- Sweden

- /

- Specialty Stores

- /

- OM:FOI B

Fenix Outdoor International (OM:FOI B) Net Margin Miss Reinforces Cautious Market Narratives

Reviewed by Simply Wall St

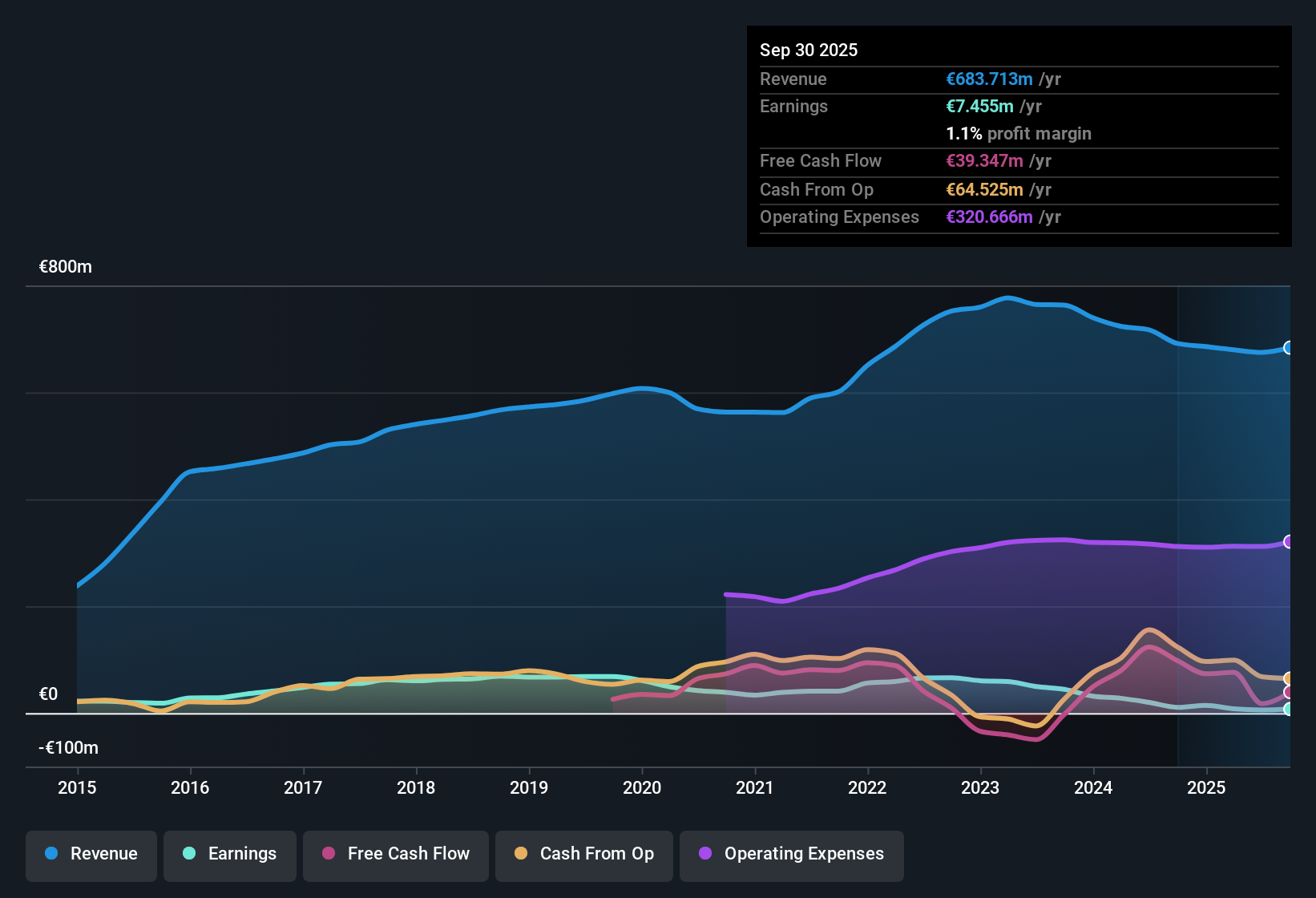

Fenix Outdoor International (OM:FOI B) posted a net profit margin of 1.1%, slipping from 1.6% this time last year, as the company continues to face narrowing profitability. Over the past five years, earnings have declined by 23% annually, with this year's results confirming negative earnings growth and little sign of a short-term turnaround. Despite this, reported earnings are considered high quality.

See our full analysis for Fenix Outdoor International.Next, we will see how these headline numbers stack up against the dominant narratives in the market. Some assumptions will get tested and others may need adjusting.

Curious how numbers become stories that shape markets? Explore Community Narratives

High P/E Ratio Fuels Valuation Debate

- Fenix Outdoor International trades at a lofty price-to-earnings (P/E) multiple of 86.4x. This figure is significantly higher than both the peer group average of 36x and the broader European specialty retail industry at 20.4x. The current share price stands at SEK525 compared to a DCF fair value of SEK83.54.

- Bulls typically argue that premium valuations are justified for companies with resilient brands and sustainable business practices. In this case, the market is paying an unusually steep price for shares, especially as profit margins narrow year on year.

- The P/E multiple is more than double that of the nearest peers. Bullish arguments suggest this is supported by high-quality earnings, yet the sharp decline in margins indicates the situation may not be as clear-cut as bulls hope.

- The share price premium over DCF fair value prompts investors to carefully consider whether current optimism overlooks the impact of continued earnings pressure.

Profit Compression Continues Despite Quality

- Net profit margins have shrunk to 1.1% from last year's 1.6%, while annual earnings have been declining at a rate of 23% over the past five years.

- Notably, the prevailing market view is that although earnings are described as high quality, the business has not yet stabilized from its extended period of decline. This highlights ongoing tensions between fundamental quality and operational realities.

- Bears highlight the compounding effect of several consecutive years of negative earnings growth, raising questions about whether the company's strong brand is enough to offset persistent profitability headwinds.

- Investors expecting a fast turnaround may be disappointed, as there is no clear signal in current filings or data indicating that a reversal in margin pressure is imminent.

Expensive Shares Leave Little Room for Error

- With the share price at SEK525 and DCF fair value estimated at SEK83.54, Fenix Outdoor International is trading at more than six times its fair value assessment.

- According to the prevailing market view, such a wide gap between price and fundamental value emphasizes cautious sentiment. Investors appear to be betting on aspects of the business not yet reflected in recent financial performance.

- The risk is that any further deterioration in profitability or lack of improvement will quickly expose the downside of paying such a steep premium.

- Conversely, the upside scenario depends significantly on the company's ability to quickly reverse declines and justify the optimistic multiples embedded in the current price.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Fenix Outdoor International's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Fenix Outdoor International’s persistently shrinking profit margins, declining earnings, and steep valuation raise serious doubts about future performance and downside risk.

If paying a premium for ongoing declines feels risky, consider these 839 undervalued stocks based on cash flows for ideas where market pessimism might be overstated and long-term value still exists.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FOI B

Fenix Outdoor International

Together w ith its subsidiaries, develops and markets outdoor products worldwide.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives