Stock Analysis

As Sweden's Riksbank reduces borrowing costs, the Swedish tech sector is poised for potential growth amidst favorable economic conditions. In this article, we will explore three high-growth tech stocks in Sweden that stand out due to their innovative capabilities and strong market positioning.

Top 10 High Growth Tech Companies In Sweden

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Truecaller | 20.32% | 21.61% | ★★★★★★ |

| Fortnox | 20.18% | 22.60% | ★★★★★★ |

| Bonesupport Holding | 33.76% | 31.20% | ★★★★★★ |

| Xbrane Biopharma | 58.82% | 99.79% | ★★★★★★ |

| Skolon | 31.76% | 121.72% | ★★★★★★ |

| Yubico | 22.52% | 43.69% | ★★★★★★ |

| Hemnet Group | 20.13% | 25.41% | ★★★★★★ |

| Sileon | 45.80% | 116.53% | ★★★★★★ |

| BioArctic | 39.57% | 102.80% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Better Collective (OM:BETCO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Better Collective A/S, along with its subsidiaries, operates as a digital sports media company in Europe, North America, and internationally with a market cap of SEK14.49 billion.

Operations: The company generates revenue primarily through its Publishing and Paid Media segments, with Publishing contributing €245.06 million and Paid Media €109.72 million.

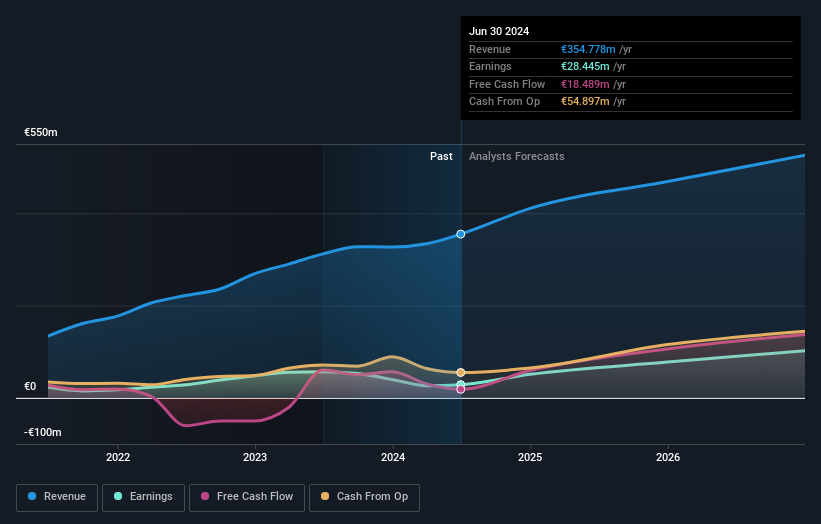

Better Collective's recent financial performance highlights its strong growth trajectory, with Q2 2024 sales reaching €99.12 million, a 27% increase from the previous year. Net income for the same period rose to €10.29 million, up from €8.3 million. The company's R&D expenses have consistently driven innovation in their software offerings, contributing to their revenue growth of 15% annually and earnings forecasted to grow at an impressive rate of 45.5%. Additionally, Better Collective has initiated a share repurchase program worth €2.4 million to cover acquisition obligations, reflecting confidence in its future prospects and commitment to shareholder value.

- Get an in-depth perspective on Better Collective's performance by reading our health report here.

Evaluate Better Collective's historical performance by accessing our past performance report.

BioInvent International (OM:BINV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BioInvent International AB (publ) is a clinical-stage company focused on discovering, researching, and developing novel immuno-modulatory antibodies for cancer treatment globally, with a market cap of SEK2.55 billion.

Operations: BioInvent International generates revenue primarily from developing antibody-based drugs, amounting to SEK61.15 million. The company focuses on cancer treatment through novel immuno-modulatory antibodies across various regions including Sweden, Europe, and the United States.

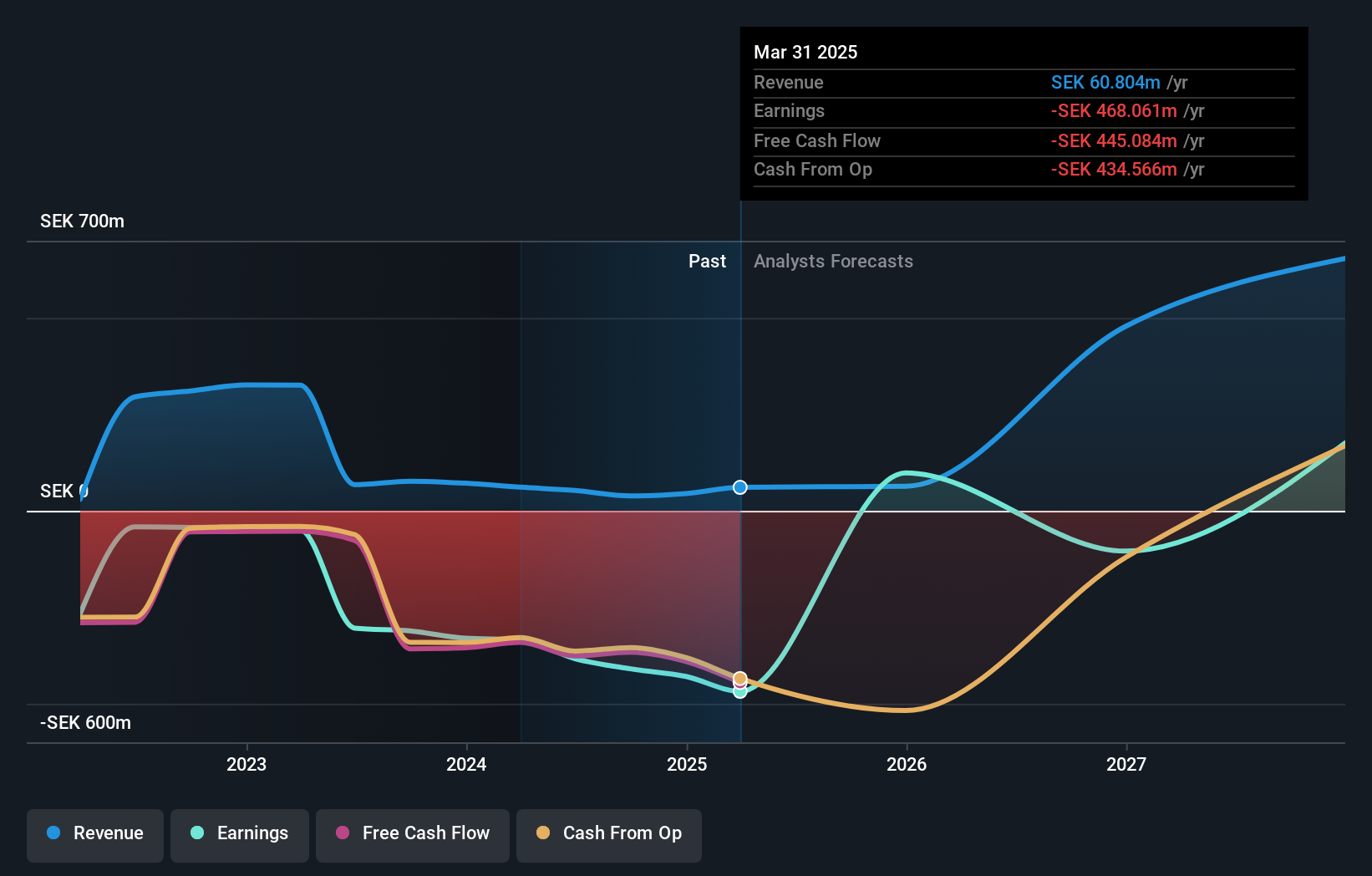

BioInvent International is making significant strides in the biotech sector, particularly with its anti-TNFR2 antibody BI-1910, which recently received a Notice of Allowance from the USPTO. The company's R&D expenses have been pivotal, contributing to their forecasted revenue growth of 55.8% annually and an expected earnings increase of 89% per year. Although currently unprofitable, BioInvent's innovative approach in immunomodulatory agents like BI-1808 shows promise for future cancer therapies and profitability within three years.

- Click here to discover the nuances of BioInvent International with our detailed analytical health report.

Assess BioInvent International's past performance with our detailed historical performance reports.

Storytel (OM:STORY B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Storytel AB (publ) offers streaming services for audiobooks and e-books, with a market cap of SEK3.98 billion.

Operations: Storytel AB (publ) generates revenue primarily from its audiobooks and e-books streaming services, with a significant portion of SEK825.91 million coming from books. The company also has segment adjustments amounting to SEK3.46 billion.

Storytel's revenue is forecast to grow at 9.9% annually, outpacing the Swedish market's 1.1%. The company reported Q2 sales of SEK 924.49 million, up from SEK 851.07 million last year, and net income of SEK 29.22 million compared to a loss of SEK 31.72 million previously. With R&D expenses contributing significantly to its innovative audiobook platform, Storytel expects earnings growth of approximately 108.8% per year over the next three years, signaling strong future prospects in digital media consumption trends.

- Unlock comprehensive insights into our analysis of Storytel stock in this health report.

Gain insights into Storytel's past trends and performance with our Past report.

Next Steps

- Gain an insight into the universe of 81 Swedish High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:STORY B

Storytel

Provides audiobooks and e-books streaming services.