- Sweden

- /

- Commercial Services

- /

- OM:ITAB

Uncovering Hidden Gems In Sweden Featuring Three Promising Stocks

Reviewed by Simply Wall St

As global markets react to China's robust stimulus measures and the U.S. stock indices reach record highs, European markets have shown resilience with the pan-European STOXX Europe 600 Index rebounding significantly. Amid this backdrop, Sweden's economic landscape offers intriguing opportunities for investors seeking hidden gems in the small-cap sector. Identifying promising stocks often involves looking at companies that can capitalize on current market conditions and broader economic trends. In Sweden, several small-cap companies are well-positioned to benefit from these dynamics, making them potential candidates for closer examination.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Svolder | NA | -22.68% | -24.17% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Creades | NA | -28.54% | -27.09% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Creades (OM:CRED A)

Simply Wall St Value Rating: ★★★★★★

Overview: Creades AB is a private equity and venture capital investment firm specializing in various stages of venture and growth investments, with a market cap of SEK11.06 billion.

Operations: Creades derives its revenue primarily from online retailers, amounting to SEK1.11 billion.

Creades, a small cap Swedish investment company, has shown impressive earnings growth of 129.4% over the past year, outpacing the Diversified Financial industry’s 80.2%. The firm reported a net income of SEK 771 million for Q2 2024 compared to a net loss of SEK 299 million last year. Its price-to-earnings ratio stands at an attractive 10.1x versus the Swedish market average of 23.9x, highlighting its value potential.

- Dive into the specifics of Creades here with our thorough health report.

Explore historical data to track Creades' performance over time in our Past section.

ITAB Shop Concept (OM:ITAB)

Simply Wall St Value Rating: ★★★★★★

Overview: ITAB Shop Concept AB (publ) specializes in solution design, customized shop fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for physical stores with a market cap of SEK7.65 billion.

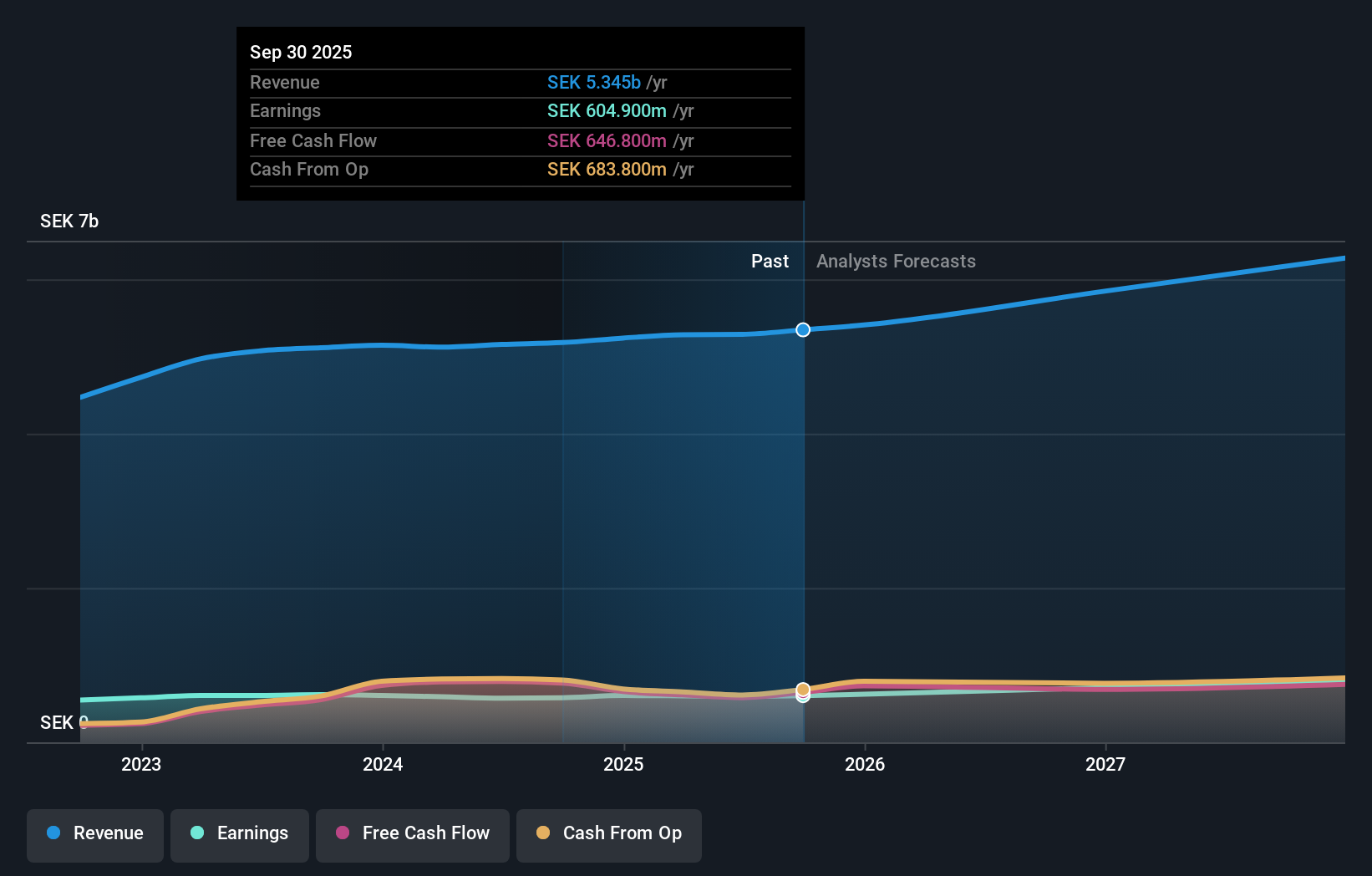

Operations: ITAB Shop Concept AB (publ) generates revenue primarily from its Furniture & Fixtures segment, which reported SEK6.39 billion. The company’s net profit margin trends provide insights into its profitability.

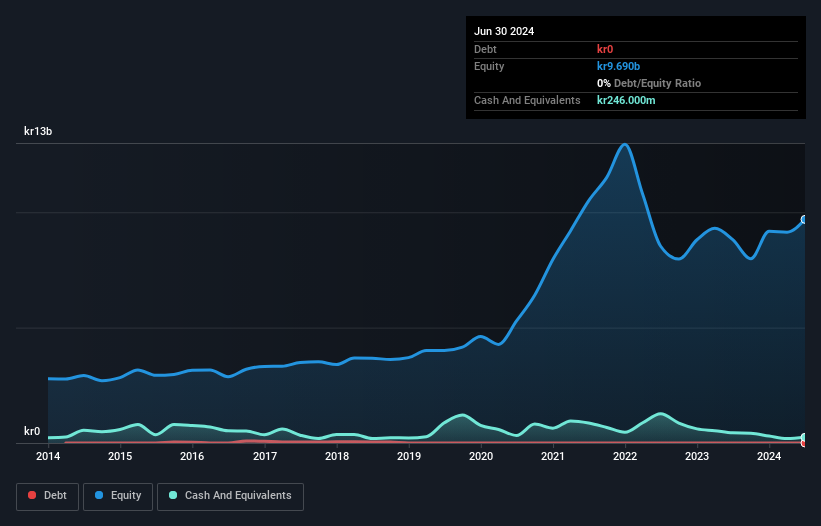

ITAB Shop Concept has shown significant improvement, reducing its debt to equity ratio from 137.6% to 20% over the past five years. The company is trading at 3.7% below our estimate of fair value and has a satisfactory net debt to equity ratio of 8.8%. Earnings grew by an impressive 56.7% last year, outpacing the industry’s -2%. Recent contracts worth EUR 42 million highlight ITAB's growing market presence in Europe and the UK.

- Get an in-depth perspective on ITAB Shop Concept's performance by reading our health report here.

Understand ITAB Shop Concept's track record by examining our Past report.

OEM International (OM:OEM B)

Simply Wall St Value Rating: ★★★★★★

Overview: OEM International AB (publ), together with its subsidiaries, provides products and systems for industrial applications, and has a market cap of SEK16.28 billion.

Operations: The company's revenue primarily comes from Sweden (SEK 3.28 billion), followed by Denmark, Norway, the British Isles, and East Central Europe (SEK 1.20 billion), and Finland, the Baltic States, and China (SEK 1.05 billion). Segment adjustments contribute SEK 136.10 million to the overall revenue while eliminations reduce it by SEK 504.60 million.

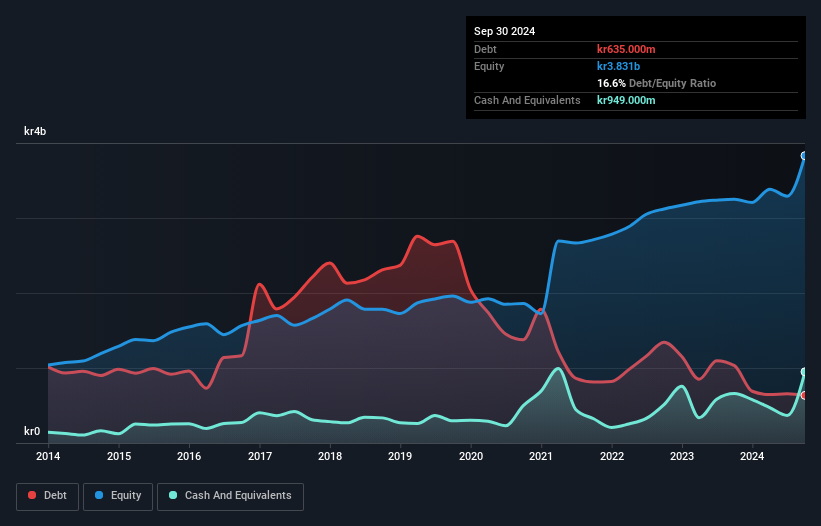

OEM International has seen its debt to equity ratio drop from 29.7% to 2% over the past five years, indicating a stronger balance sheet. Despite trading at 61.3% below its estimated fair value, recent earnings growth was negative at -5.9%, underperforming the industry average of 1.3%. The company reported SEK 1,331 million in sales for Q2 2024 and SEK 139 million in net income, down from SEK 157 million a year ago, with basic EPS dropping to SEK 1.01 from SEK 1.13.

Where To Now?

- Access the full spectrum of 58 Swedish Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ITAB

ITAB Shop Concept

Provides solution design, customized shop fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for the physical stores.

Flawless balance sheet with solid track record and pays a dividend.