- Sweden

- /

- Real Estate

- /

- OM:NIVI B

Analysts Have Been Trimming Their Nivika Fastigheter AB (publ) (STO:NIVI B) Price Target After Its Latest Report

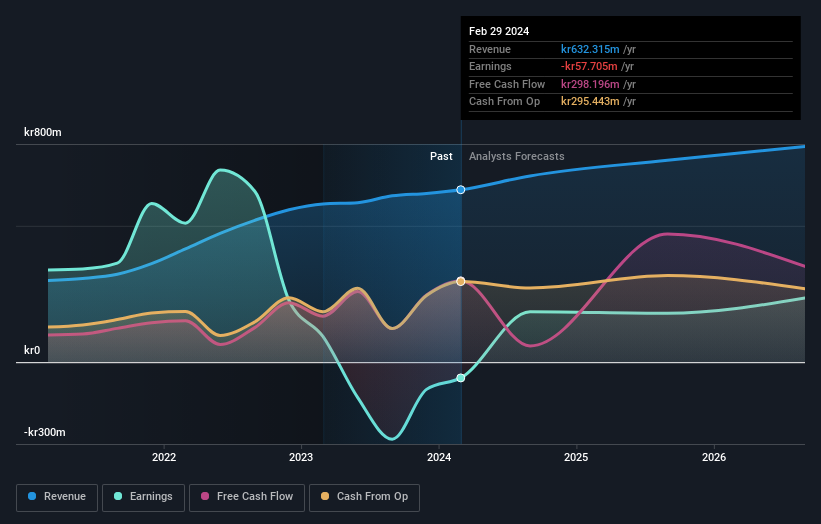

As you might know, Nivika Fastigheter AB (publ) (STO:NIVI B) recently reported its quarterly numbers. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

View our latest analysis for Nivika Fastigheter

Taking into account the latest results, the current consensus from Nivika Fastigheter's two analysts is for revenues of kr683.0m in 2024. This would reflect a solid 8.0% increase on its revenue over the past 12 months. Yet prior to the latest earnings, the analysts had been anticipated revenues of kr691.5m and earnings per share (EPS) of kr2.00 in 2024. Overall, while the analysts have reconfirmed their revenue estimates, the consensus now no longer provides an EPS estimate. This implies that the market believes revenue is more important after these latest results.

The average price target fell 8.9% to kr41.00, withthe analysts clearly having become less optimistic about Nivika Fastigheter'sprospects following its latest earnings.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that Nivika Fastigheter's revenue growth is expected to slow, with the forecast 17% annualised growth rate until the end of 2024 being well below the historical 28% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 5.4% annually. Even after the forecast slowdown in growth, it seems obvious that Nivika Fastigheter is also expected to grow faster than the wider industry.

The Bottom Line

The clear take away from these updates is that the analysts made no change to their revenue estimates for next year, with the business apparently performing in line with their models. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

We have estimates for Nivika Fastigheter from its two analysts out to 2026, and you can see them free on our platform here.

Plus, you should also learn about the 2 warning signs we've spotted with Nivika Fastigheter (including 1 which is potentially serious) .

Valuation is complex, but we're here to simplify it.

Discover if Nivika Fastigheter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NIVI B

Nivika Fastigheter

Owns, manages, and develops residential and commercial properties in Sweden.

Slightly overvalued with limited growth.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026