Oncopeptides (OM:ONCO): Losses Narrow 43% Annually, Growth Outlook Sharpens Valuation Debate

Reviewed by Simply Wall St

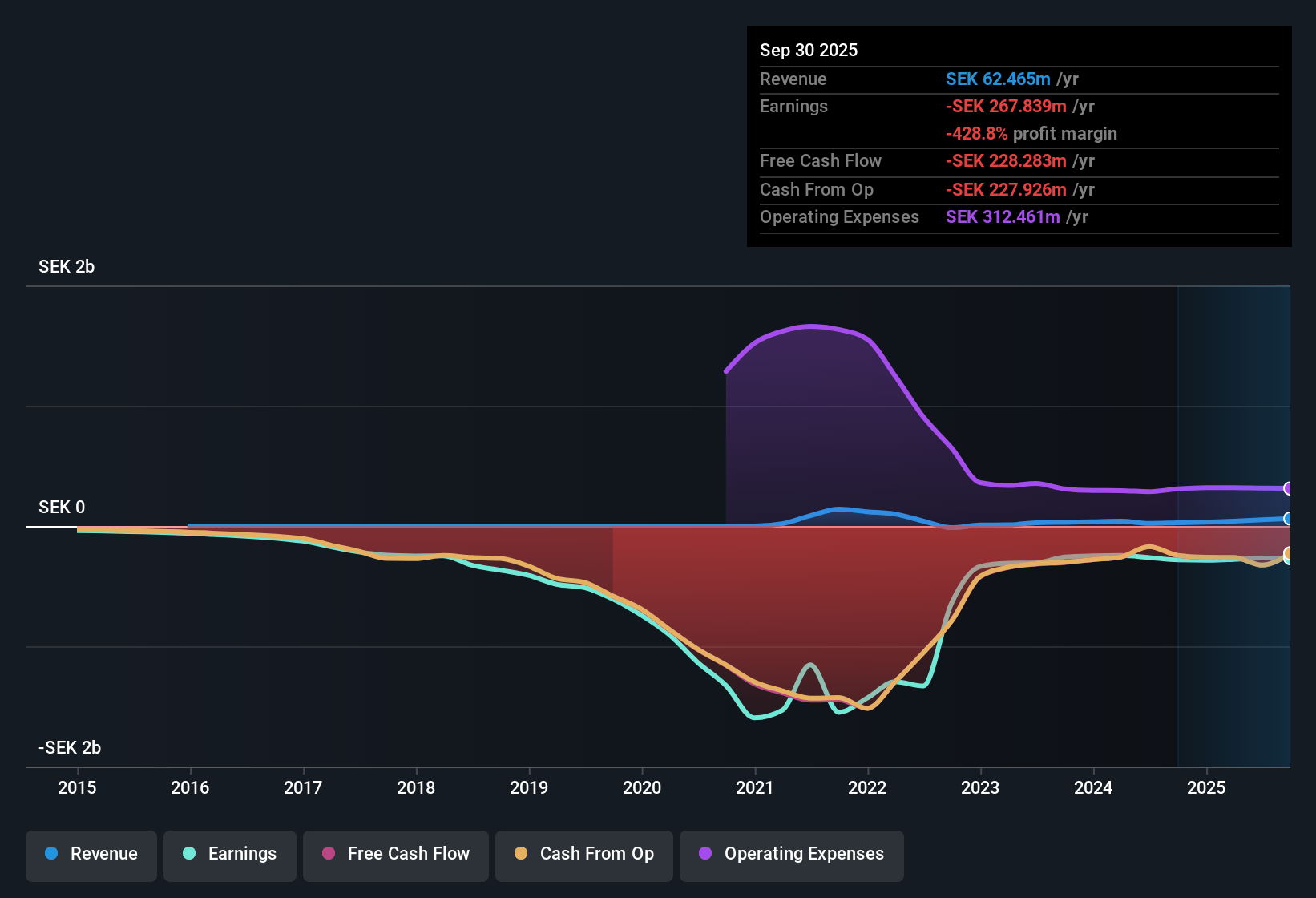

Oncopeptides (OM:ONCO) remains unprofitable, but has aggressively narrowed its losses by 43.3% per year over the past five years. With earnings expected to surge by 95.25% each year and profitability projected within the next three years, investors have plenty to weigh against near-term risks as the company targets annual revenue growth of 71.2%, far outpacing the wider Swedish market.

See our full analysis for Oncopeptides.The next step is to see how these figures compare with the broader market narratives that surround Oncopeptides, revealing where the numbers support consensus views and where they might challenge expectations.

See what the community is saying about Oncopeptides

Pepaxti Sales Drive Margin Recovery

- Operating margins are under pressure as Oncopeptides remains unprofitable, but three consecutive quarters of over 30% revenue growth for Pepaxti demonstrate real progress toward absorbing fixed costs and stabilizing expenses.

- Analysts' consensus view highlights that strict cost controls and a rapidly expanding European market for Pepaxti are expected to support sustainable margin improvement.

- Consensus notes Oncopeptides' positive real-world data and ongoing inclusion in clinical guidelines accelerate revenue, creating a pathway to potential cash flow positivity by 2026.

- The company’s efficient cost discipline means higher sales volumes could soon turn into stronger earnings, reinforcing the sustainable growth thesis from consensus analysts.

See what the community thinks about Oncopeptides’ growth trajectory and where analysts agree or diverge in their narrative. 📊 Read the full Oncopeptides Consensus Narrative.

Product Concentration Signals Risk

- Oncopeptides relies almost entirely on one drug, Pepaxti, for revenue streams. This introduces material product concentration risk if adoption slows, adverse data emerges, or superior therapies reach the market.

- Analysts' consensus narrative underlines that while management is pursuing new partnerships and pipeline development, the risk remains that a stumbling block in Pepaxti’s performance—whether through regulatory setbacks or competition—could trigger revenue volatility and threaten the company’s path to consistent profitability.

- Critics highlight that without rapid progress in pipeline expansion or closing new licensing deals (such as those in Japan), future earnings and cash flows may remain highly sensitive to a single product’s fate.

- Consensus also flags the need for continuous funding, as ongoing rights issues and reliance on short-term credit lines point to a precarious financial position if sales momentum fails to meet aggressive targets.

Valuation: Premium to Industry, Discount to Peers

- Oncopeptides trades at a 20.9x Price-to-Sales Ratio, which is more than double the Swedish Biotech industry average of 8.7x and at a notable discount to its direct biotech peer group, which sits at 28.9x.

- According to the analysts' consensus, the market is valuing Oncopeptides’ high-growth narrative with a premium to industry despite continued losses. This reflects investor willingness to pay up for revenue momentum but not fully pricing in material execution and concentration risks.

- The current share price of SEK4.78 is 13.3% below the analyst target of SEK5.50, indicating the market still sees upside but remains cautious about the company’s ability to deliver on ambitious sales and earnings targets.

- Consensus urges investors to critically assess whether expected growth and margin recovery are enough to justify the current valuation premium given competitive pressures and need for further funding.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Oncopeptides on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

View the financials from a new perspective. Craft your take on Oncopeptides’ story in just a few minutes: Do it your way.

A great starting point for your Oncopeptides research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite rapid growth, Oncopeptides faces risks from its dependence on a single product and ongoing financial uncertainty if Pepaxti’s performance falters.

Want more resilient opportunities? Check out solid balance sheet and fundamentals stocks screener (1977 results) to discover companies with stronger balance sheets and less risk from single-product reliance or funding issues.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ONCO

Oncopeptides

A biotech company, engages in the research, development, and commercialization of targeted therapies for difficult-to-treat hematological diseases in the United States, Europe, and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives