Passive investing in index funds can generate returns that roughly match the overall market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Cellink AB (publ) (STO:CLNK B) share price is up 87% in the last year, clearly besting the market return of around -0.03% (not including dividends). That's a solid performance by our standards! Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

Check out our latest analysis for Cellink

We don't think that Cellink's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over the last twelve months, Cellink's revenue grew by 160%. That's well above most other pre-profit companies. While the share price gain of 87% over twelve months is pretty tasty, you might argue it doesn't fully reflect the strong revenue growth. So quite frankly it could be a good time to investigate Cellink in some detail. Human beings have trouble conceptualizing (and valuing) exponential growth. Is that what we're seeing here?

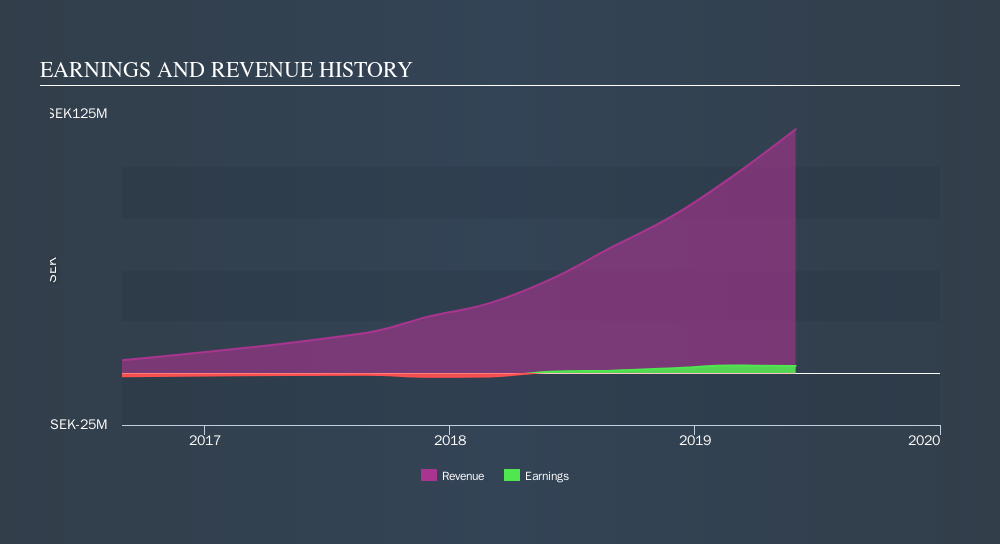

The company's revenue and earnings (over time) are depicted in the image below.

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. It might be well worthwhile taking a look at our free report on Cellink's earnings, revenue and cash flow.

A Different Perspective

Cellink shareholders should be happy with the total gain of 87% over the last twelve months. That's better than the more recent three month gain of 13%, implying that share price has plateaued recently. Having said that, we doubt shareholders would be concerned. It seems the market is simply waiting on more information, because if the business delivers so will the share price (eventually). It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OM:BICO

BICO Group

Provides hardware, laboratory automation, and software solutions in North America, Europe, Asia, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives