- Sweden

- /

- Real Estate

- /

- OM:ANNE B

Annehem Fastigheter (OM:ANNE B): One-Off SEK42M Loss Challenges Bullish Valuation Narrative

Reviewed by Simply Wall St

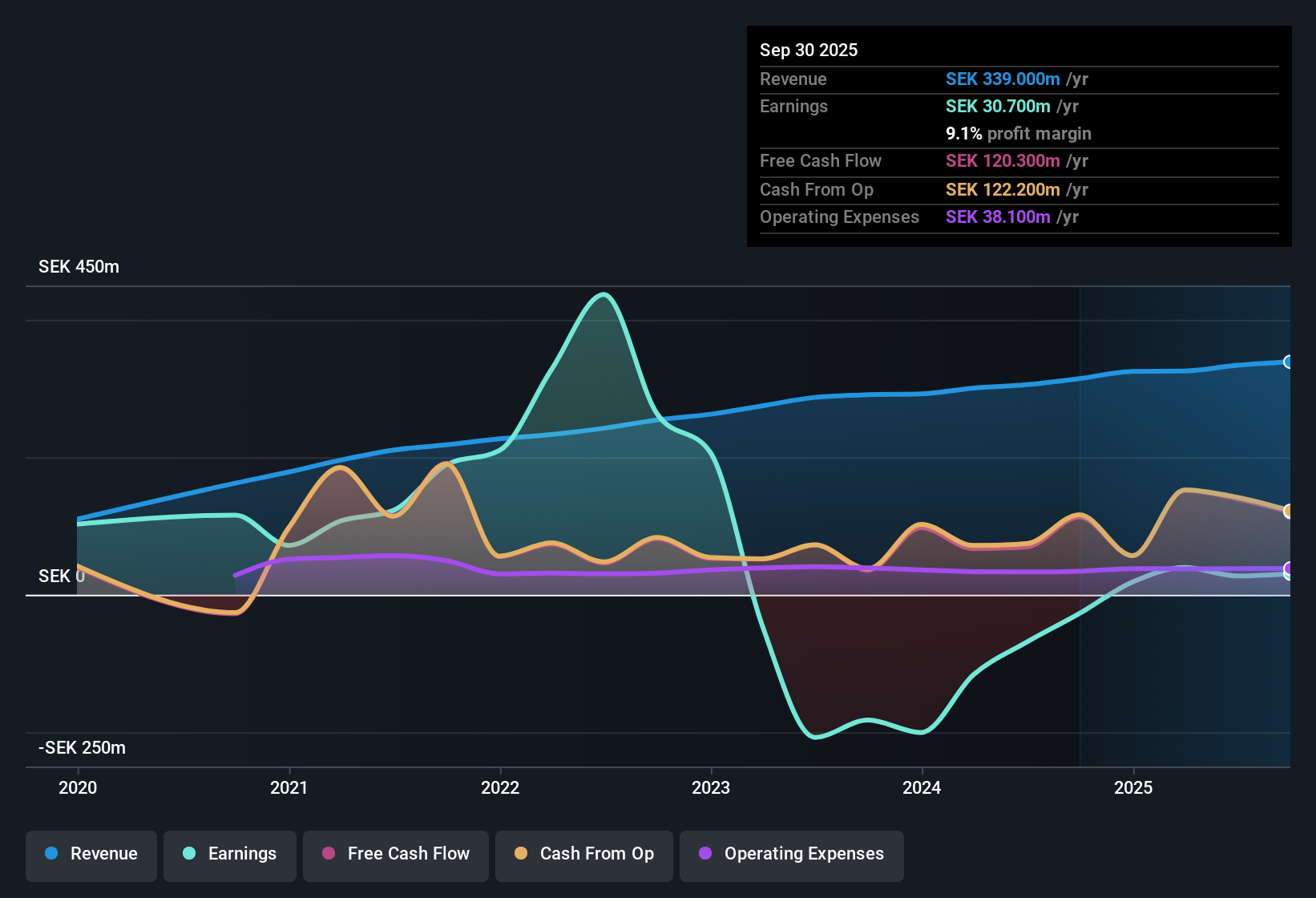

Annehem Fastigheter (OM:ANNE B) is expected to outperform the broader market, with revenue forecast to grow 6.2% per year compared to Sweden’s 3.6% market average. EPS growth is projected at a robust 40.1% annually, far exceeding the market’s 12.3% pace. The company has just returned to profitability after an extended period of earnings declines. However, a notable one-off loss of SEK42.0 million in the last year impacted recent results, keeping financial quality in the spotlight for investors this earnings season.

See our full analysis for Annehem Fastigheter.Next, we will see how these headline figures compare against the market’s prevailing narratives and expectations for Annehem Fastigheter. Some long-held views may get reinforced, while others could be shaken up by the latest numbers.

Curious how numbers become stories that shape markets? Explore Community Narratives

Steep Price-to-Earnings Premium Signals High Expectations

- Annehem Fastigheter’s Price-To-Earnings ratio stands at 62.8x, placing it well above the Swedish real estate industry average of 16.1x and peers at 9.6x.

- Recent performance highlights a tension between anticipated growth and the valuation premium, as prevailing market analysis notes:

- Such a high P/E indicates investors are paying a premium for projected strong profit expansion, but that outlook comes with considerable pressure to deliver on growth expectations.

- A P/E multiple at this level could limit future share price upside if revenue or earnings growth does not accelerate sharply, emphasizing the importance of consistent performance.

One-Off SEK42M Loss Distorts Near-Term Profit Quality

- The company reported a significant one-off loss of SEK42.0 million in the last twelve months, a factor that has weighed down recent earnings metrics.

- Prevailing market discussion frames this as a reminder that:

- Investors should consider both the return to profitability and the impact of non-recurring items, as these unusual charges may mask the real pace of improvement from core operations.

- Assessing ongoing financial strength remains critical, given recent profitability is not fully reflective of underlying trends due to the one-off expense.

Market Price Outpaces DCF Fair Value by Wide Margin

- The current share price of SEK19.44 is notably above its DCF fair value estimate of SEK14.21, a gap of over SEK5 per share.

- According to market analysis, this valuation gap draws attention because:

- Trading above fair value suggests investors may be factoring in future growth or sector recovery hopes, which have yet to materialize based on discounted cash flow assumptions.

- Such a premium over DCF fair value signals the market expects momentum or new positive catalysts, making Annehem Fastigheter vulnerable if macro or sector headwinds persist.

Curious how numbers become stories that shape markets? Explore Community Narratives Curious how numbers become stories that shape markets? Explore Community Narratives

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Annehem Fastigheter's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Annehem Fastigheter’s substantial valuation premium and exposure to one-off losses mean investors face uncertainty around the company’s future growth and downside risk.

If you want stocks where price better reflects fundamentals, discover opportunities in these 876 undervalued stocks based on cash flows that could offer more compelling value and less risk of disappointment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ANNE B

Annehem Fastigheter

Operates as a property company in Sweden and Finland.

Reasonable growth potential with very low risk.

Similar Companies

Market Insights

Community Narratives