- Sweden

- /

- Real Estate

- /

- OM:SAGA A

Sagax (OM:SAGA A) Earnings Surge Driven by SEK1.2B One-Off Gain Challenges Profit Quality Narratives

Reviewed by Simply Wall St

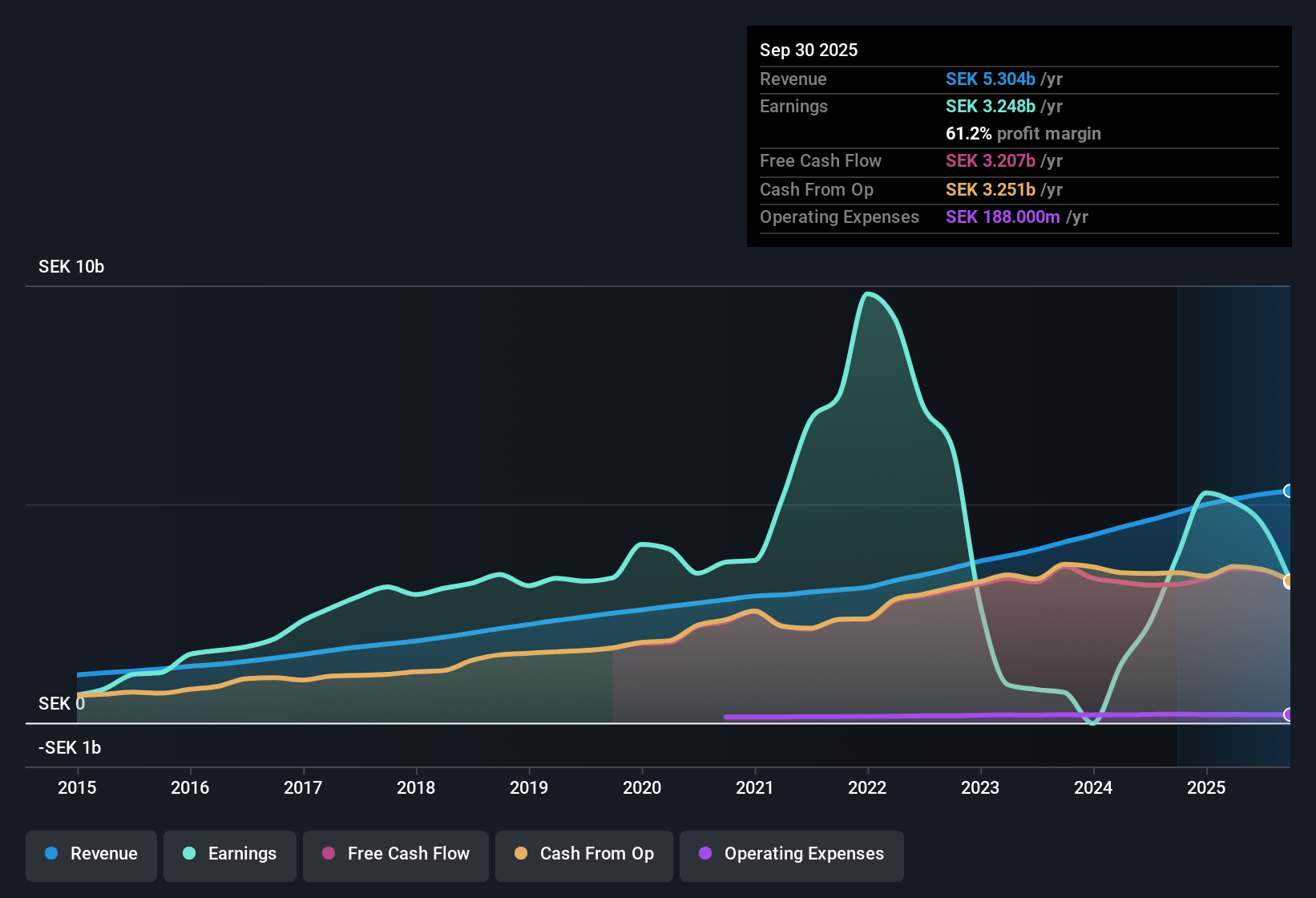

AB Sagax (OM:SAGA A) posted a striking surge in profitability, with earnings up 101.5% over the last year after a run of average annual declines of 17.2% over the past five years. Net profit margins climbed to 87.1% from 48.8%, as a SEK1.2 billion one-off gain played a big role in the past twelve months’ results. With such a significant non-recurring boost to earnings, investors will need to weigh whether these headline figures signal true momentum or just a temporary upside.

See our full analysis for AB Sagax.Next up, we stack the headline and margin figures against the current market narrative to see which stories hold up under closer scrutiny and where expectations might need to shift.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off SEK1.2 Billion Gain Clouds Profit Trends

- The past twelve months included a SEK1.2 billion ($1.2 billion) one-off gain, a single event that dramatically inflates this year’s net profit and margin results.

- What’s challenging for investors is that headline profit growth and current margins are both heavily supported by this unique gain, making it tough to judge if underlying operations have truly improved.

- Consistent profitability was hard to achieve over the last five years, given the average annual earnings decline of 17.2% before this event.

- Skeptics stress that such a one-off boost does little to clarify recurring earnings power for future periods.

Forecasted 21.4% Earnings Growth Outpaces Market

- Analysts expect Sagax’s earnings to grow by 21.4% annually looking forward, with anticipated revenue growth of 8.4% per year, placing both figures ahead of the Swedish market average.

- While bulls would highlight strong projected growth, the story is nuanced because previous years’ declining profits contrast sharply with upbeat forecasts. Sustained momentum will require that profitable growth proves to be more than a rebound from past declines.

- Analysts cite the recent net margin jump, but long-term trends reinforce the need to see recurring growth without reliance on exceptional items.

- Some bullish investors see margin expansion as setting a constructive tone, even as temporary boosts complicate the growth case.

Premium Valuation: P/E of 22.9x vs Industry 16.1x

- Sagax trades at a Price-to-Earnings ratio of 22.9x, notably higher than both the Swedish real estate industry average of 16.1x and peer group average of 17.8x.

- The prevailing analysis contends that robust forecasted growth and margin expansion may justify Sagax’s premium, but with shares at SEK224.0 and recent gains driven by non-recurring items, there is visible tension over whether today’s valuation fully reflects underlying risks.

- Investors must weigh if projected outperformance offsets the risk of future results normalizing towards industry trends.

- The non-recurring SEK1.2 billion gain could be causing the market to overestimate sustainable earnings, making today’s premium less secure than it first appears.

To see how these numbers connect to broader narratives and long-term drivers for Sagax, read the full range of perspectives from the community narrative. Curious how numbers become stories that shape markets? Explore Community Narratives

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on AB Sagax's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Sagax’s eye-catching profit jump is heavily reliant on a one-off gain, raising concerns about true earnings quality and a stretched valuation compared to peers.

If you want companies whose price better reflects genuine, recurring growth potential, start your search with these 878 undervalued stocks based on cash flows where the numbers support lasting value, not just one-off boosts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SAGA A

AB Sagax

A property company, owns and manages a property portfolio in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives