- Sweden

- /

- Real Estate

- /

- OM:TINGS A

Investors who have held Tingsvalvet Fastighets (STO:TINGS A) over the last five years have watched its earnings decline along with their investment

Tingsvalvet Fastighets AB (publ) (STO:TINGS A) shareholders should be happy to see the share price up 19% in the last month. But that doesn't change the fact that the returns over the last half decade have been disappointing. Indeed, the share price is down 62% in the period. Some might say the recent bounce is to be expected after such a bad drop. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

While the stock has risen 16% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Tingsvalvet Fastighets

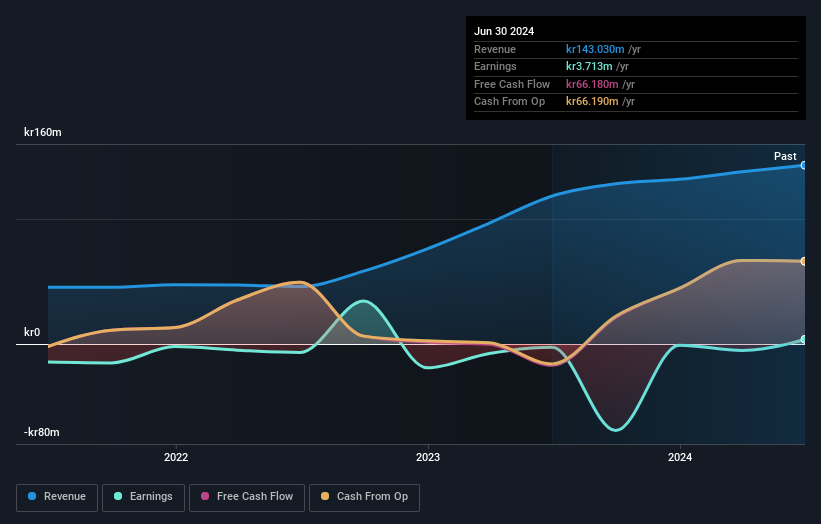

We don't think that Tingsvalvet Fastighets' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Tingsvalvet Fastighets' total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Tingsvalvet Fastighets' TSR of was a loss of 52% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

We're pleased to report that Tingsvalvet Fastighets shareholders have received a total shareholder return of 61% over one year. There's no doubt those recent returns are much better than the TSR loss of 9% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Tingsvalvet Fastighets better, we need to consider many other factors. To that end, you should learn about the 5 warning signs we've spotted with Tingsvalvet Fastighets (including 2 which are significant) .

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Tingsvalvet Fastighets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:TINGS A

Tingsvalvet Fastighets

A real estate company, owns, manages, and leases office and commercial properties in Central Sweden.

Moderate and fair value.