- Sweden

- /

- Entertainment

- /

- OM:FRAG

Fragbite Group AB (publ) (STO:FRAG) Soars 62% But It's A Story Of Risk Vs Reward

Those holding Fragbite Group AB (publ) (STO:FRAG) shares would be relieved that the share price has rebounded 62% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 99% share price decline over the last year.

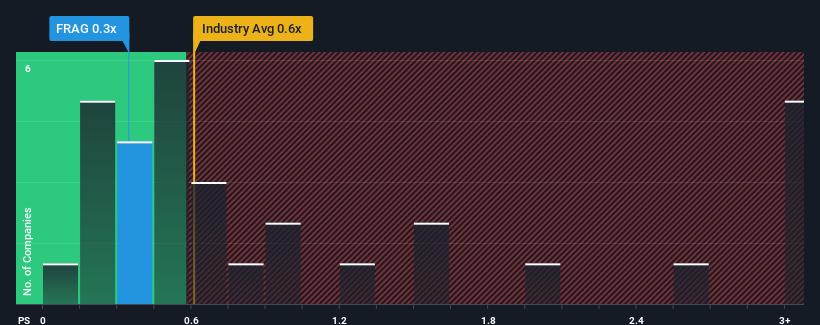

Although its price has surged higher, there still wouldn't be many who think Fragbite Group's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Sweden's Entertainment industry is similar at about 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Fragbite Group

What Does Fragbite Group's P/S Mean For Shareholders?

Fragbite Group's revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fragbite Group.How Is Fragbite Group's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Fragbite Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 4.1%. While this performance is only fair, the company was still able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue growth will be highly resilient over the next year growing by 90%. With the rest of the industry predicted to shrink by 0.8%, that would be a fantastic result.

In light of this, it's peculiar that Fragbite Group's P/S sits in-line with the majority of other companies. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

What Does Fragbite Group's P/S Mean For Investors?

Fragbite Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We note that even though Fragbite Group trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. There could be some unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. The market could be pricing in the event that tough industry conditions will impact future revenues. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 4 warning signs for Fragbite Group that we have uncovered.

If you're unsure about the strength of Fragbite Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:FRAG

Fragbite Group

Develops and publishes games and esports content for the GAMING, ESPORTS, and WEB3 markets in the Nordic region.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.