Even though Saniona (STO:SANION) has lost kr257m market cap in last 7 days, shareholders are still up 306% over 3 years

Saniona AB (publ) (STO:SANION) shareholders might be concerned after seeing the share price drop 11% in the last week. But that doesn't change the fact that the returns over the last three years have been spectacular. Indeed, the share price is up a whopping 306% in that time. As long term investors the recent fall doesn't detract all that much from the longer term story. The share price action could signify that the business itself is dramatically improved, in that time.

In light of the stock dropping 11% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive three-year return.

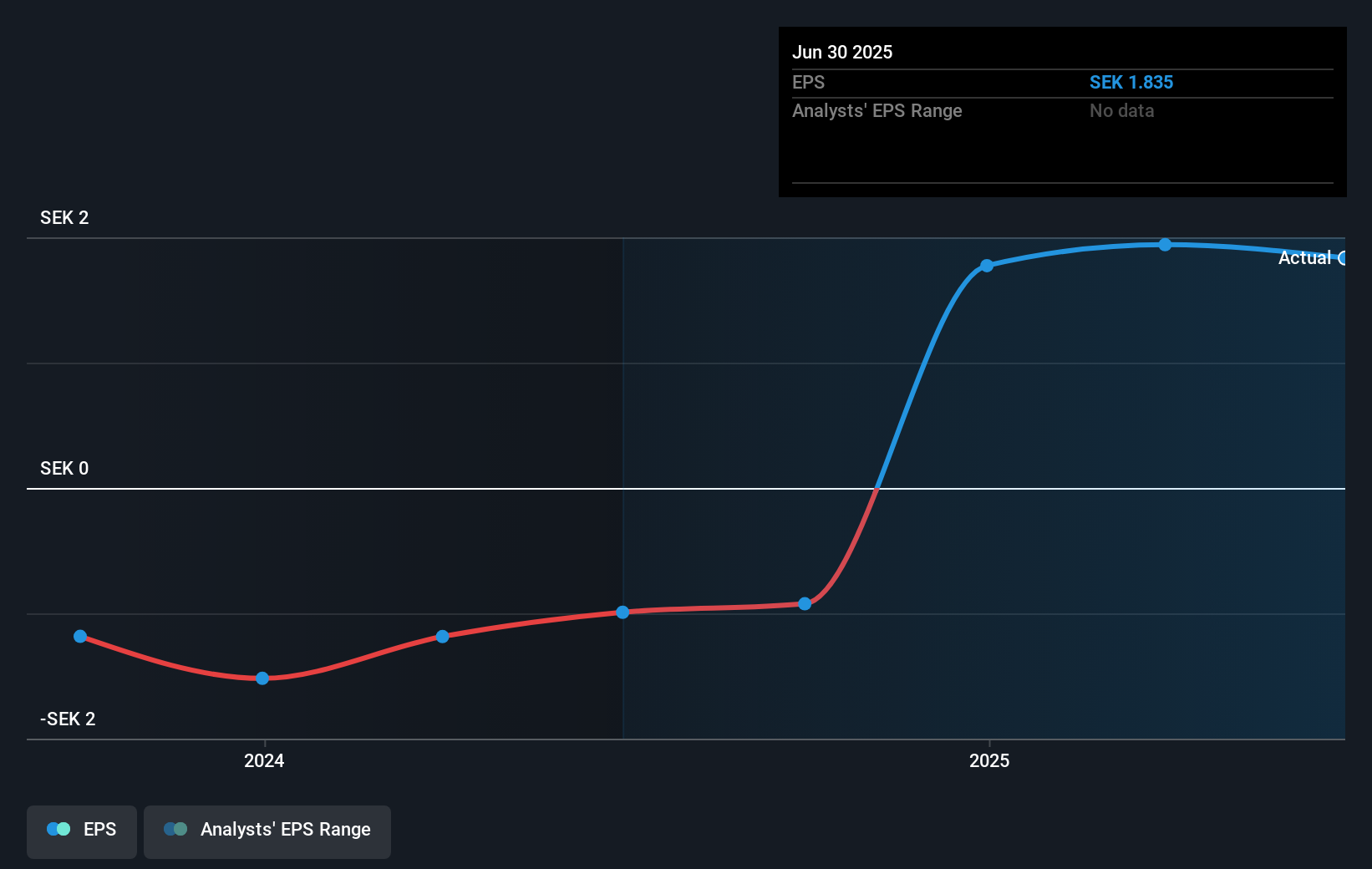

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, Saniona moved from a loss to profitability. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Saniona has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Saniona stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Saniona has rewarded shareholders with a total shareholder return of 161% in the last twelve months. Notably the five-year annualised TSR loss of 6% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 3 warning signs we've spotted with Saniona .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SANION

Saniona

A clinical-stage biopharmaceutical company, engages in the research, development, and commercialization of treatments for rare disease patients in Sweden, the United States, Germany, Denmark, and the United Kingdom.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success