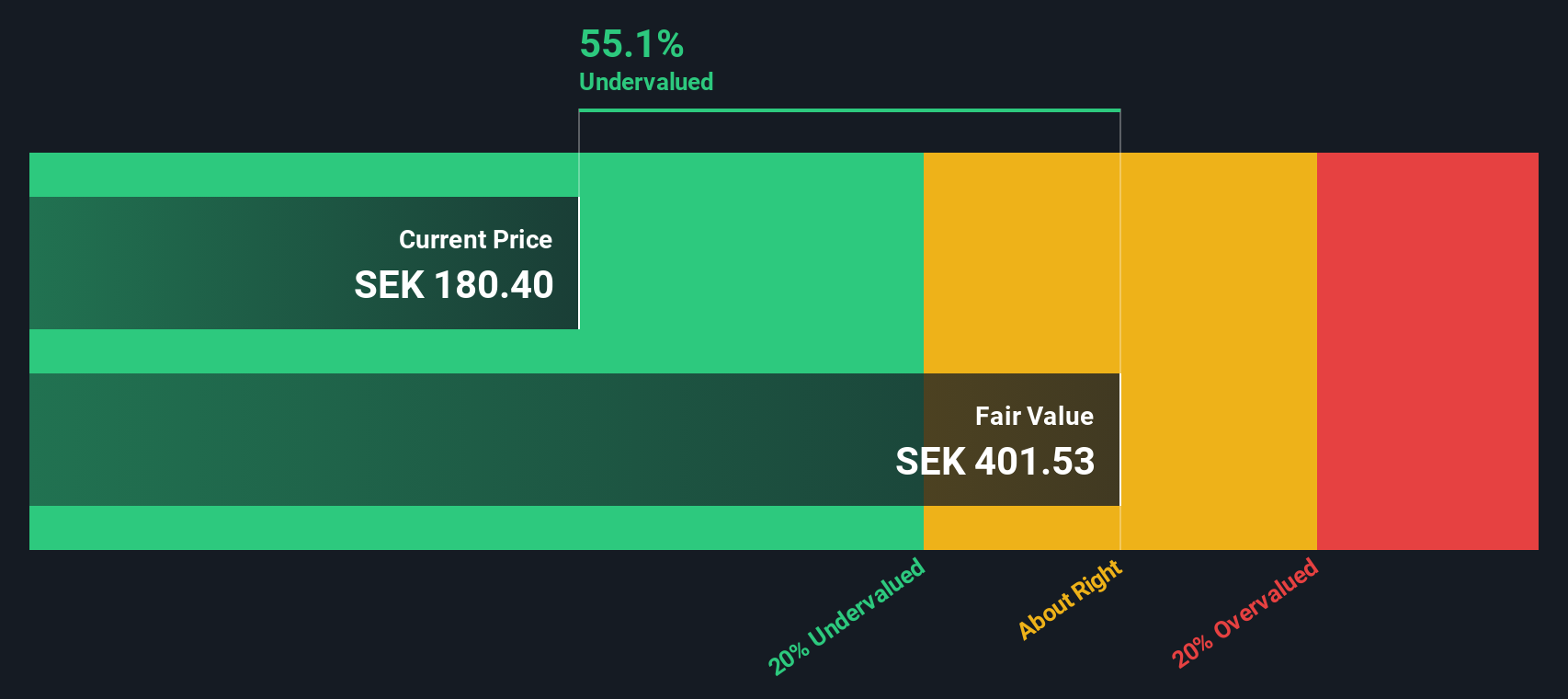

While multiples-based valuations make H & M Hennes & Mauritz look expensive compared to peers, our DCF model shows a different picture. The SWS DCF model estimates the fair value at SEK404.07, which is far above the current trading price. Could the market be overlooking long-term earnings potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out H & M Hennes & Mauritz for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own H & M Hennes & Mauritz Narrative

If you have a different perspective or want to dive deeper into the numbers, you can shape your own investment story in just a few minutes. Do it your way.

A great starting point for your H & M Hennes & Mauritz research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let a great opportunity slip by while the market is moving. There are standout stocks driven by powerful trends you should be watching right now.

- Uncover companies shaking up artificial intelligence by getting started with these 27 AI penny stocks to see who’s setting the pace for tomorrow’s tech growth.

- Capture high yield and reliable cash-flow by reviewing these 15 dividend stocks with yields > 3%, where top stocks with strong dividends are making steady returns work for you.

- Catch the undervalued gems other investors may be missing by reviewing these 885 undervalued stocks based on cash flows and position yourself ahead of the next breakout story.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H & M Hennes & Mauritz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HM B

H & M Hennes & Mauritz

Provides clothing, accessories, footwear, cosmetics, home textiles, and homeware for women, men, and children worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives