- Sweden

- /

- Specialty Stores

- /

- OM:BMAX

Byggmax (OM:BMAX) Profit Margin Jumps to 2.9%, Reinforcing Positive Investor Narratives

Reviewed by Simply Wall St

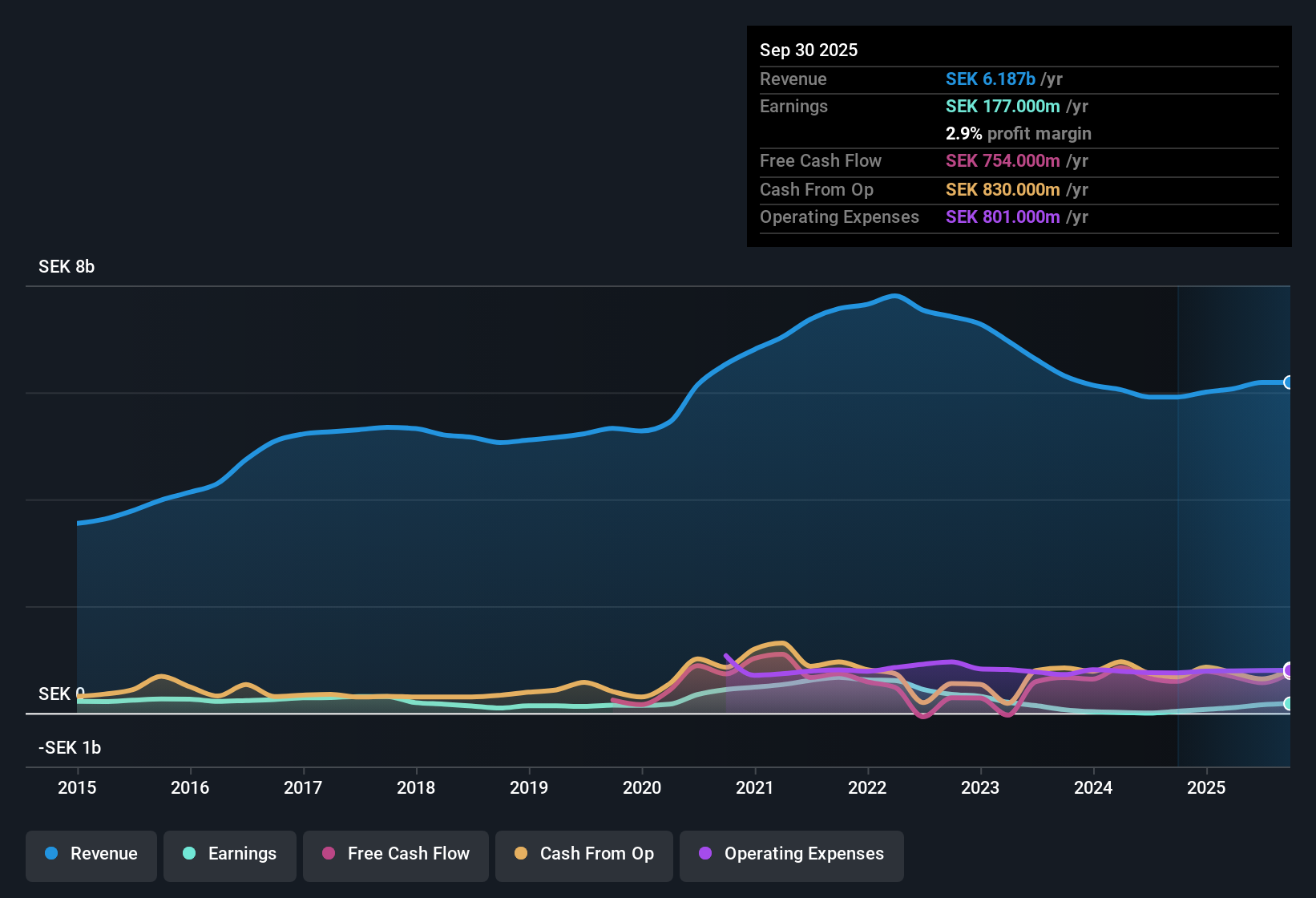

Byggmax Group (OM:BMAX) has delivered a dramatic earnings turnaround, with net profit margins rising to 2.9% from last year's 0.6%. The company's earnings soared 420.6% in the most recent year after five years of average declines at 43.5% per year. Investors now see Byggmax trading below estimated fair value and benefiting from a much stronger earnings outlook, which sets a positive tone for upcoming quarters.

See our full analysis for Byggmax Group.We’re taking these fresh results and setting them side by side with the Simply Wall St community narratives to see which stories hold up and which might need a rethink.

See what the community is saying about Byggmax Group

Profit Margin Expansion Outpaces Swedish Peers

- Byggmax’s net profit margin now stands at 2.9%, surpassing last year’s 0.6% and indicating a significant improvement in profitability quality not just sequentially, but also versus the broader Swedish market. Average earnings growth in the Swedish market is 12.6% annually over the next three years compared to Byggmax’s forecasted 22.4%.

- According to analysts’ consensus view, strong operational efficiencies, including better purchasing strategies and improved e-commerce logistics, are expected to keep driving margins higher.

- The combination of optimized strategies and financial stability has given Byggmax flexibility to invest strategically, aiming for profit margins to rise from 2.5% today to 5.4% in three years.

- What’s notable is that these margin gains align with expanded product offerings, positioning the company to capitalize on sector growth even as revenue growth forecasts of 2.6% per year trail the Swedish market average.

- With margins rebounding and strategic growth levers in play, see what the consensus narrative signals about Byggmax’s evolving story. 📊 Read the full Byggmax Group Consensus Narrative.

Leverage and Debt Levels Set Up for Expansion

- Reduced net debt and a stronger leverage ratio place Byggmax on solid financial footing for future investments, supporting the bulls’ view that earnings quality can be sustained or improved through cyclical swings.

- The consensus narrative emphasizes that this improved capital structure gives Byggmax room to expand via new initiatives such as modular houses and private label greenhouses, but warns that maintaining profitability will depend on efficient inventory and continued operational discipline.

- This financial flexibility comes as forecasts see earnings rising from SEK 155 million today to SEK 377.8 million by September 2028, yet depends on avoiding inventory imbalances and keeping leverage in check even as growth initiatives ramp up.

- The shift toward lower net debt and potential high season sales gains further underpins the company’s readiness to take advantage of market opportunities as they arise.

At a Discount to DCF Fair Value and Industry PE

- Byggmax trades at SEK 47.10 per share, below both its DCF fair value of SEK 63.14 and the analysts’ price target of SEK 53.00, and carries a PE ratio of 15.6x, a discount to the European specialty retail industry average of 20.8x and peer group average of 55.7x.

- Analysts’ consensus view suggests that this valuation gap reflects not just recent profit growth, but also market skepticism about whether Byggmax can continue outperforming slower sector revenue trends and live up to expected margin improvements.

- For Byggmax to match analysts’ expectations, it needs to reach SEK 377.8 million in earnings and a PE of 11.6x by 2028, requiring operational discipline despite only modest revenue growth projections.

- The relatively small 6.5% difference between the current share price and the price target signals that the market sees Byggmax as fairly valued, rewarding recent execution but watching closely for sustained outperformance in profitability and cost control.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Byggmax Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think your perspective offers fresh insight? Take just a few minutes to shape your own interpretation and contribute your narrative: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Byggmax Group.

See What Else Is Out There

Despite Byggmax's improved profits and margin gains, its modest revenue growth lags the Swedish market and raises questions about consistent future expansion.

If stable and reliable performance matters most to you, consider discovering companies offering steadier track records across cycles with stable growth stocks screener (2101 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Byggmax Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BMAX

Byggmax Group

Sells building materials and related products for DIY projects in Sweden, Norway, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives