BioGaia (OM:BIOG B) Valuation in Focus After Launch of New Patented Probiotic Strain

Reviewed by Kshitija Bhandaru

BioGaia (OM:BIOG B) has just published details on its latest patented probiotic strain, L. reuteri BG-R46®. Developed in collaboration with the Swedish University of Agricultural Sciences, this new strain could enhance gut health and support anti-inflammatory benefits.

See our latest analysis for BioGaia.

After a steady string of research wins, including the recent debut of its BG-R46® strain, BioGaia's share price has shown moderate momentum. The most recent 90-day period saw a 4.7% gain, with a 5.1% total shareholder return over the past year. The company’s ongoing innovation continues to support confidence among long-term investors, even as short-term price swings reflect changing sentiment around new developments.

If you’re interested in spotting what else is sparking investor confidence, now’s a smart time to discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst targets, but innovation headlines arriving quickly, investors now face a pivotal question: Is BioGaia undervalued, or has the market already factored in all future growth?

Most Popular Narrative: 19% Undervalued

Enthusiasm is rising as BioGaia's narrative valuation stands notably above the current share price, suggesting a sizable gap yet to close. The stage is set for those seeking to understand what underpins this optimistic view.

Strong growth in the Adult Health segment (23% net of currency effects), increased uptake in North America, and expanding presence in major U.S. retail chains (CVS, Target, Walmart) indicate untapped revenue potential as global health awareness and preventative care become more mainstream. This is likely to drive sustained top-line growth.

What is fueling this bullish stance? The narrative is built on bold growth drivers, margin expansion, and a dramatic shift in key markets. The catalyst is ambitious profit forecasts and a premium future earnings multiple. Want the full picture? Find out what underlies this provocative fair value call.

Result: Fair Value of $130 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising operating expenses and slower than expected returns from new market investments could challenge the current outlook and pressure BioGaia’s earnings trajectory.

Find out about the key risks to this BioGaia narrative.

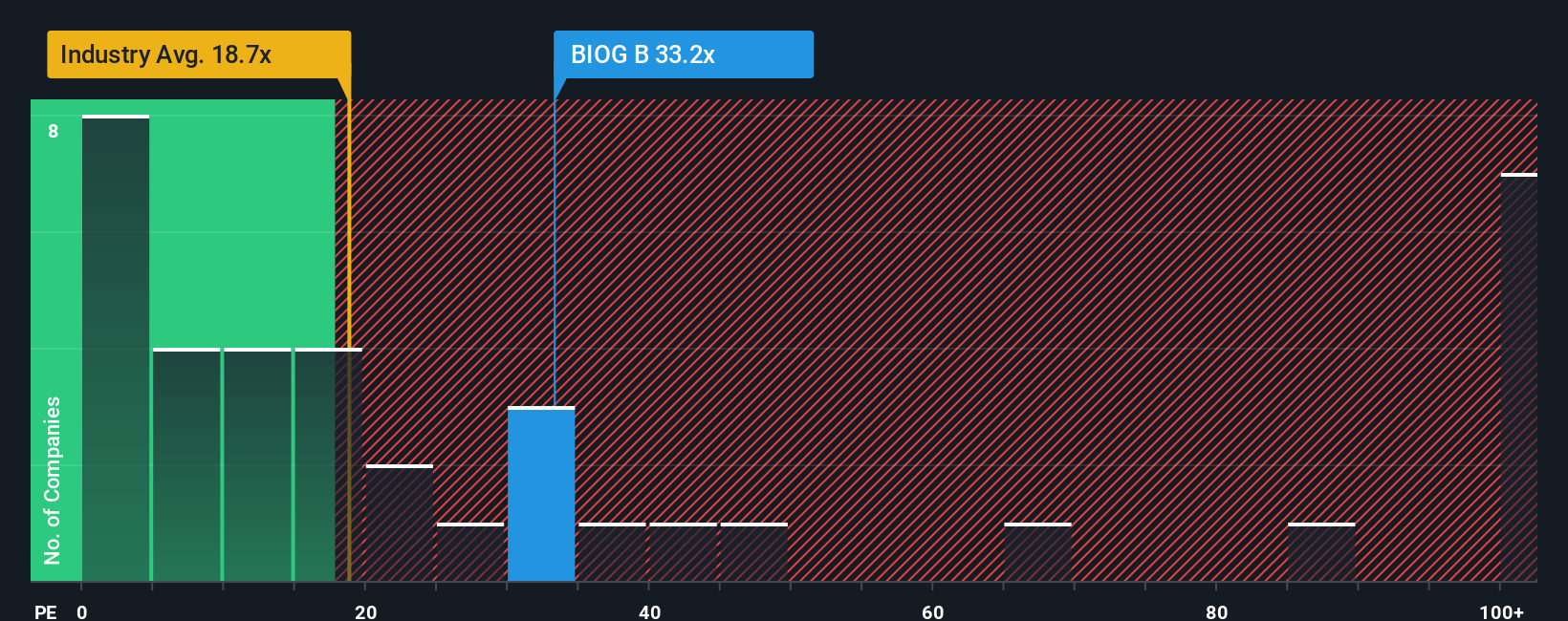

Another View: Multiples Send a Cautionary Signal

While analyst forecasts and narrative valuations see upside, the market's price-to-earnings ratio of 37.1x stands well above the European biotech sector’s average of 17.4x and even higher than BioGaia's own fair ratio of 35.2x. This premium could signal elevated expectations and more downside risk if performance disappoints. Are shares getting ahead of themselves?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BioGaia Narrative

If you see the story differently, or want to weigh your own research and perspective, you can create a fresh BioGaia narrative in just minutes with Do it your way

A great starting point for your BioGaia research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make sure you stay ahead in a competitive market. These handpicked categories can spark your next move toward smarter, future-focused investments.

- Capitalize on the potential of next-generation technology by checking out these 24 AI penny stocks reshaping industries with innovative breakthroughs.

- Take advantage of untapped growth with these 871 undervalued stocks based on cash flows, where strong fundamentals meet attractive entry points.

- Boost your passive income with these 20 dividend stocks with yields > 3% featuring companies offering steady yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioGaia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOG B

BioGaia

A healthcare company, develops, manufactures, markets and sells probiotic products for gut, oral, and immune health in Europe, the Middle East, Africa, the United States, the Asia-Pacific, Australia, and New Zealand.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives