- Sweden

- /

- Consumer Durables

- /

- OM:BESQAB

Aros Bostadsutveckling AB (publ)'s (STO:AROS) Shares Not Telling The Full Story

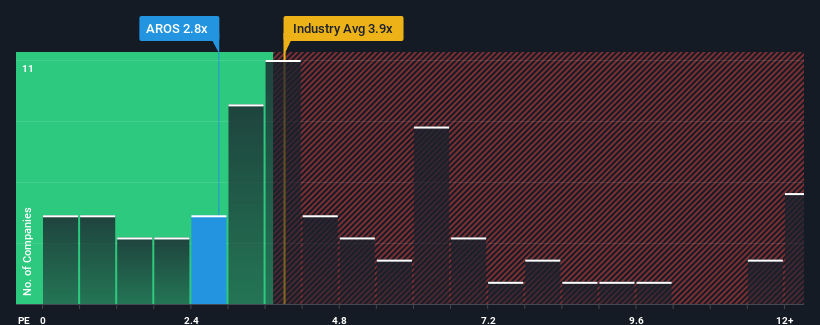

With a price-to-sales (or "P/S") ratio of 2.8x Aros Bostadsutveckling AB (publ) (STO:AROS) may be sending bullish signals at the moment, given that almost half of all the Real Estate companies in Sweden have P/S ratios greater than 3.9x and even P/S higher than 7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Aros Bostadsutveckling

What Does Aros Bostadsutveckling's Recent Performance Look Like?

Aros Bostadsutveckling certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Aros Bostadsutveckling's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Aros Bostadsutveckling's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Pleasingly, revenue has also lifted 148% in aggregate from three years ago, thanks to the last 12 months of explosive growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 72% each year as estimated by the three analysts watching the company. With the industry only predicted to deliver 5.6% each year, the company is positioned for a stronger revenue result.

With this information, we find it odd that Aros Bostadsutveckling is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Aros Bostadsutveckling's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Aros Bostadsutveckling's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You should always think about risks. Case in point, we've spotted 3 warning signs for Aros Bostadsutveckling you should be aware of, and 2 of them are a bit unpleasant.

If these risks are making you reconsider your opinion on Aros Bostadsutveckling, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Besqab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BESQAB

Besqab

AROS Bostadsutveckling AB engages in green field development of residential buildings and conversion of commercial real estate into residential premises.

High growth potential with imperfect balance sheet.

Market Insights

Community Narratives