- Sweden

- /

- Real Estate

- /

- OM:HUFV A

Does Hufvudstaden’s Recent 7.2% Rally Reflect Its True Value in 2025?

Reviewed by Simply Wall St

Trying to figure out what to do with Hufvudstaden’s stock can feel like standing at a busy intersection, waiting for the right signal to make your move. Over the last week, investors have enjoyed a 3.8% bump, while the past month’s returns stand at 7.2%. Even with this recent momentum, though, the year-to-date gain is a moderate 5.2%. Take a step back, and the picture gets more mixed: the stock is down 4.4% over one year, but up 9.0% and 7.8% over the last three and five years, respectively.

Some of these swings reflect underlying shifts in market sentiment as investors weigh both the growth potential and perceived risks tied to premium property owners like Hufvudstaden. While the past few weeks have seen the stock buoyed by generally positive vibes around the Swedish market, bigger questions about property valuations and long-term demand still hang over the sector.

On a pure numbers basis, Hufvudstaden currently earns a value score of just 1 out of 6, meaning it checks only one box when it comes to being considered undervalued by traditional measures. But is that the whole story? Let’s look at the main ways investors assess valuation, and perhaps even more importantly, consider whether there’s a better way to judge this stock’s true worth.

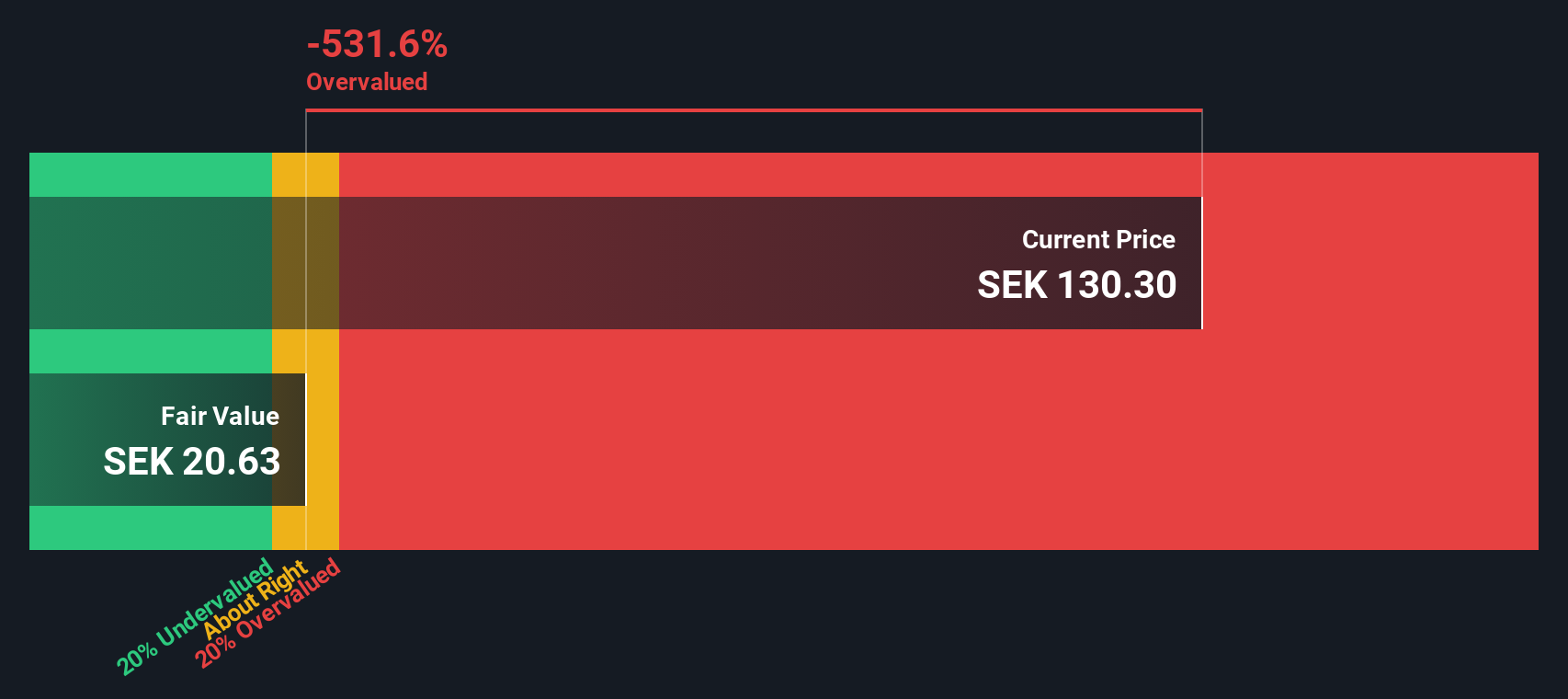

Hufvudstaden scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Hufvudstaden Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach values a company by estimating all future cash flows and then discounting them back to today’s value. This gives investors a sense of what the business is really worth, based on its ability to generate cash over time.

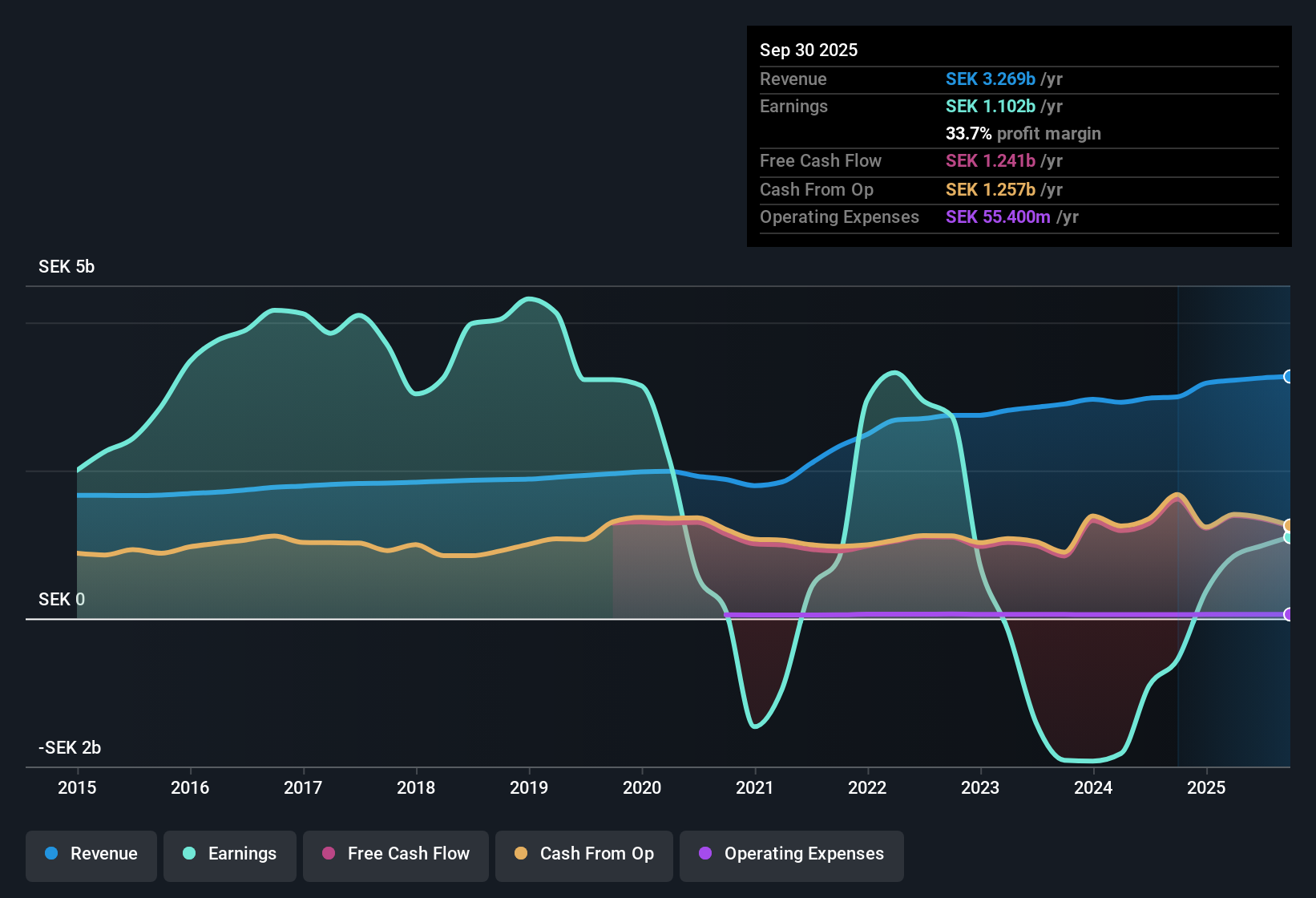

For Hufvudstaden, the latest reported Free Cash Flow (FCF) is SEK 1.32 billion. Analysts have provided forecasts for the next few years. After 2027, Simply Wall St’s model extends the projections using estimates. The annual FCF is projected to fluctuate over the next decade, with figures ranging from SEK 223 million in 2026 (discounted to SEK 207 million) to SEK 322 million by 2035 (discounted to SEK 156 million). These estimates are adjusted each year to reflect expected shifts in business performance and economic conditions.

Based on this cash flow outlook, the model calculates an intrinsic value per share of SEK 26.09. When compared to its current trading price, this implies Hufvudstaden’s stock is an eye-catching 393.3% overvalued according to the DCF model.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Hufvudstaden.

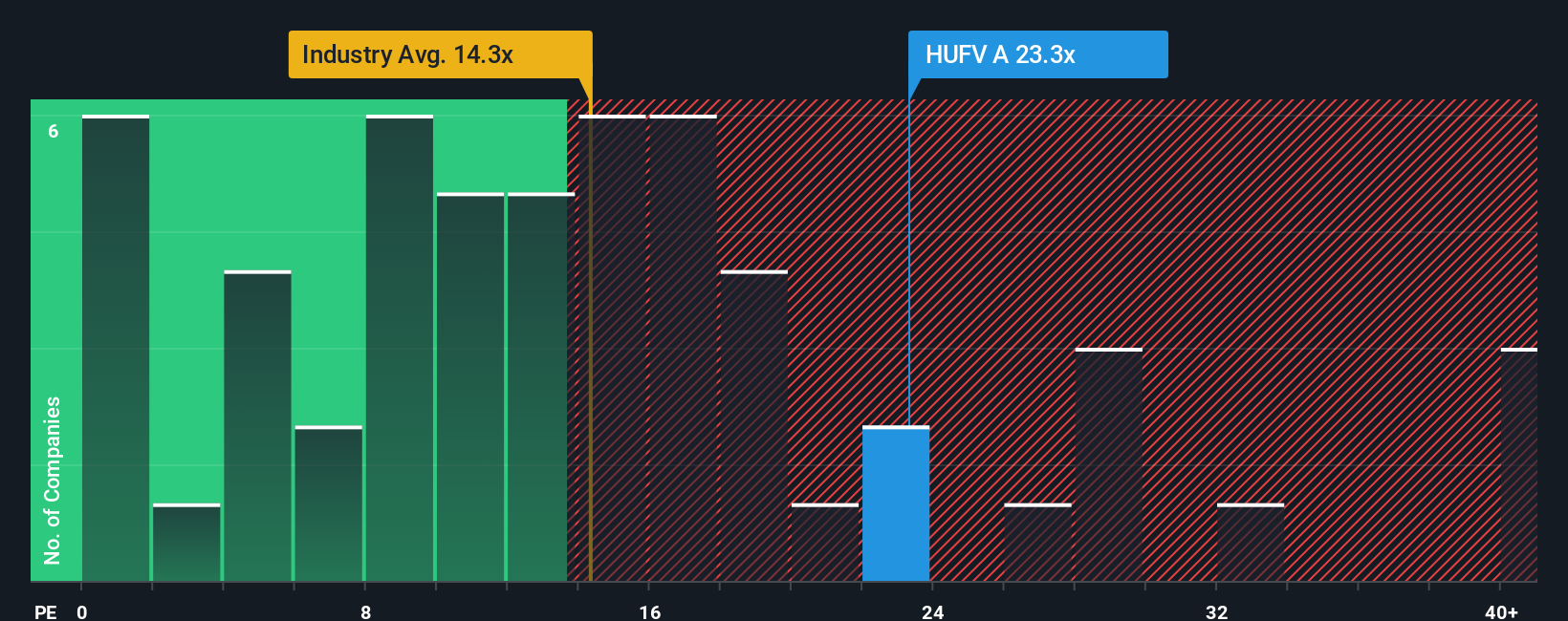

Approach 2: Hufvudstaden Price vs Earnings (P/E)

The price-to-earnings (P/E) ratio is a widely used measure for valuing profitable companies like Hufvudstaden because it directly connects a company's share price to its bottom-line earnings. For investors, the P/E offers an at-a-glance look at how much they are paying for each unit of earnings, making it especially useful for companies with steady profits.

It is important to note that what counts as a “fair” P/E is not always straightforward. A higher multiple can reflect stronger growth prospects, lower business risks, or superior profitability, while a lower one may signal the opposite. To put things in perspective, Hufvudstaden is currently trading at a P/E of 26.3x. This compares to an industry average of just 17.5x and a peer group average of 47.4x, placing the company in the middle of the pack.

However, simply comparing raw P/E ratios has its drawbacks. That is where the Simply Wall St "Fair Ratio" comes in. This proprietary benchmark estimates the multiple the company deserves, factoring in earnings growth potential, profit margins, business risks, industry dynamics, and company size. For Hufvudstaden, the Fair Ratio stands at 22.0x. Because the current P/E is moderately above this, it suggests investors may be paying a small premium, possibly for perceived quality or future growth potential, but not to an extreme degree.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Hufvudstaden Narrative

Earlier, we mentioned there could be an even smarter way to understand a company’s value. Let’s introduce you to Narratives. A Narrative is more than just a story; it’s your unique investment perspective that connects your view of Hufvudstaden’s future, such as where its revenue, earnings, and margins might go, with your own fair value calculation and reasons behind it. Narratives are simple to use and available right inside the Community page on Simply Wall St. This empowers millions of investors to lay out their decision-making process clearly, even if they’re not valuation experts.

With a Narrative, you can track how your outlook ties into real financial forecasts, then see at a glance whether the current market price gives you the buying or selling opportunity you’re seeking. Because Narratives update automatically whenever new data, earnings, or news arrive, you’re always working with the freshest information. For example, while one Hufvudstaden investor sees a Fair Value as high as SEK 30, driven by optimism on retail property demand, another pegs it down at SEK 20, expecting tougher market conditions ahead. Narratives let you combine your insights with data to make investment moves that fit your beliefs and adapt as the story develops.

Do you think there's more to the story for Hufvudstaden? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hufvudstaden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HUFV A

Hufvudstaden

Engages in the ownership, development, and management of commercial properties in Stockholm and Gothenburg, Sweden.

Second-rate dividend payer with limited growth.

Similar Companies

Market Insights

Community Narratives