- Sweden

- /

- Entertainment

- /

- OM:MTG B

Does MTG’s Share Buyback Reflect a Shift in Capital Allocation Priorities for OM:MTG B?

Reviewed by Sasha Jovanovic

- Modern Times Group MTG announced in October 2025 that it had started a share repurchase program, following authorization from its May 2025 Annual General Meeting, with plans to buy back up to 12,203,000 shares, representing 10% of its issued share capital, or spend up to SEK400 million by May 2026.

- This buyback program allows MTG not only to enhance long-term shareholder value and returns but also to provide shares for its long-term incentive initiatives.

- With the share buyback program underway, we'll evaluate how this added capital allocation tool influences MTG's investment outlook and flexibility.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Modern Times Group MTG Investment Narrative Recap

Owning shares in Modern Times Group MTG means believing in the company’s ability to grow and monetize its mobile games and e-sports portfolio while efficiently allocating capital to enhance shareholder value. The launch of the SEK400 million share buyback program in October 2025 may support near-term sentiment, but it does not significantly alter the immediate catalysts or biggest risk: whether MTG can sustain growth in its top-performing titles and improve per-user revenue remains the dominant focus for investors.

The recent upward revision of earnings guidance to 7%–9% organic growth in 2025 stands out as especially relevant. This forecast aligns with management’s commitment to expanding revenues and could provide important context for how the buyback program interacts with ongoing efforts to drive organic top-line growth and support longer-term profitability targets. Despite the more active capital allocation, investors should not overlook the fact that ...

Read the full narrative on Modern Times Group MTG (it's free!)

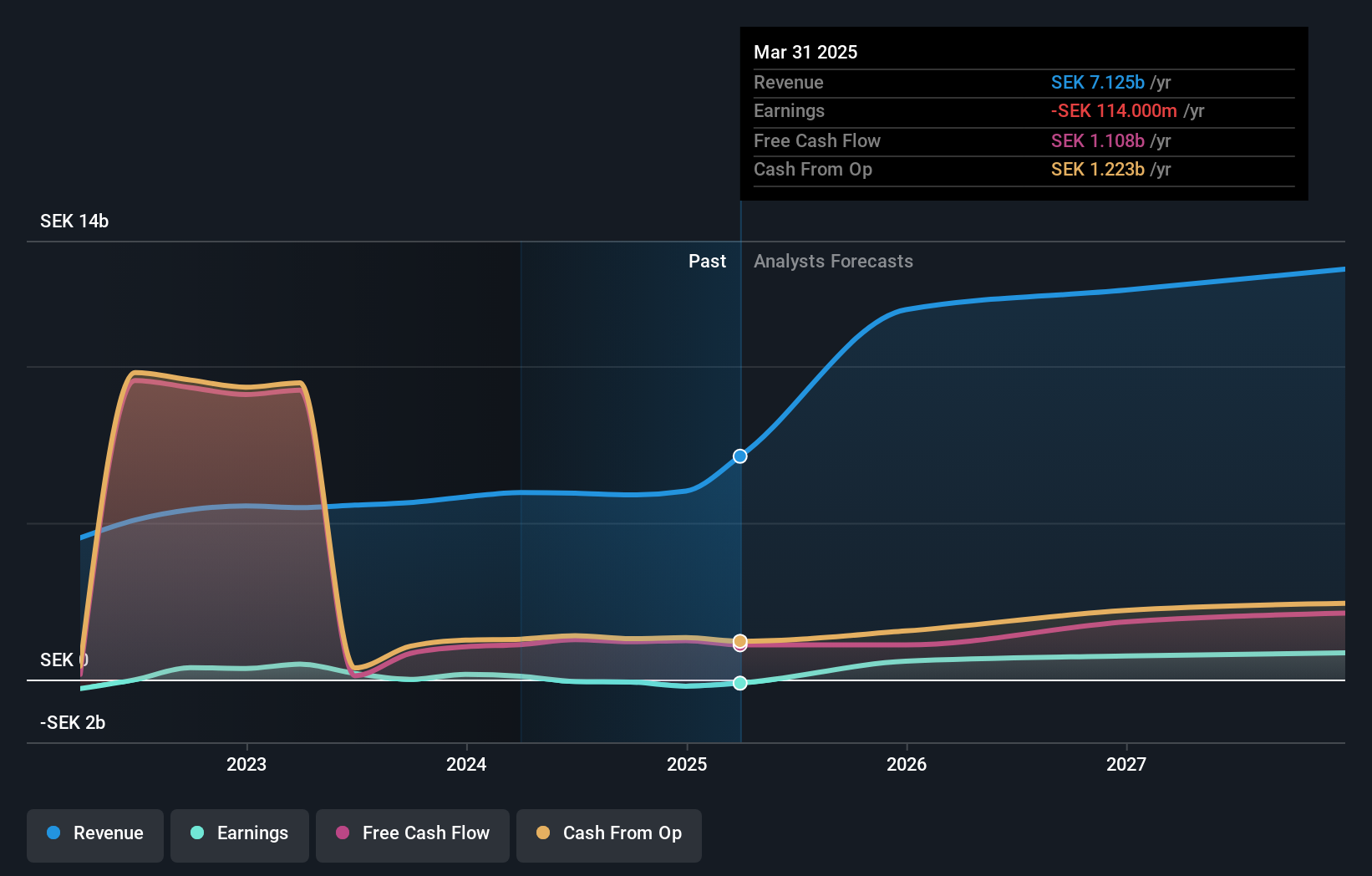

Modern Times Group MTG is projected to reach SEK14.3 billion in revenue and SEK1.2 billion in earnings by 2028. This outlook assumes an annual revenue growth rate of 18.6% and a SEK1.26 billion increase in earnings from the current level of SEK -64.0 million.

Uncover how Modern Times Group MTG's forecasts yield a SEK138.33 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community users estimate MTG’s fair value between SEK138 and SEK342 per share, showcasing wide differences in expectations. Keep in mind the business’s ongoing dependence on its top-performing games as you review these varying outlooks.

Explore 3 other fair value estimates on Modern Times Group MTG - why the stock might be worth just SEK138.33!

Build Your Own Modern Times Group MTG Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Modern Times Group MTG research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Modern Times Group MTG research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Modern Times Group MTG's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MTG B

Modern Times Group MTG

Through its subsidiaries, engages in the provision of game franchises in Sweden, the United Kingdom, Germany, rest of Europe, Singapore, India, the United States, and New Zealand.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives