- Sweden

- /

- Real Estate

- /

- OM:FASTAT

Aktiebolaget Fastator (publ) (STO:FASTAT) Stock's 27% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Aktiebolaget Fastator (publ) (STO:FASTAT) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 56% loss during that time.

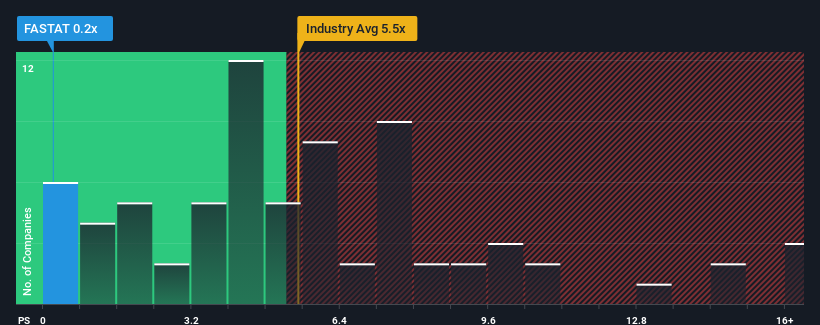

Since its price has dipped substantially, when around half the companies operating in Sweden's Real Estate industry have price-to-sales ratios (or "P/S") above 5.5x, you may consider Aktiebolaget Fastator as an incredibly enticing stock to check out with its 0.2x P/S ratio. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Aktiebolaget Fastator

What Does Aktiebolaget Fastator's P/S Mean For Shareholders?

For instance, Aktiebolaget Fastator's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Aktiebolaget Fastator will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Aktiebolaget Fastator's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 22%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 35% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 6.4% shows it's noticeably more attractive.

With this information, we find it odd that Aktiebolaget Fastator is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Aktiebolaget Fastator's P/S

Aktiebolaget Fastator's P/S looks about as weak as its stock price lately. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Aktiebolaget Fastator revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Aktiebolaget Fastator (3 are concerning!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:FASTAT

Low risk and slightly overvalued.

Market Insights

Community Narratives