- Sweden

- /

- Real Estate

- /

- OM:CATE

Should Catena’s (OM:CATE) Eight-Year ICA Lease Boost Confidence in Its Long-Term Income Stability?

Reviewed by Sasha Jovanovic

- Catena announced that it has secured two eight-year lease agreements with ICA Fastigheter AB for logistics facilities at its Helsingborg site, covering one existing property and a new, sustainably-built 18,042 m2 building to be completed by early 2027.

- This development reflects increased long-term occupancy and income certainty for Catena, while highlighting growing demand from major clients for sustainable and modern logistics solutions.

- To assess how Catena’s portfolio and income outlook may be affected, let’s examine the significance of securing ICA as a long-term anchor tenant.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Catena Investment Narrative Recap

Owning Catena shares means believing in the long-term need for modern logistics infrastructure and the company’s ability to secure high-quality, long-duration tenants, like ICA. The recent eight-year lease agreements with ICA enhance short-term income security, addressing a key catalyst, tenant demand and occupancy, while partially mitigating the risk of tenant hesitancy and slower leasing amidst market uncertainty. Still, the current oversupply and vacancy challenges in certain regions remain a potential drag on growth and occupancy rates in the months ahead.

Among recent announcements, Catena’s July 2025 acquisition in Jonkoping is particularly relevant as it expands logistics capacity in a region also flagged for oversupply risk. This move, alongside the new ICA lease, shows how Catena is growing its portfolio while still facing fluctuating tenant interest and ongoing pressure to keep occupancy rates strong amid competitive conditions. But while long leases are being signed by anchor tenants, investors should also be aware that...

Read the full narrative on Catena (it's free!)

Catena's narrative projects SEK3.3 billion in revenue and SEK1.5 billion in earnings by 2028. This requires 10.3% yearly revenue growth and a SEK0.1 billion earnings increase from SEK1.4 billion today.

Uncover how Catena's forecasts yield a SEK510.00 fair value, a 14% upside to its current price.

Exploring Other Perspectives

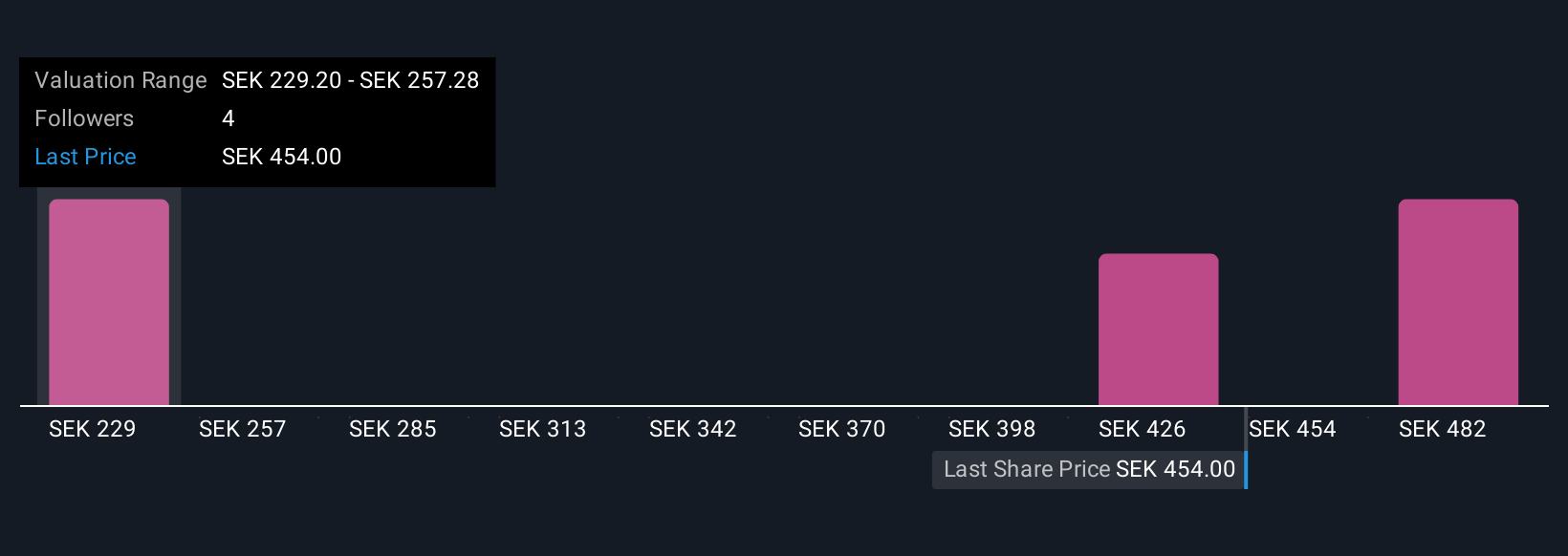

Three community estimates for Catena’s fair value range widely from SEK229.20 to SEK510, reflecting sharply different outlooks among Simply Wall St Community members. With supply in certain regions expected to outpace demand, your view on occupancy risk could shape your perspective on the company's future.

Explore 3 other fair value estimates on Catena - why the stock might be worth 49% less than the current price!

Build Your Own Catena Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Catena research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Catena research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Catena's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CATE

Catena

Owns, develops, manages, and sells logistics properties in Sweden and Denmark.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives