Slammed 27% Nepa AB (publ) (STO:NEPA) Screens Well Here But There Might Be A Catch

Nepa AB (publ) (STO:NEPA) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. The recent drop has obliterated the annual return, with the share price now down 3.7% over that longer period.

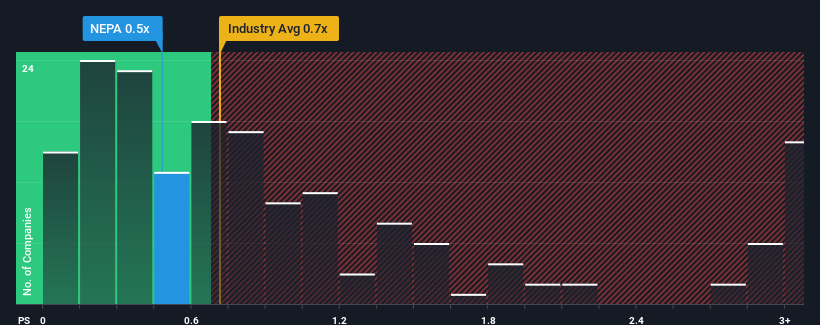

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Nepa's P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Media industry in Sweden is about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Nepa

How Has Nepa Performed Recently?

Nepa could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Nepa will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Nepa?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Nepa's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.7%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 5.1% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 5.8% per annum as estimated by the one analyst watching the company. With the industry only predicted to deliver 1.9% each year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Nepa's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Nepa looks to be in line with the rest of the Media industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Nepa's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you take the next step, you should know about the 3 warning signs for Nepa (1 is a bit unpleasant!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Nepa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NEPA

Nepa

Operates as a consumer research and analytics company in Sweden and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives