- Sweden

- /

- Real Estate

- /

- OM:FPAR A

European Undervalued Small Caps With Insider Buying To Watch

Reviewed by Simply Wall St

Amidst renewed uncertainty surrounding U.S. trade policy and escalating geopolitical tensions in the Middle East, European markets have experienced notable declines, with the STOXX Europe 600 Index dropping by 1.57%. Despite these challenges, small-cap stocks in Europe might offer intriguing opportunities for investors seeking value, particularly when insider buying signals potential confidence in a company's prospects.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 11.7x | 0.5x | 35.23% | ★★★★★☆ |

| AKVA group | 17.1x | 0.8x | 49.95% | ★★★★★☆ |

| Jadestone Energy | NA | 0.4x | 34.27% | ★★★★★☆ |

| Tristel | 28.0x | 3.9x | 13.01% | ★★★★☆☆ |

| Close Brothers Group | NA | 0.6x | 37.90% | ★★★★☆☆ |

| Italmobiliare | 11.4x | 1.5x | -206.30% | ★★★☆☆☆ |

| Fuller Smith & Turner | 11.8x | 0.9x | -30.65% | ★★★☆☆☆ |

| H+H International | 33.0x | 0.8x | 45.69% | ★★★☆☆☆ |

| Eastnine | 18.8x | 9.0x | 37.95% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.6x | 39.47% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Georgia Capital (LSE:CGEO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Georgia Capital is an investment holding company focused on acquiring and developing businesses in Georgia, with a market capitalization of approximately £0.47 billion.

Operations: Georgia Capital's revenue streams primarily consist of various business operations, with a notable focus on achieving high gross profit margins, reaching 1.0% in several recent periods. Operating expenses remain relatively low compared to revenue, with general and administrative expenses frequently under GEL 10 million. The company has experienced fluctuations in net income margin, ranging from negative values to over 1.12%.

PE: 5.6x

Georgia Capital, a small company in Europe, has recently completed a share repurchase program, buying back 2.3 million shares for £31.87 million by May 6, 2025. This significant buyback indicates insider confidence in the company's prospects. Despite relying entirely on external borrowing, which carries higher risk compared to customer deposits, the firm is seen as undervalued due to its strategic financial maneuvers and potential for growth within its industry context.

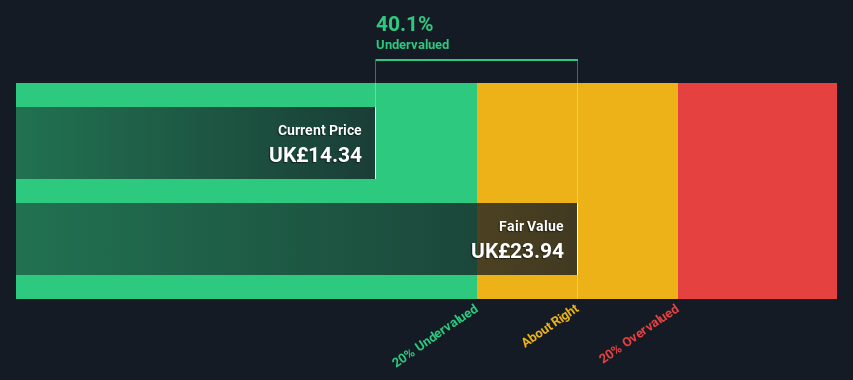

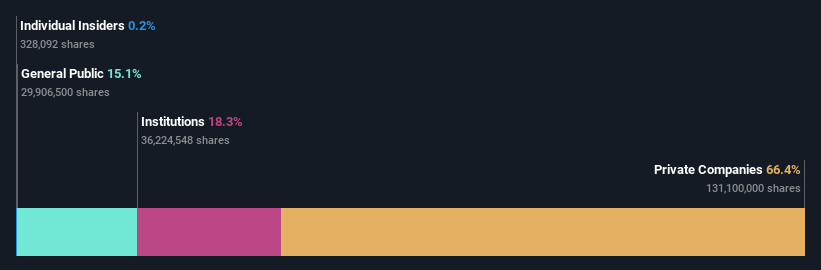

FastPartner (OM:FPAR A)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: FastPartner is a real estate company focused on property management across multiple regions, with a market cap of SEK 11.52 billion.

Operations: FastPartner generates revenue primarily through property management across three regions, with Region 1 contributing the highest portion. The company's cost of goods sold (COGS) has been increasing, impacting its gross profit margins, which have fluctuated but reached 71.45% in recent periods. Operating expenses are relatively stable compared to other financial metrics, while non-operating expenses have varied significantly, affecting net income results over time.

PE: 18.6x

FastPartner, a European company with smaller market capitalization, recently reported first-quarter sales of SEK 571.5 million and net income of SEK 141.6 million, reflecting a decline from the previous year. Despite this, insider confidence is evident as an individual purchased 800,000 shares for approximately SEK 39.2 million in the past year. The company relies solely on external borrowing for funding but is forecasted to grow earnings by 27% annually, suggesting potential future growth opportunities despite current financial challenges.

- Take a closer look at FastPartner's potential here in our valuation report.

Gain insights into FastPartner's past trends and performance with our Past report.

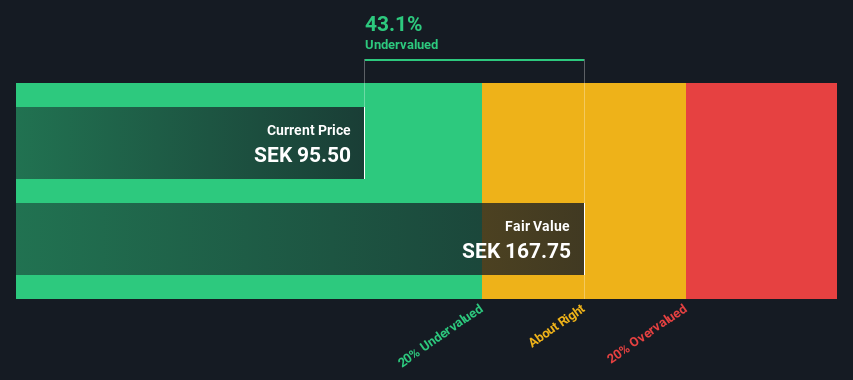

Scandi Standard (OM:SCST)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Scandi Standard is a company that specializes in the production and sale of chicken-based food products, with operations focused on ready-to-cook and ready-to-eat segments, and has a market cap of SEK 2.67 billion.

Operations: Scandi Standard generates revenue primarily from its Ready-To-Cook and Ready-To-Eat segments, with the former contributing significantly more to total sales. The company's cost structure is heavily influenced by the Cost of Goods Sold (COGS), which has a substantial impact on its overall profitability. Over recent periods, the net profit margin has shown some fluctuations but remains relatively modest, indicating challenges in converting revenue into profit.

PE: 23.7x

Scandi Standard, a European player with a focus on poultry production, has caught attention due to its potential as an undervalued stock. The company recently announced a dividend of SEK 2.50 per share in two payments, reflecting stable cash flow management despite high debt levels and reliance on external borrowing. Insider confidence is evident as Independent Director Cecilia Lannebo increased their stake by 193%, translating to an investment of over SEK 10 million. While first-quarter sales rose to SEK 3,376 million from the previous year, net income saw a slight dip to SEK 66 million. The company's earnings are projected to grow annually by nearly 20%, suggesting promising future prospects amidst financial challenges.

Key Takeaways

- Get an in-depth perspective on all 74 Undervalued European Small Caps With Insider Buying by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FPAR A

FastPartner

A real estate company, owns, develops, and manages residential and commercial properties in Sweden.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives