- Sweden

- /

- Real Estate

- /

- OM:EAST

Eastnine (OM:EAST) One-Off €18.5M Gain Challenges Bearish Narratives on Profitability Sustainability

Reviewed by Simply Wall St

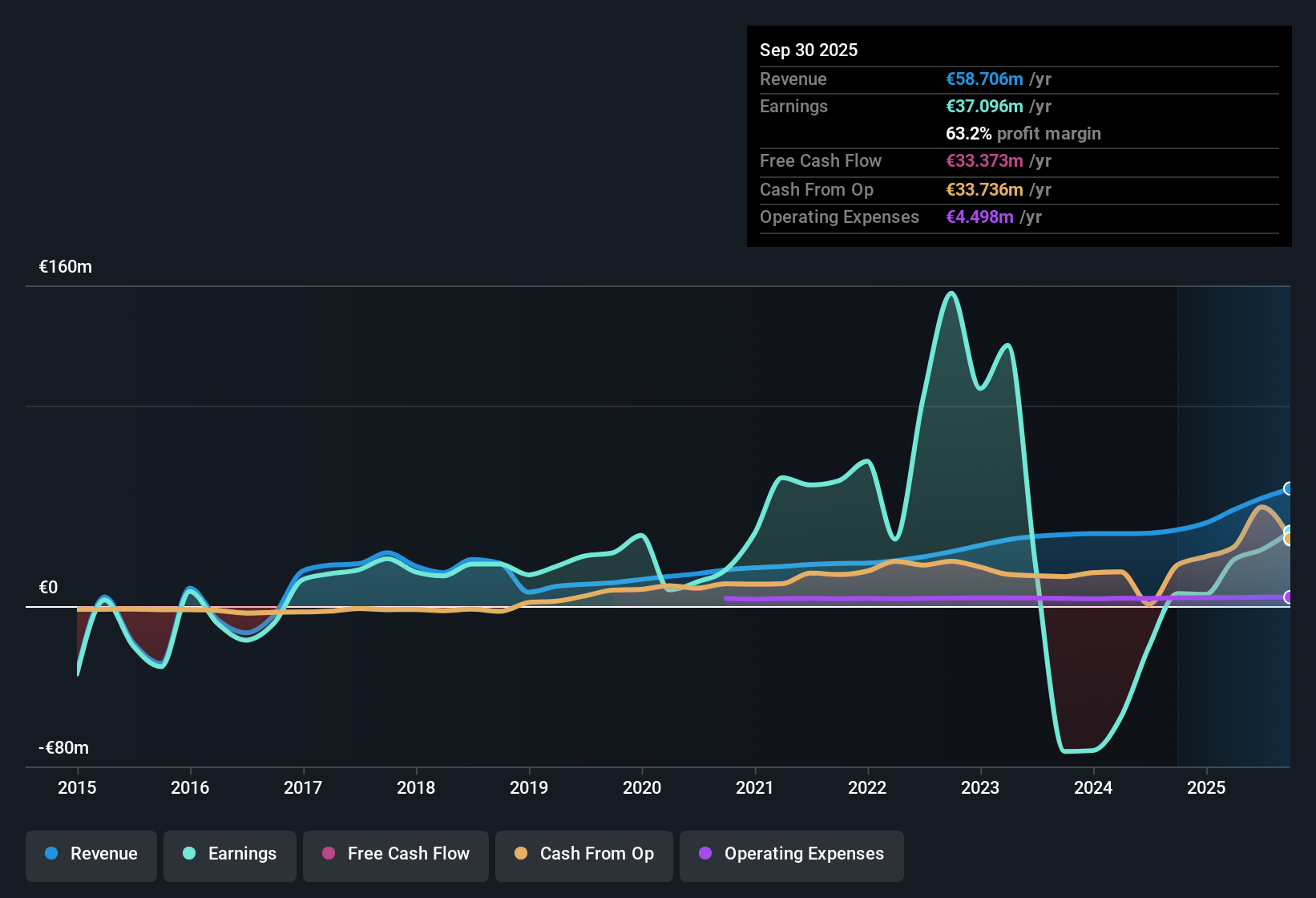

Eastnine (OM:EAST) reported a notable one-off gain of €18.5 million for the twelve months ending September 30, 2025. This contributed to the company's recent transition to profitability and improvement in net profit margins. Despite this positive shift, earnings have declined by 29.8% per year over the last five years. Forecasts predict an annual earnings contraction of -7.2% moving forward, with revenue growth projected at just 2.1% per year, trailing behind the Swedish market average of 3.6%. The combination of a below-peer Price-to-Earnings ratio and an attractive dividend offers value-focused upside. However, investors remain watchful given the consistent decline in earnings and the softer revenue outlook.

See our full analysis for Eastnine.Next, we will see how these numbers measure up against the most widely followed market narratives, where the stories align, and where they might start to diverge.

See what the community is saying about Eastnine

Margin Expansion Outpaces Analyst Predictions

- Profit margins are expected to rise from 52.4% today to 58.2% over three years, significantly exceeding many peers in the Swedish real estate sector.

- According to the analysts' consensus view, the strategic focus on Poland, where office space demand is strong and supply is limited, is projected to help drive rental revenue and stabilize net margins in the face of broader revenue headwinds.

- This narrative is reinforced by high economic occupancy rates and a diversified multinational tenant base, which provide income stability and reduce the likelihood of large swings in vacancy costs.

- The consensus also highlights how sustainability initiatives, including a high percentage of green leases, are positioning Eastnine favorably to attract new investors and support long-term equity value.

To see how the consensus around margins and growth prospects for Eastnine compares to market realities, check the full Consensus Narrative for the most up-to-date analysis. 📊 Read the full Eastnine Consensus Narrative.

Concentration Risks and Expansion Challenges

- With 51% of revenue now concentrated in Poland and a limited expansion plan with no major new acquisitions noted for the latest period, Eastnine faces heightened risk if local market demand falters or tenant needs change.

- The consensus narrative underscores several potential pitfalls, including:

- Any negative shift in the Polish office market or tenant turnover could challenge stability, especially since high occupancy comes with the risk that tenants may outgrow their current space requirements.

- Rising interest expenses, together with a lack of acquisition-driven growth, may weigh on net margins and slow future earnings momentum.

Valuation Gap: Discount to Peers and Fair Value

- Eastnine's shares are trading at SEK49.85, a Price-to-Earnings ratio of 15.8x, substantially below both peer averages (19x) and the broader industry (16.1x), and also at a 20.9% discount to the analyst price target of SEK58.0, with an even wider discount to DCF fair value of SEK77.19.

- Consensus narrative points out that for these discounts to close, investors will need to believe in forecasts of 7.9% annual revenue growth and a move to 20.9x PE by 2028.

- This expectation is set against the backdrop of slow current revenue growth (2.1% forecasted) and the risk that expansion plans remain subdued, which could limit upward valuation re-rating.

- Despite the valuation appeal and dividend, sustained growth is critical for Eastnine to reach or exceed these targets and justify the price gap to fair value and analyst assumptions.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Eastnine on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on these results? Shape your viewpoint in just a few minutes and craft your own narrative. Do it your way

A great starting point for your Eastnine research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite a compelling valuation and margin expansion, Eastnine faces persistent earnings declines and subdued revenue growth. The company is lagging behind market averages, which limits its re-rating potential.

If consistent top-line progress and reliable performance matter to you, use our stable growth stocks screener (2090 results) to focus on companies delivering steady growth regardless of market headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastnine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EAST

Established dividend payer and good value.

Market Insights

Community Narratives