- Sweden

- /

- Real Estate

- /

- OM:NYF

Nyfosa (OM:NYF): Valuation in Focus After Earnings Show Return to Profitability

Reviewed by Simply Wall St

Nyfosa (OM:NYF) has just released its third quarter and nine-month results for 2025, highlighting a return to profitability after a period of losses. This turnaround in earnings is drawing attention from investors who are watching the company’s recovery.

See our latest analysis for Nyfosa.

Nyfosa’s return to profitability comes at a time when its share price remains under pressure, with a year-to-date decline of 24.27%. While the recent earnings turnaround and moves like the planned acquisition in Kuopio have caught some positive attention, the momentum is still recovering. This is reflected in a one-year total shareholder return of -23.81%. However, looking further out, investors who stayed the course over three and five years would have seen total returns of 27.4% and 16.8% respectively, a reminder that sentiment and outlook can shift quickly in real estate stocks.

If Nyfosa’s bounceback has you wondering what other opportunities might be emerging, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With the stock still trading below analysts’ targets despite a solid earnings recovery, investors are left to wonder if this is a rare value opportunity in Nyfosa, or if the market has already factored in all upcoming growth.

Price-to-Earnings of 29.8x: Is it justified?

Nyfosa is currently trading at a price-to-earnings (P/E) ratio of 29.8x, which is substantially higher than both its industry peers and the wider Swedish market. This elevated multiple stands out even as the stock price remains below analyst targets, sparking questions about whether the market is overvaluing its earnings potential.

The price-to-earnings ratio measures how much investors are willing to pay today for each unit of earnings. In the context of real estate companies, a higher P/E typically reflects expectations for robust future growth or a premium for stability.

For Nyfosa, this P/E of 29.8x is almost double the Swedish real estate industry average of 14.9x and also well above the peer group average of 20.8x. While some market participants might see this as a sign of optimism about future earnings acceleration, it also suggests that Nyfosa must deliver strong profit momentum to justify its premium. However, when compared to its estimated fair price-to-earnings ratio of 38.3x, the current level could be seen as conservative by some standards. This may indicate a potential for further rerating if growth materializes as forecast.

Explore the SWS fair ratio for Nyfosa

Result: Price-to-Earnings of 29.8x (OVERVALUED)

However, slower annual revenue growth and continued share price volatility could challenge expectations for further upside. This highlights the need for cautious optimism.

Find out about the key risks to this Nyfosa narrative.

Another View: What Does the SWS DCF Model Say?

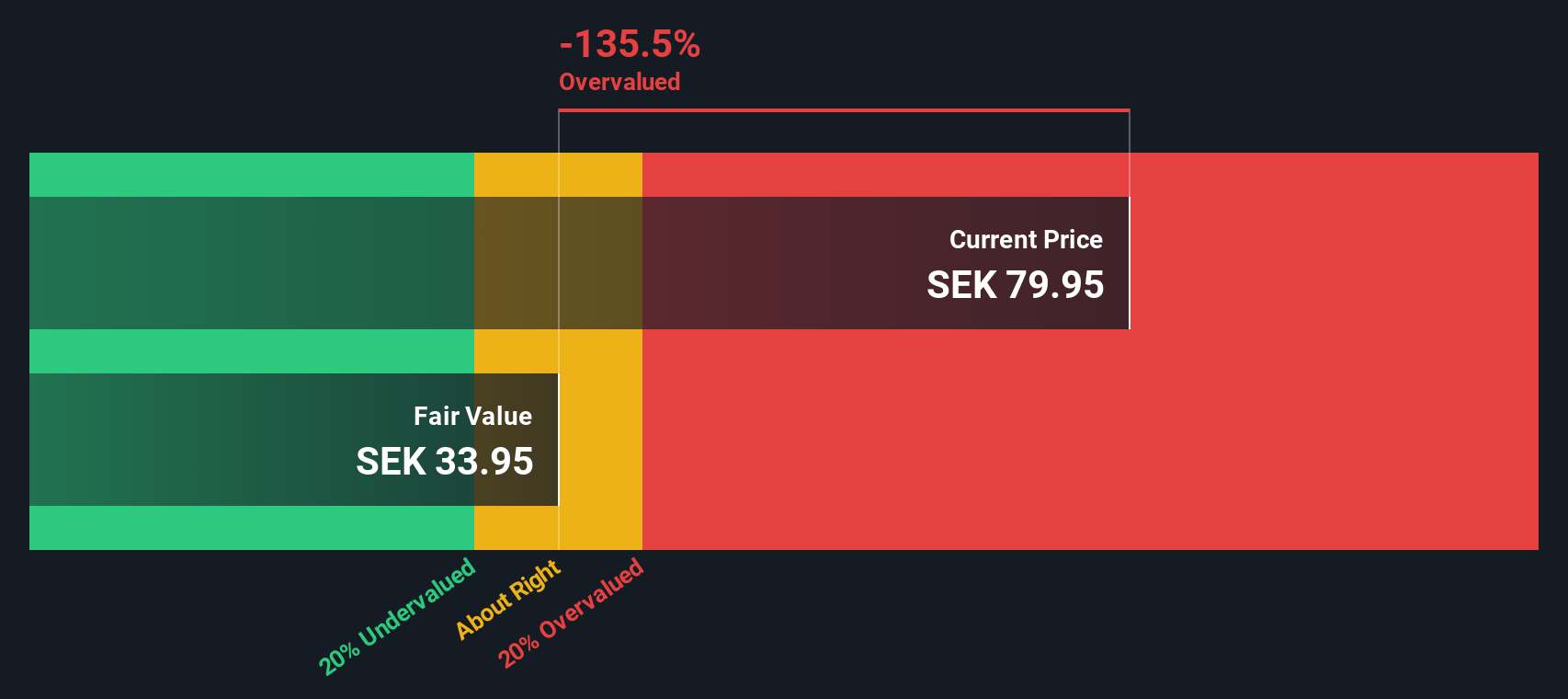

Looking at Nyfosa through the SWS DCF model provides a much less optimistic picture. The model currently estimates a fair value of SEK33.9 per share, which is significantly below the current price of SEK80.95. This suggests the shares may be overvalued according to cash flow-based assumptions. Is the market being too optimistic, or is there more to Nyfosa’s story than discounted cash flows can see?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nyfosa for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nyfosa Narrative

If you see things differently or want to investigate further, you can dig into the figures and craft your own narrative in just a few minutes using Do it your way.

A great starting point for your Nyfosa research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stop waiting for the perfect setup. If you want to get ahead and tap into new opportunities, don't let your research end here. Make your next move count with these standout strategies.

- Capture rapid growth by targeting high-potential companies through these 3588 penny stocks with strong financials and see which nimble disruptors could be set for an outsized run.

- Secure reliable income by checking out these 20 dividend stocks with yields > 3% that offer attractive yields above 3% while maintaining solid fundamentals.

- Ride the wave of artificial intelligence by following these 27 AI penny stocks making headlines with their transformative approach to automation and machine learning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nyfosa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NYF

Nyfosa

A transaction-intensive real estate company, invests, manages, develops, and sells properties in Sweden, Norway, and Finland.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives