- Sweden

- /

- Real Estate

- /

- OM:PNDX B

Pandox (OM:PNDX B) Profit Surge Driven by SEK556M One-Off Gain Raises Quality Questions

Reviewed by Simply Wall St

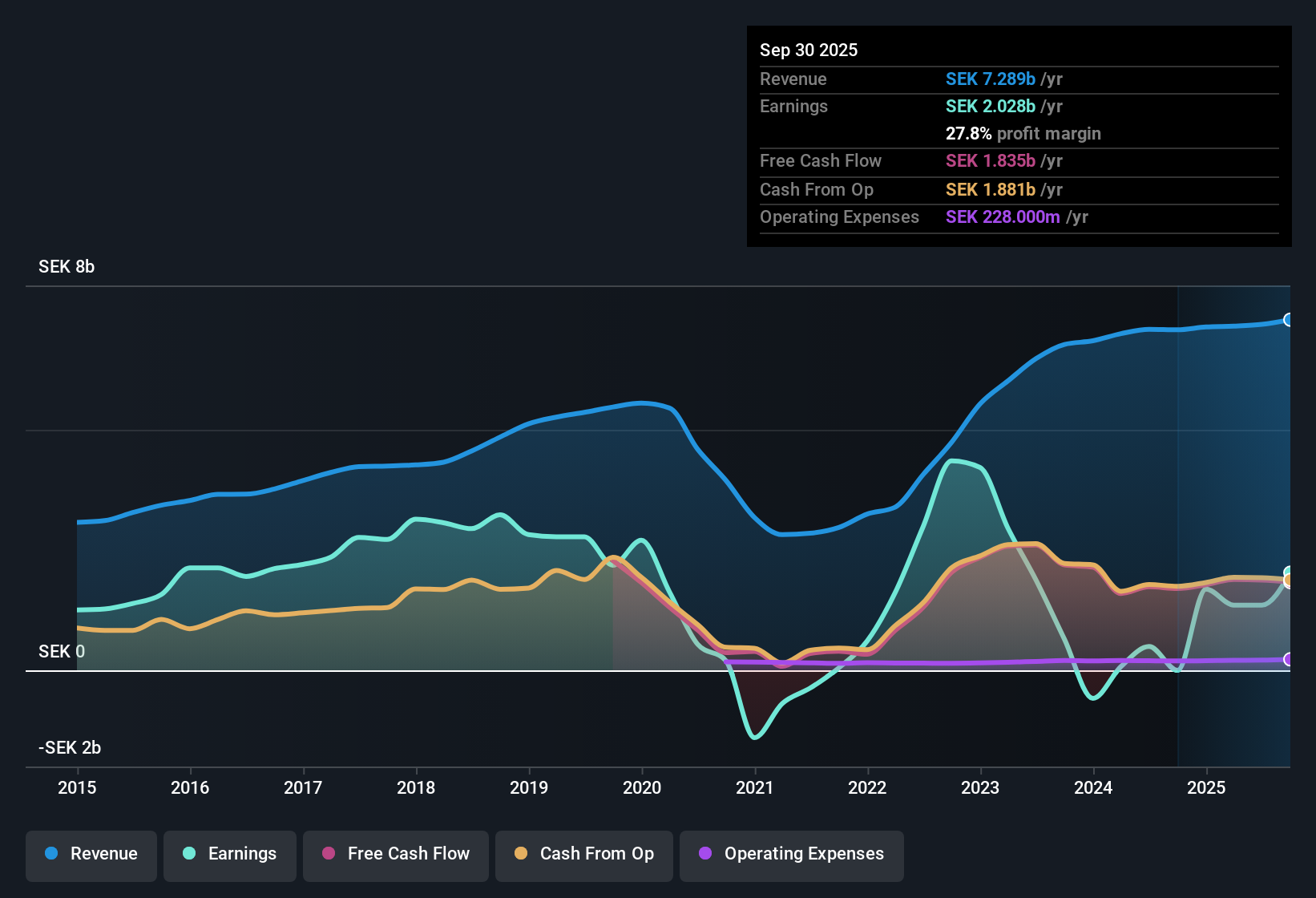

Pandox (OM:PNDX B) delivered standout earnings growth over the past year, with profits soaring 173.5%, far surpassing the company’s five-year average growth of 16.1% per year. Net profit margin improved sharply to 18.8% from 7% a year earlier, benefiting from a sizeable one-off gain of SEK556.0M during the period. As earnings catch the spotlight, investors will be watching closely. Despite rosy profitability, revenue is set to decline by 8.2% annually over the next three years while future earnings growth is predicted at 10.6%, trailing the broader Swedish market’s expected 12.3% pace.

See our full analysis for Pandox.The next section dives into how these headline numbers stack up against the most widely debated narratives in the market, surfacing where the stories align and where they face new questions.

See what the community is saying about Pandox

Margin Leap Fueled by One-Off Gain

- The net profit margin surged to 18.8%, largely due to a SEK556.0 million non-recurring gain that is unlikely to repeat in coming periods.

- Consensus narrative highlights the margin expansion as a positive but notes that the temporary nature of this large gain raises questions about how sustainable these levels are as non-recurring items diminish.

- Pandox's margin jump is notable in recent years, but analysts warn the effect of a one-off event could fade, putting pressure on future margins.

- The consensus sees upgraded properties and robust demand at domestic brands supporting some margin improvements. However, risks remain if underlying operational performance softens once the one-off benefit is no longer present.

The run-up in margins is significant, but consensus suggests ongoing earnings quality will need to be watched closely as normal operations resume. 📊 Read the full Pandox Consensus Narrative.

Premium Price Tag vs. Peers

- Pandox trades at a 27.6x Price-to-Earnings ratio, far higher than the Swedish real estate industry average of 16.1x and peers at 19.7x. Its current share price of 191.8 is above both the DCF fair value of 41.33 and the analyst price target of 220.0.

- Analysts' consensus narrative debates whether sustained profit growth justifies paying this premium, especially as revenue is forecast to decline by 8.2% annually for the next three years.

- The premium reflects optimism for property upgrades, new leases, and stable domestic demand to drive future cash flows.

- However, expectations for declining revenue and a slower profit trajectory raise questions about whether current pricing already factors in the upside, making valuation more sensitive to execution risk and sector headwinds.

Currency and Refinancing Risks Lurk

- The appreciation of the Swedish krona created significant negative translation effects for foreign property earnings, contributing to a weaker EPRA NRV per share and exposing Pandox to ongoing currency volatility.

- Consensus narrative stresses that debt load, now at 47.4% loan-to-value after recent acquisitions, and exposure to currency swings are key watchpoints as future refinancing or further krona strength could reduce profitability.

- The company faces added pressure from economic swings and high borrowing, which could limit flexibility during periods of earnings pressure or market stress.

- Consensus highlights that stability in the company’s core Nordic operations can help offset some risk. However, financing and FX exposures will remain in focus for any durable turnaround.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Pandox on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different perspective on the data? Share your take and craft a unique narrative in just a few minutes. Do it your way

A great starting point for your Pandox research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Pandox faces valuation risks, declining revenue forecasts, and ongoing currency and debt challenges. These factors could pressure future profits if conditions worsen.

If you're seeking stocks with stronger value upside and less premium risk than Pandox, check out these 876 undervalued stocks based on cash flows to see which opportunities might offer a better margin of safety right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:PNDX B

Pandox

A hotel property company, owns, develops, and leases hotel properties.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives