- Sweden

- /

- Life Sciences

- /

- OM:MCAP

MedCap (OM:MCAP) Margin Decline Raises Questions Despite Strong Revenue Growth Forecasts

Reviewed by Simply Wall St

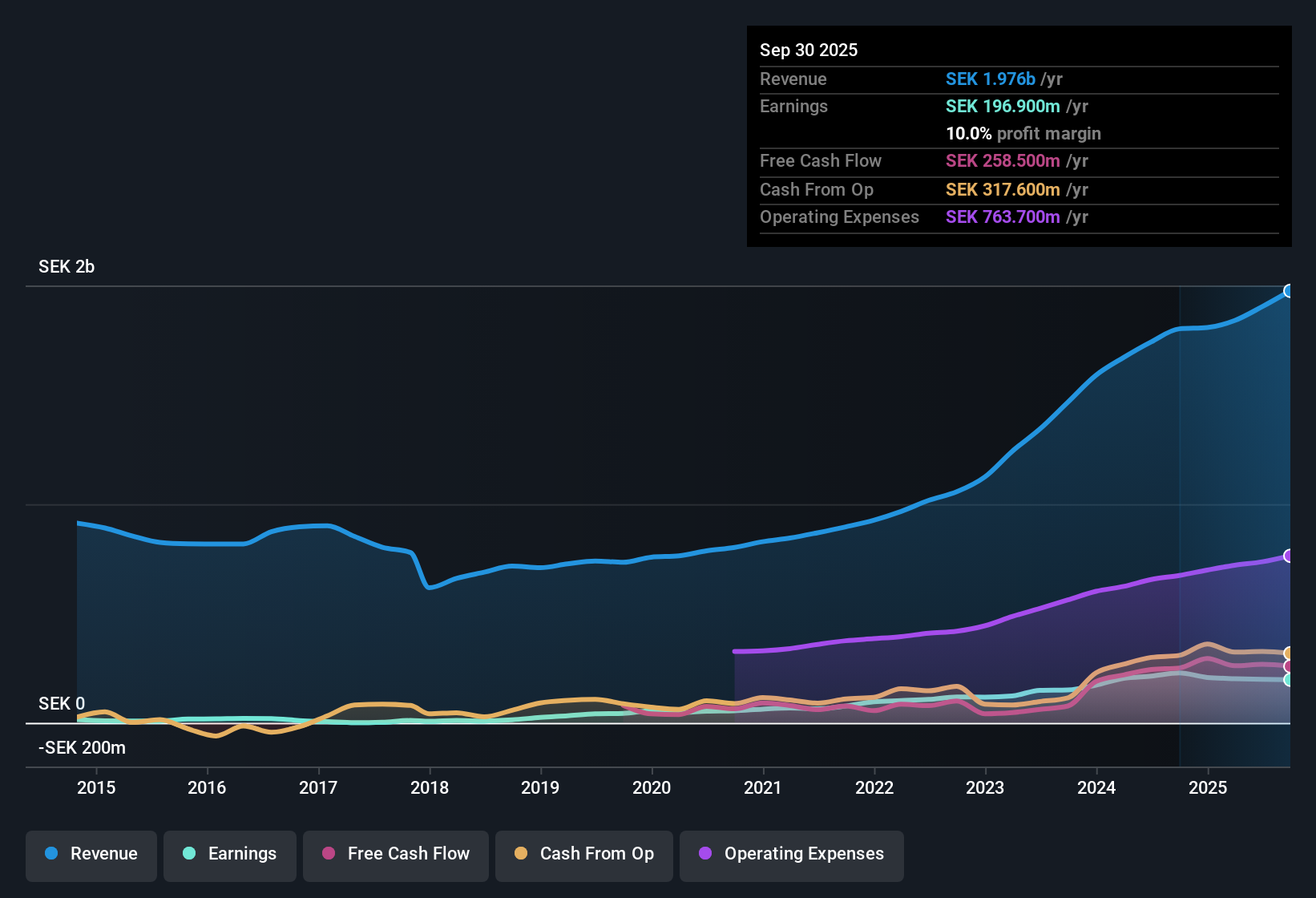

MedCap (OM:MCAP) delivered revenue growth forecasts of 13.2% per year, putting the broader Swedish market’s 3.8% annual pace in the shade. While the company’s net profit margin sits at 10% compared to last year’s 12.7%, the last five years saw average annual earnings growth of 25.9%, though the most recent year recorded a negative figure. For investors, robust long-term earnings growth, an ongoing top-line trajectory, and a share price that trades below intrinsic value estimates will likely shape the current valuation debate.

See our full analysis for MedCap.Next up, we will see how these results stack up against the market narratives. Some themes may get confirmed, while others could face new questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Retreats From Highs

- MedCap’s net profit margin is now 10%, a reduction from last year’s 12.7%, underscoring a notable shift after several robust years of expansion.

- The prevailing market view highlights that bulls may be challenged by this margin slide, which stands out against the backdrop of strong 25.9% average annual earnings growth over five years.

- What is surprising is that the latest year’s earnings growth turned negative despite this strong long-term trend.

- With margins narrowing, the sustainability of past profit momentum comes into question for those focused on bottom-line resilience.

Earnings Growth Averages Out Over Five Years

- Over the last five years, MedCap posted an impressive 25.9% average annual earnings growth rate, even as the most recent year showed a decline.

- Prevailing analysis contends that while such historical growth heavily supports the bullish case, the recent annual dip signals that past gains are not guaranteed to continue at the same pace.

- Bulls may point to the above-market revenue forecasts and past earnings success, but persistent achievement will depend on reversing this latest downturn.

- Investors should weigh whether the negative shift is a temporary blip or hints at a longer-term moderation in growth, especially as new revenue predictions are tested.

Valuation Discount Against DCF and Peers

- MedCap’s shares change hands at SEK607, below the DCF fair value of SEK670.91, and its price-earnings ratio of 46.4x sits under the peer average of 63.8x but above the European Life Sciences industry benchmark of 37.5x.

- The prevailing market view emphasizes that this valuation gap could make MedCap appear attractive to value-oriented investors, but the premium versus the sector suggests heightened expectations for future performance.

- The discount to intrinsic value, paired with high-quality earnings, presents a potential entry point, but the premium to the sector means investors expect sustained growth or outperformance.

- This creates a tension: bargain-hunters may find the DCF discount compelling, while others will question whether earnings growth can rebound to justify paying above the broader industry average.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on MedCap's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite strong long-term growth, MedCap’s latest yearly earnings dip and narrowing profit margins signal that its performance may be losing consistency.

If you’re seeking steadier results, discover stable growth stocks screener (2102 results) that deliver reliable growth and margins, even when the broader market momentum slows down.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MCAP

MedCap

A private equity firm specializing in investments in secondary direct, later stage, industry consolidation, add-on acquisitions, growth capital, middle market, mature, turnarounds, buyout.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives