- Sweden

- /

- Real Estate

- /

- OM:FPAR A

FastPartner (OM:FPAR A) Returns to Profitability, Challenging Bearish Narratives on Earnings Quality

Reviewed by Simply Wall St

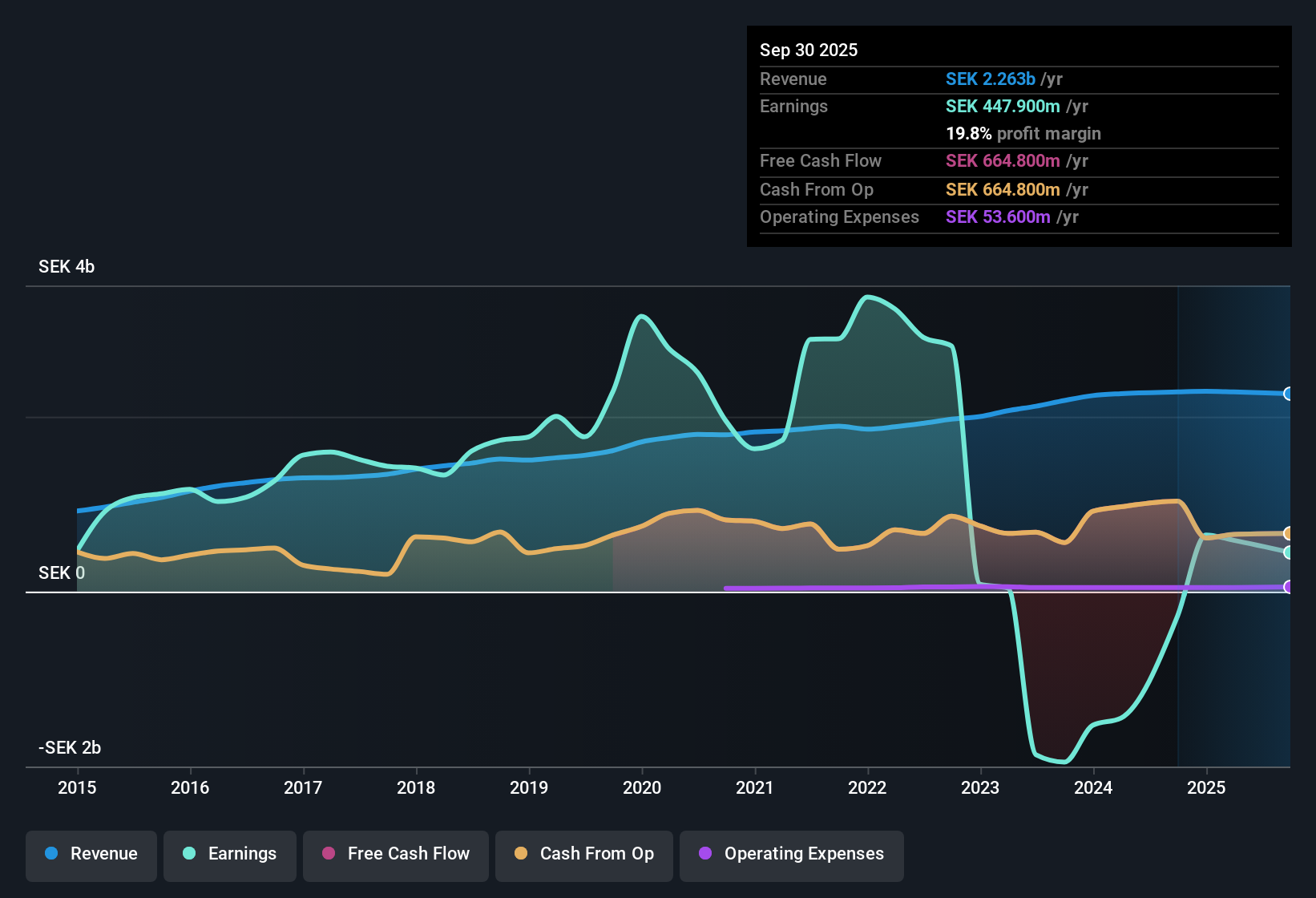

FastPartner (OM:FPAR A) turned a corner in the last twelve months, with earnings swinging positive after five years of decline at a steep annualized rate of 48.8%. Looking ahead, the company is forecast to deliver aggressive earnings growth of 29.1% per year over the next three years and is expected to outpace the broader Swedish market’s 12.3% projection. Revenue, however, is only set to rise 0.9% per year, which trails the Swedish market’s expected 3.6% annual growth.

See our full analysis for FastPartner.The next section puts FastPartner’s numbers side by side with the most widely followed market narratives and highlights where consensus holds as well as where expectations may need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

High-Quality Profit Helps Defy Sector Slowdown

- FastPartner’s earnings have flipped positive after five years of steep annual declines, with the company now reporting high-quality profit as noted in filings. This marks a shift from contraction to durable profitability, which stands out at a time when revenue gains are projected to lag the broader Swedish market.

- Against this improvement,

- the prevailing view highlights that operational stability and careful cost management have supported FastPartner’s resilience even as sector-wide risks loom,

- yet the muted revenue outlook creates tension, since ongoing growth will rely heavily on maintaining this earnings quality, not headline expansion.

Premium Price Tag Versus DCF Fair Value

- FastPartner’s share price of SEK56.20 trades above its DCF fair value estimate of SEK43.39 and remains above the industry average on a price-to-earnings basis, at 18.8x versus 16.1x.

- What stands out is that,

- while some investors might view the above-average multiple as a sign of market confidence in management’s discipline,

- others could see the fair value gap and caution that the premium leaves less room for error if sector headwinds start biting harder.

Dividend Quality Under the Spotlight

- While FastPartner offers high-quality reported profit, official statements also flag concern about the company’s financial position and the sustainability of its dividend policy.

- Bears argue this is a key weak spot,

- since persistent sector pressures on property values and refinancing costs could squeeze payout capacity,

- even as the company’s underlying operational turnaround attracts income-focused investors searching for stability.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on FastPartner's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While FastPartner’s rapid earnings turnaround is notable, its premium valuation and limited revenue growth highlight the risk of overpaying if market optimism fades.

If you want more value for your money, discover opportunities trading below fair value with these 878 undervalued stocks based on cash flows that could offer a safer margin and stronger upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FPAR A

FastPartner

A real estate company, owns, develops, and manages residential and commercial properties in Sweden.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives