- Sweden

- /

- Specialty Stores

- /

- OM:HM B

Do H&M’s (OM:HM B) Premium Collaborations Signal a New Brand Strategy or Risk Dilution?

Reviewed by Sasha Jovanovic

- Earlier this month, Perfect Moment Ltd. announced a holiday collaboration with H&M featuring a 28-piece ski and lifestyle capsule, while H&M also launched The Style Shop, Curated by Maison Black, to spotlight Black designers in select U.S. stores.

- These two initiatives highlight H&M's effort to attract new and diverse audiences through premium collection partnerships and in-store experiences championing inclusivity.

- We'll examine how H&M's partnership with Perfect Moment to target the premium winterwear segment influences the company's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

H & M Hennes & Mauritz Investment Narrative Recap

Owning H&M shares means believing in the company’s ability to boost revenue through a blend of premium partnerships, curated store experiences, and brand elevation, especially in womenswear and digital platforms. The latest collaboration with luxury ski brand Perfect Moment and the launch of The Style Shop are positive brand moves but are unlikely to immediately shift the main catalyst: improving margins by optimizing inventory and controlling purchasing costs. The biggest near-term risk remains pressure on net margins due to higher inventory and transport costs.

The Perfect Moment partnership stands out by targeting the premium winterwear segment, aligning with H&M’s strategy to strengthen its brand and access higher-margin categories. While appealing, this announcement comes as investors monitor margin pressure, an area recently affected by increased markdowns and external cost headwinds.

By contrast, investors should also be aware that ongoing cost pressures on net margins could lead to...

Read the full narrative on H & M Hennes & Mauritz (it's free!)

H & M Hennes & Mauritz's narrative projects SEK242.9 billion revenue and SEK14.3 billion earnings by 2028. This requires 1.4% yearly revenue growth and a SEK4.4 billion earnings increase from SEK9.9 billion today.

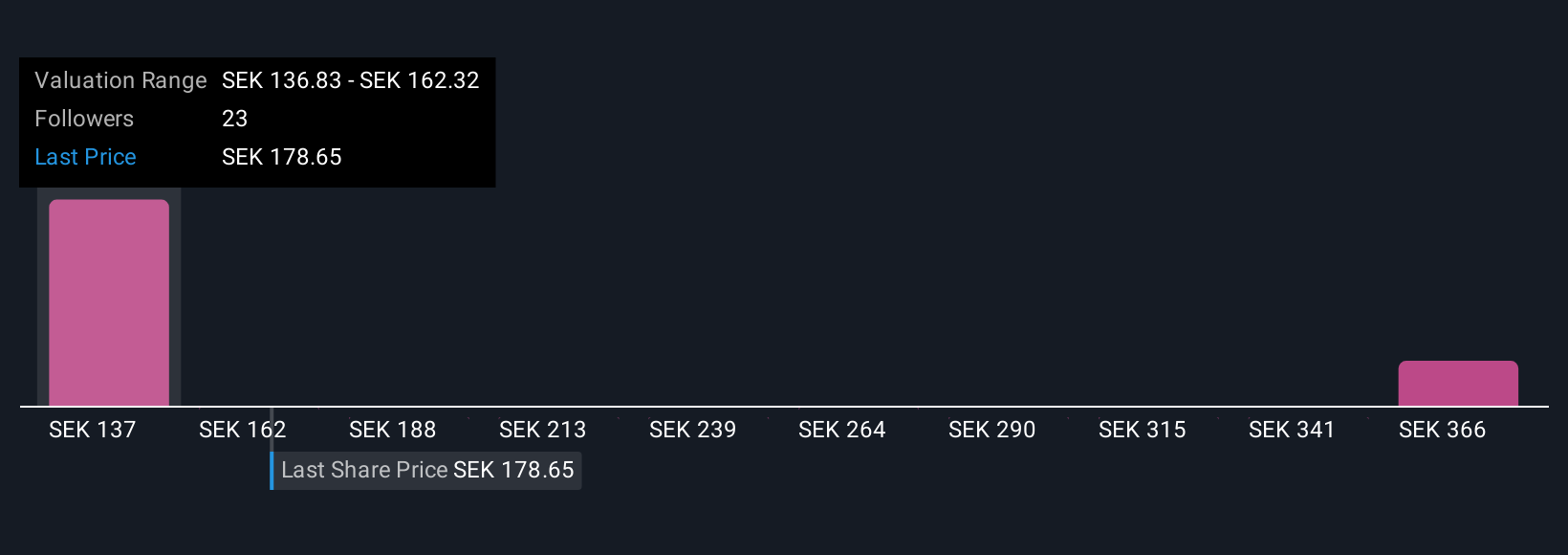

Uncover how H & M Hennes & Mauritz's forecasts yield a SEK149.78 fair value, a 18% downside to its current price.

Exploring Other Perspectives

Five private investors in the Simply Wall St Community estimate H&M’s fair value between SEK149.78 and SEK405.20, showing broad views on its potential. While margin improvements remain central for future performance, this diversity signals the importance of considering several viewpoints before making investment decisions.

Explore 5 other fair value estimates on H & M Hennes & Mauritz - why the stock might be worth over 2x more than the current price!

Build Your Own H & M Hennes & Mauritz Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your H & M Hennes & Mauritz research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free H & M Hennes & Mauritz research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate H & M Hennes & Mauritz's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H & M Hennes & Mauritz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HM B

H & M Hennes & Mauritz

Provides clothing, accessories, footwear, cosmetics, home textiles, and homeware for women, men, and children worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives