- Sweden

- /

- Real Estate

- /

- OM:SVEAF

Three Stocks Estimated To Be Trading Below Intrinsic Value In January 2025

Reviewed by Simply Wall St

As global markets experience a rebound, driven by easing inflation and strong earnings in the financial sector, investors are increasingly optimistic about potential opportunities. In this climate, identifying stocks that are trading below their intrinsic value can be particularly appealing, as these investments may offer significant upside potential when market conditions stabilize further.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Atlantic Union Bankshares (NYSE:AUB) | US$37.87 | US$75.61 | 49.9% |

| Dongsung FineTec (KOSDAQ:A033500) | ₩18390.00 | ₩36681.91 | 49.9% |

| Avant Group (TSE:3836) | ¥1897.00 | ¥3776.87 | 49.8% |

| Thai Coconut (SET:COCOCO) | THB10.80 | THB21.59 | 50% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1114.70 | ₹2219.85 | 49.8% |

| Equity Bancshares (NYSE:EQBK) | US$43.13 | US$86.02 | 49.9% |

| Zhaojin Mining Industry (SEHK:1818) | HK$11.96 | HK$23.83 | 49.8% |

| Hd Hyundai MipoLtd (KOSE:A010620) | ₩128700.00 | ₩257269.19 | 50% |

| LifeMD (NasdaqGM:LFMD) | US$4.90 | US$9.77 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5880.00 | ¥11700.97 | 49.7% |

Here's a peek at a few of the choices from the screener.

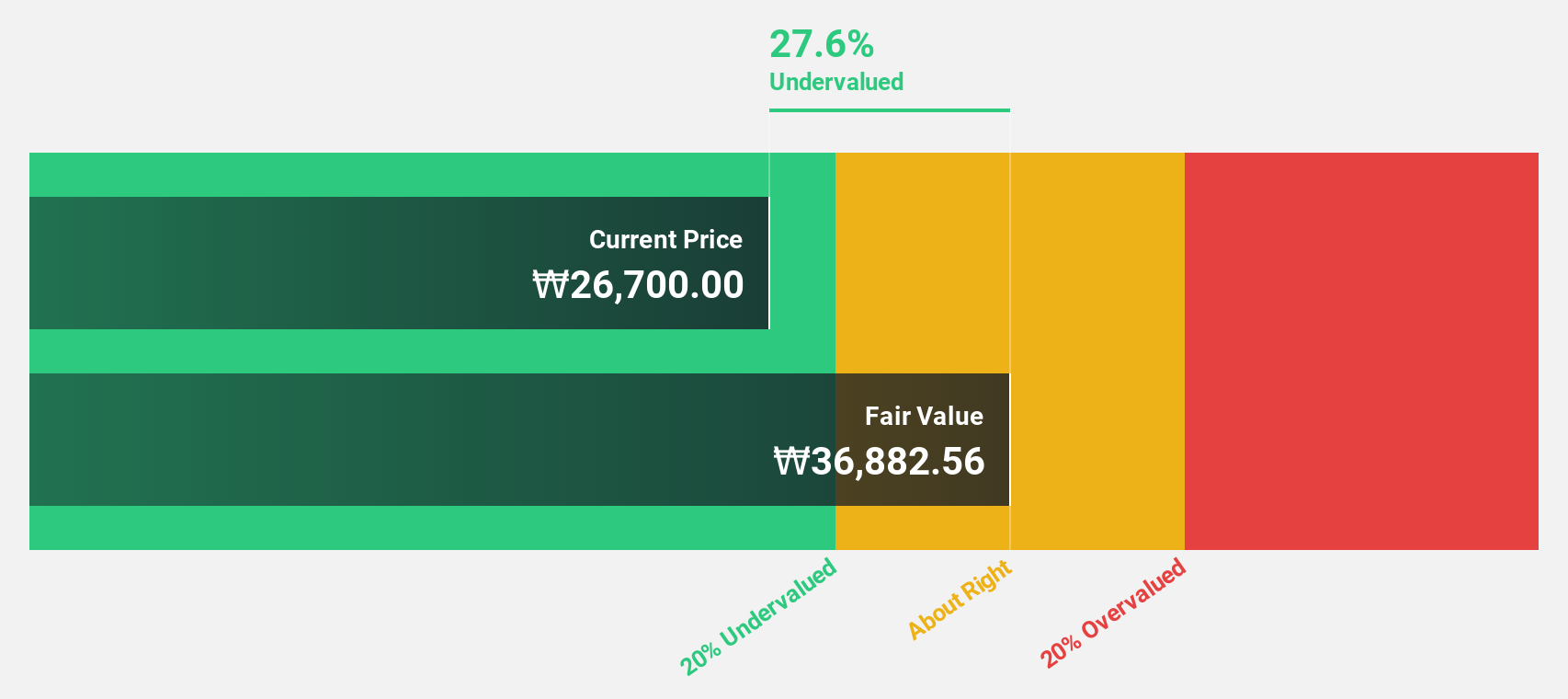

Dongsung FineTec (KOSDAQ:A033500)

Overview: Dongsung FineTec Co., Ltd. manufactures and sells cryogenic insulation products in South Korea, with a market cap of approximately ₩535.08 billion.

Operations: The company's revenue is primarily derived from its Cooling Material segment, contributing ₩528.74 billion, and its Gas Business segment, which adds ₩21.94 billion.

Estimated Discount To Fair Value: 49.9%

Dongsung FineTec's current trading price of ₩18,390 is significantly below its estimated fair value of ₩36,681.91, highlighting its potential undervaluation based on cash flows. Despite a slight decline in recent quarterly net income to KRW 8.70 billion from KRW 9.87 billion a year ago, the company's earnings are forecast to grow by 34.84% annually over the next three years—outpacing the market's growth rate and indicating robust future profitability prospects.

- According our earnings growth report, there's an indication that Dongsung FineTec might be ready to expand.

- Dive into the specifics of Dongsung FineTec here with our thorough financial health report.

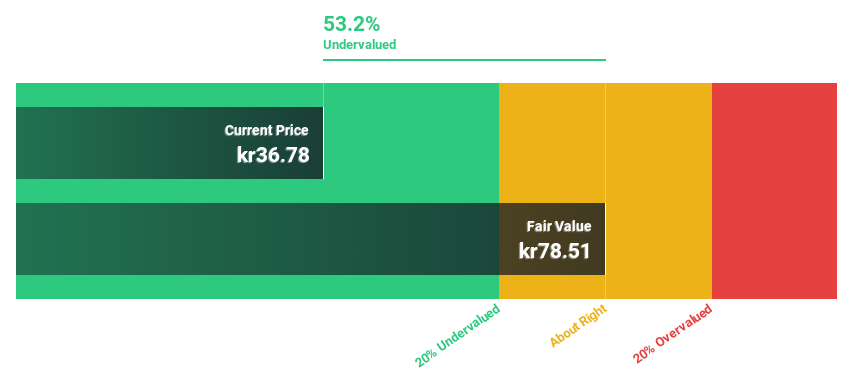

Sveafastigheter (OM:SVEAF)

Overview: Sveafastigheter AB (publ) is a real estate company that owns, manages, and builds residential properties in Sweden, with a market cap of SEK7.18 billion.

Operations: The company's revenue segments include SEK1.29 billion from Property Management, with an additional segment adjustment of SEK9 million.

Estimated Discount To Fair Value: 36.4%

Sveafastigheter's current price of SEK35.9 is notably below its estimated fair value of SEK56.48, suggesting undervaluation based on cash flows. Recent revenue growth of 72.2% and forecasts for continued above-market growth at 6.4% annually bolster its potential, despite a net loss reduction from SEK750 million to SEK338 million year-on-year in Q3 2024. The company is expected to achieve profitability within three years, although return on equity remains low at a forecasted 4.6%.

- Insights from our recent growth report point to a promising forecast for Sveafastigheter's business outlook.

- Get an in-depth perspective on Sveafastigheter's balance sheet by reading our health report here.

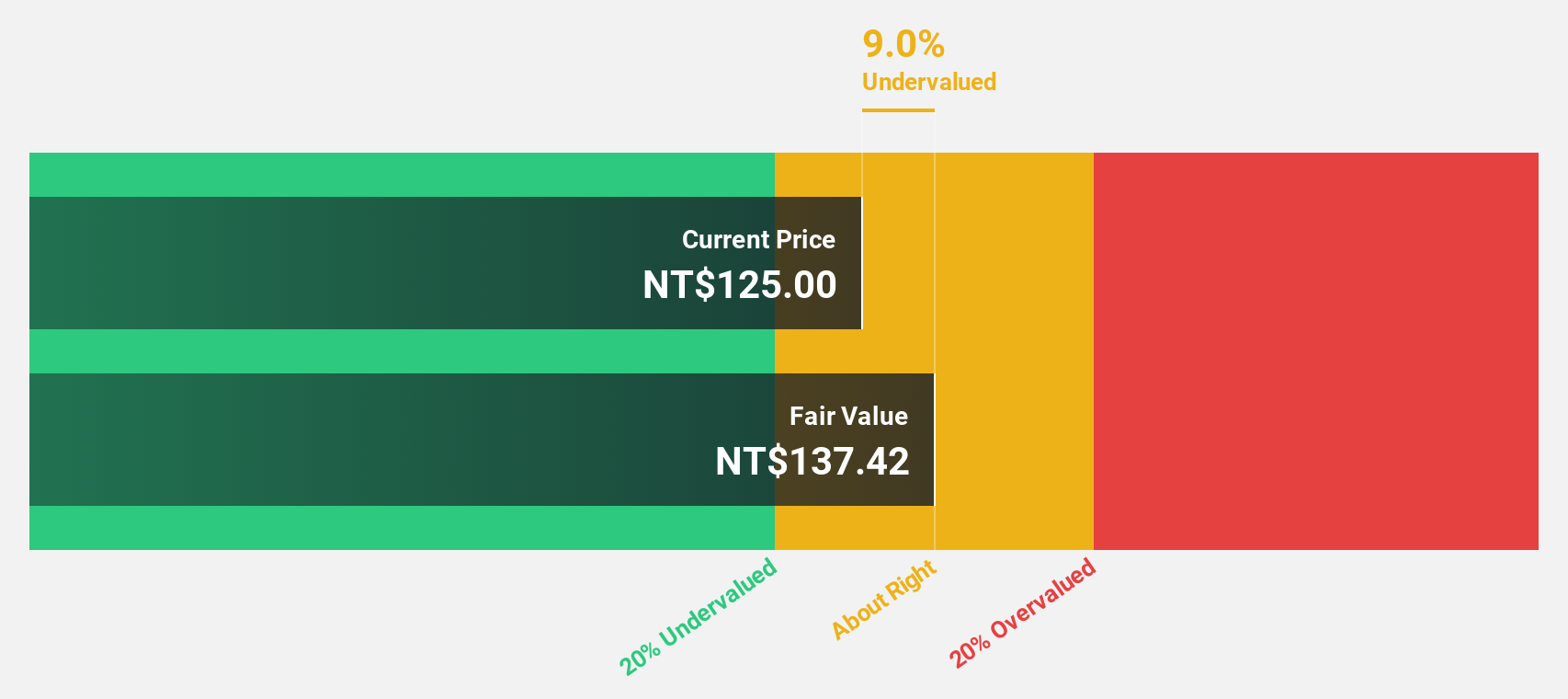

Visual Photonics Epitaxy (TWSE:2455)

Overview: Visual Photonics Epitaxy Co., Ltd. specializes in the R&D, manufacturing, and sales of optoelectronic semiconductor epitaxy and components globally, with a market cap of NT$30.51 billion.

Operations: The company generates revenue from its Semiconductor Equipment and Services segment, amounting to NT$3.46 billion.

Estimated Discount To Fair Value: 14.3%

Visual Photonics Epitaxy's current trading price of NT$162 is below its fair value estimate of NT$189.11, indicating potential undervaluation based on cash flows. The company reported significant earnings growth, with net income for the first nine months of 2024 at NT$538.19 million compared to NT$261.85 million a year ago. Despite a volatile share price, earnings are projected to grow significantly over the next three years, supported by robust revenue forecasts exceeding market averages.

- The growth report we've compiled suggests that Visual Photonics Epitaxy's future prospects could be on the up.

- Navigate through the intricacies of Visual Photonics Epitaxy with our comprehensive financial health report here.

Summing It All Up

- Click this link to deep-dive into the 874 companies within our Undervalued Stocks Based On Cash Flows screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SVEAF

Sveafastigheter

A real estate company, owns, builds, and manages residential properties in Sweden.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives