- Sweden

- /

- Real Estate

- /

- OM:OP

Further Upside For Oscar Properties Holding AB (publ) (STO:OP) Shares Could Introduce Price Risks After 34% Bounce

Oscar Properties Holding AB (publ) (STO:OP) shares have continued their recent momentum with a 34% gain in the last month alone. But the last month did very little to improve the 54% share price decline over the last year.

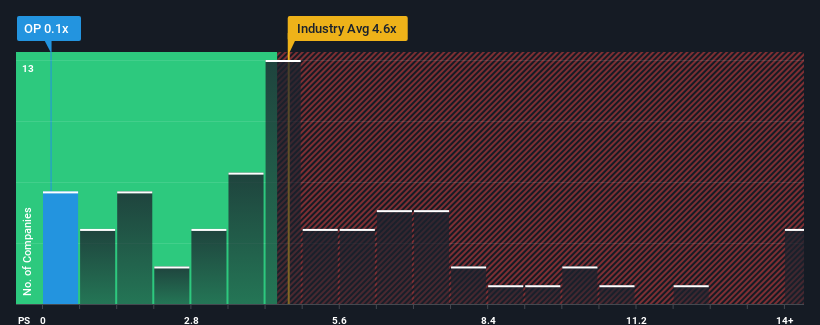

Even after such a large jump in price, Oscar Properties Holding may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Real Estate industry in Sweden have P/S ratios greater than 4.6x and even P/S higher than 7x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Oscar Properties Holding

What Does Oscar Properties Holding's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Oscar Properties Holding has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Oscar Properties Holding.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Oscar Properties Holding would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 32% gain to the company's top line. Pleasingly, revenue has also lifted 236% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 6.6% during the coming year according to the sole analyst following the company. With the industry only predicted to deliver 1.8%, the company is positioned for a stronger revenue result.

With this information, we find it odd that Oscar Properties Holding is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Oscar Properties Holding's P/S

Shares in Oscar Properties Holding have risen appreciably however, its P/S is still subdued. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Oscar Properties Holding's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

It is also worth noting that we have found 3 warning signs for Oscar Properties Holding (2 shouldn't be ignored!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:OP

Oscar Properties Holding

Oscar Properties Holding AB (publ) purchases, develops, manages, and sells real estate properties in Stockholm.

Moderate and slightly overvalued.

Similar Companies

Market Insights

Community Narratives