Why Investors Shouldn't Be Surprised By Orexo AB (publ)'s (STO:ORX) 28% Share Price Plunge

Orexo AB (publ) (STO:ORX) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 153% in the last twelve months.

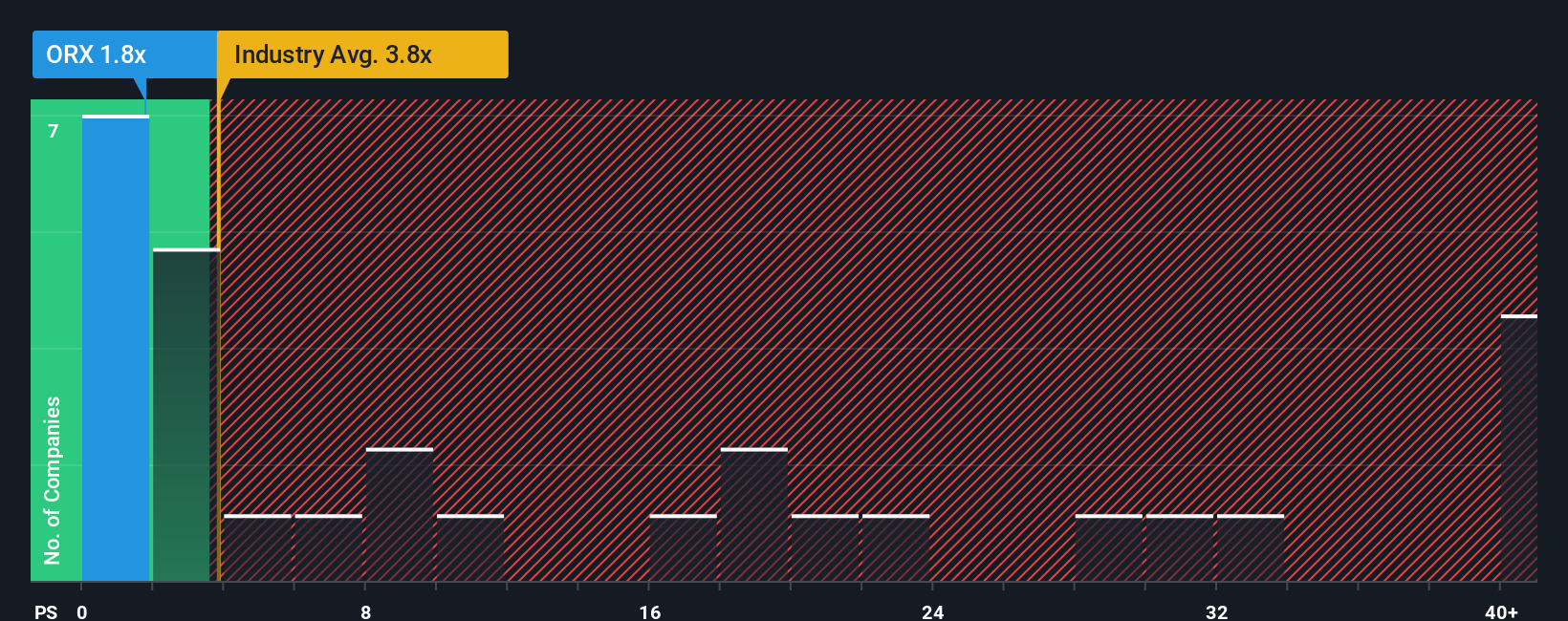

Following the heavy fall in price, Orexo may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.8x, since almost half of all companies in the Pharmaceuticals industry in Sweden have P/S ratios greater than 16.4x and even P/S higher than 35x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Orexo

What Does Orexo's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Orexo's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Orexo's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Orexo?

The only time you'd be truly comfortable seeing a P/S as depressed as Orexo's is when the company's growth is on track to lag the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.8%. This means it has also seen a slide in revenue over the longer-term as revenue is down 11% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue growth is heading into negative territory, declining 7.0% over the next year. That's not great when the rest of the industry is expected to grow by 51%.

With this in consideration, we find it intriguing that Orexo's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Shares in Orexo have plummeted and its P/S has followed suit. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Orexo's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, Orexo's poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for Orexo (1 is potentially serious!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Orexo, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ORX

Orexo

A specialty pharmaceutical company, develops and commercializes pharmaceuticals and digital therapies in the United States, European Union, the United Kingdom, and internationally.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives