- Sweden

- /

- Real Estate

- /

- OM:CAST

Castellum (OM:CAST): Evaluating Valuation After Profitability Surges on Latest Earnings Release

Reviewed by Simply Wall St

Castellum (OM:CAST) just published its third quarter and nine-month 2025 results, revealing higher net income and stronger earnings per share even as sales remained slightly lower than last year. This earnings beat is drawing investor attention.

See our latest analysis for Castellum.

Castellum's latest earnings surprise comes after a tough period for the share price, which has slipped by 13% year to date and delivered a -17.75% total shareholder return over the past year. Momentum remains challenging, even as stronger profits begin to shift perceptions about value and risk in the stock.

If you're watching Castellum's turnaround and wondering what else might be gaining attention, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock still trading below analyst price targets despite big improvements in profitability, the key question now is whether Castellum is an undervalued opportunity or if the market has already accounted for its recovery in the current price.

Most Popular Narrative: 9.3% Undervalued

Castellum’s most widely followed narrative points to a fair value notably above the current share price, hinting at meaningful upside if growth unfolds as expected. With analyst consensus supporting a higher price target, investor focus is shifting toward key business catalysts and whether recent earnings momentum is sustainable.

The acquisition of additional shares in Entra, resulting in a mandatory offer for remaining shares, is a strategic move intended to strengthen Castellum’s market positioning and earnings by integrating high-quality assets in central Oslo and leveraging long leases. Castellum plans to reinvest proceeds from divested non-strategic properties into refurbishment, tenant improvements, and new project developments. These efforts are anticipated to enhance property values and rental income over time.

Want to know what’s fueling this bullish value call? The narrative’s foundation rests not just on more deals, but on profit margins and future earnings multiples usually reserved for market leaders. Curious how Castellum plans to transform strategic property moves into sector-defying growth? The blueprint behind this valuation might surprise you.

Result: Fair Value of $116.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising vacancies or delays in leasing new projects could dampen expected growth. This may challenge Castellum’s optimistic outlook in the coming years.

Find out about the key risks to this Castellum narrative.

Another Perspective: Market Ratios Tell a Different Story

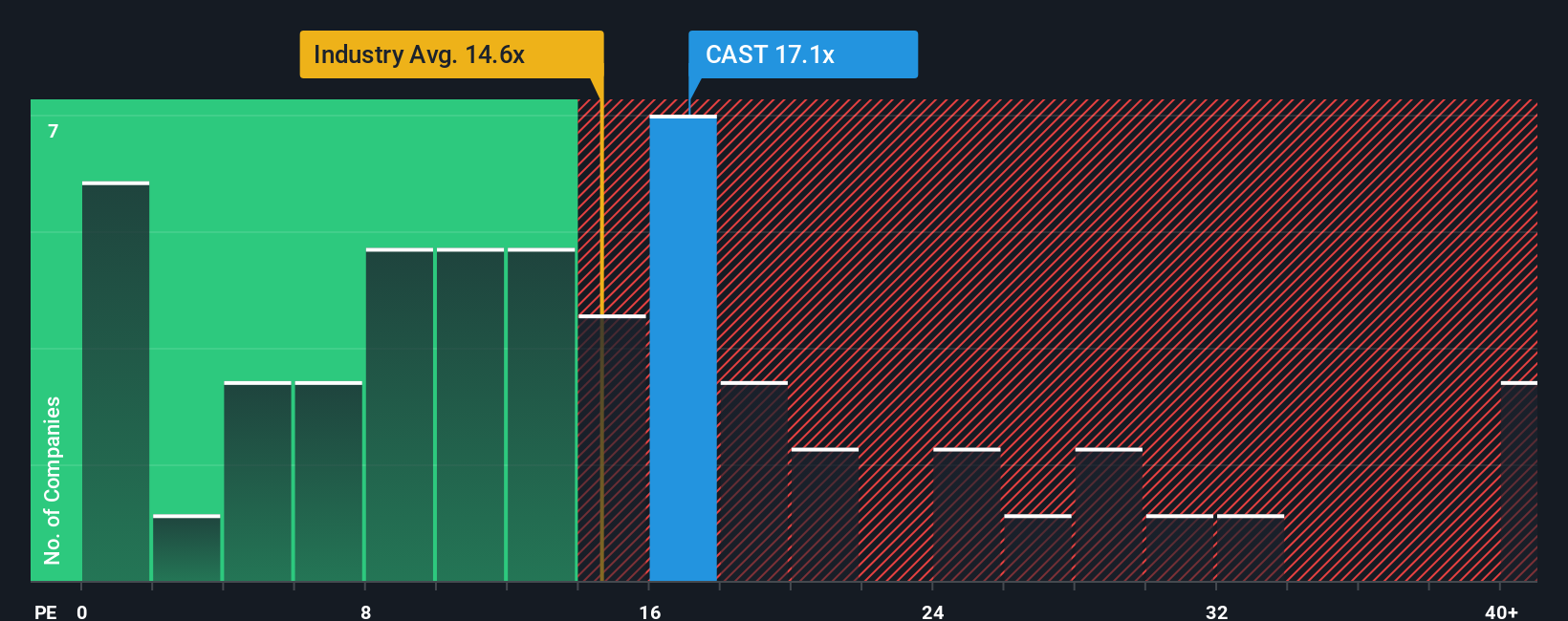

While analysts argue that Castellum is undervalued, the current price-to-earnings ratio of 17.2x is not especially cheap compared to the Swedish real estate industry at 14.8x. It does, however, look much better than the average peer at 36.9x. The fair ratio stands at 31.1x, indicating the market could push the valuation higher in time. Does this make the risk of overpaying for recent momentum more real than it seems?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Castellum Narrative

If you’d rather chart your own course or draw different conclusions from the numbers, you can easily craft a personal narrative in just a few minutes. Do it your way

A great starting point for your Castellum research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take control of your investment strategy and gain an edge by targeting the next big trends using our exclusive stock screeners. Let smarter choices set you apart today.

- Capitalize on growth by tapping into these 842 undervalued stocks based on cash flows to spot stocks currently trading below intrinsic value and poised for potential rallies.

- Secure reliable income streams with these 20 dividend stocks with yields > 3%, offering attractive yields above 3% for investors seeking consistent cash returns.

- Catalyze your portfolio’s future with AI-focused opportunities through these 26 AI penny stocks, which are set to revolutionize tomorrow’s industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CAST

Castellum

Castellum is one of the Nordic region's largest commercial real estate companies, focusing on office and logistics properties in Nordic growth cities.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives