- Sweden

- /

- Real Estate

- /

- OM:JOMA

John Mattson (OM:JOMA) Profitability Headline Driven by SEK510m One-Off Gain, Raising Core Earnings Doubts

Reviewed by Simply Wall St

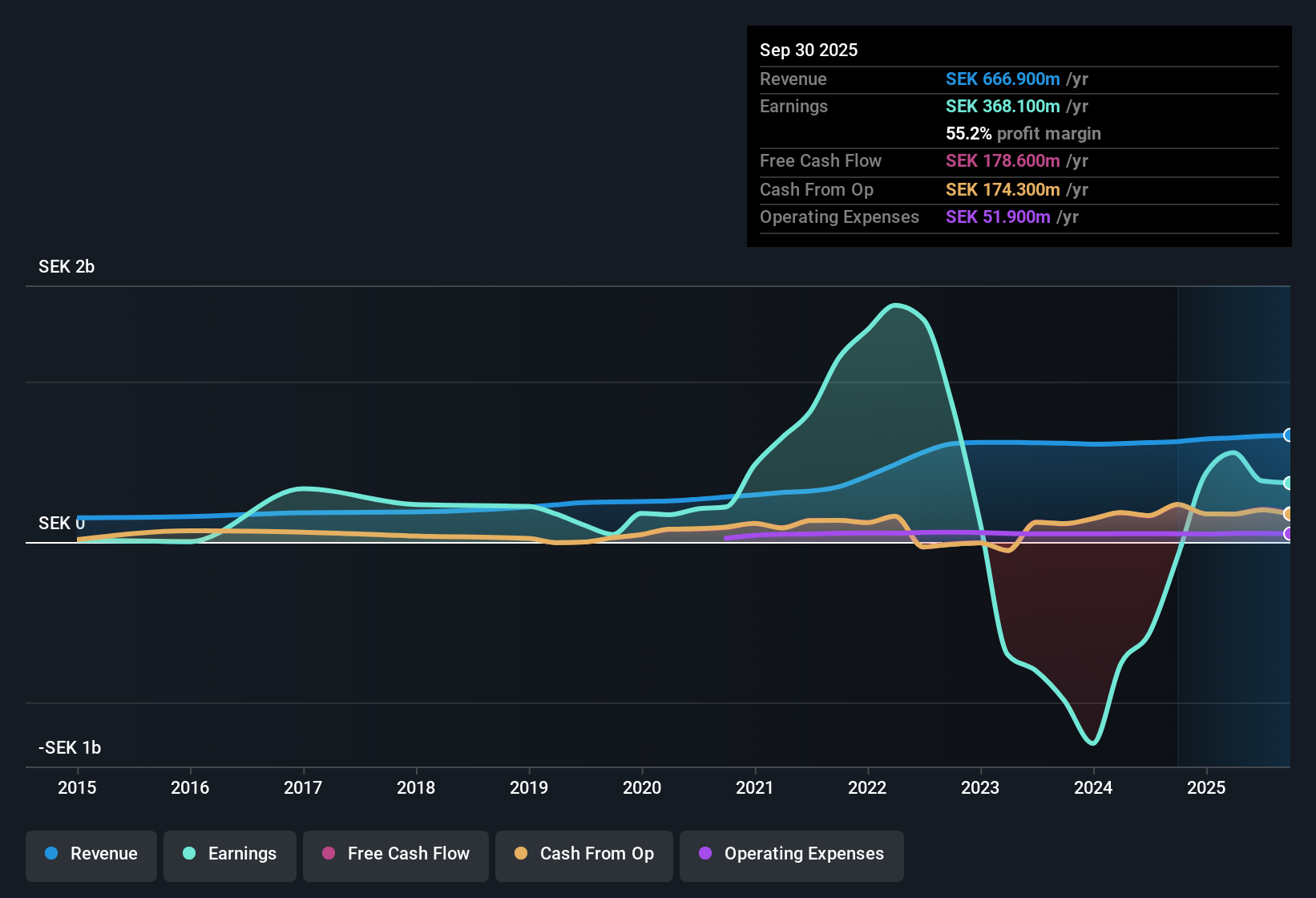

John Mattson Fastighetsföretagen (OM:JOMA) reported a turnaround to profitability this period, but the headline net profit margin comes with a large caveat: a non-recurring gain of SEK510.2 million significantly boosts the bottom line and makes it tough to judge the true quality of JOMA's core earnings. Over the last five years, earnings have dropped by an average of 34.1% per year, and analyst forecasts expect this trend to continue with an anticipated annual decline of 14.8% in the next three years. Revenue is set to grow modestly, with a 3.5% yearly increase that lags just behind the Swedish market’s 3.6% benchmark for the sector. While shares trade at 13.2x earnings, which is slightly under the peer and industry averages, recent profitability has been driven by one-time factors. This gives investors reason for caution as underlying margins remain pressured.

See our full analysis for John Mattson Fastighetsföretagen.The next section takes these numbers and puts them up against the market’s prevailing narratives, to see which stories hold up and which might need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain Masks Core Profit Quality

- SEK510.2 million of the latest profit comes from a non-recurring gain, significantly distorting traditional net profit margins and making it difficult to assess ongoing earnings power.

- Recent profitability, while a positive headline, highlights that recurring, high-quality income streams remain weak relative to peers.

- Sustained earnings declines averaging 34.1% annually over five years add to doubts that the headline turnaround reflects core business strength.

- This one-off boost questions the idea that JOMA’s defensive profile alone is driving bottom line improvement, particularly when sector narratives emphasize reliable, repeatable cash flow.

Revenue Growth Trails the Sector

- JOMA’s forecast revenue growth of 3.5% per year is behind the Swedish real estate sector’s expected 3.6%, indicating the company could face challenges outpacing industry recovery trends.

- It is notable that while market observers are drawn to property stocks with resilient growth, JOMA’s modest revenue outlook highlights its position as a “safe harbour” rather than a growth leader.

- Analysts focused on sector momentum may value stability, but the slightly slower trajectory signals ongoing challenges to regaining market share.

- This incremental growth matches retail investor perspectives that prioritize stability and income over outperformance, as reflected in discussions about steady but unspectacular expansion.

Share Price Sits Well Above DCF Fair Value

- At SEK66.4, the current share price is almost double the estimated DCF fair value of SEK34.66, even though it aligns with peer valuation multiples.

- This notable premium above fair value intensifies debate about downside risk, with prevailing sentiment recognizing the stock’s stability but noting that potential for re-rating appears limited at present.

- Market confidence is supported by JOMA trading at 13.2x earnings, a slight discount to peers, yet the significant gap with intrinsic value suggests upside could be limited if sentiment shifts.

- Sector resilience can support pricing in the near term, but persistent earnings declines and reliance on non-recurring gains could leave investors exposed if broader real estate pressures increase.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on John Mattson Fastighetsföretagen's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

JOMA’s headline turnaround is driven by a non-recurring gain. Core earnings and revenue growth still trail sector leaders and point to persistent underlying weakness.

If limited earnings quality and slower growth concern you, focus on stable growth stocks screener (2090 results) to quickly find companies delivering consistent revenue and profit expansion across different market environments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:JOMA

John Mattson Fastighetsföretagen

Operates as a residential property owner in Sweden.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives