- Sweden

- /

- Entertainment

- /

- OM:EG7

Enad Global 7 AB (publ)'s (STO:EG7) Shares Leap 27% Yet They're Still Not Telling The Full Story

Enad Global 7 AB (publ) (STO:EG7) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 15% over that time.

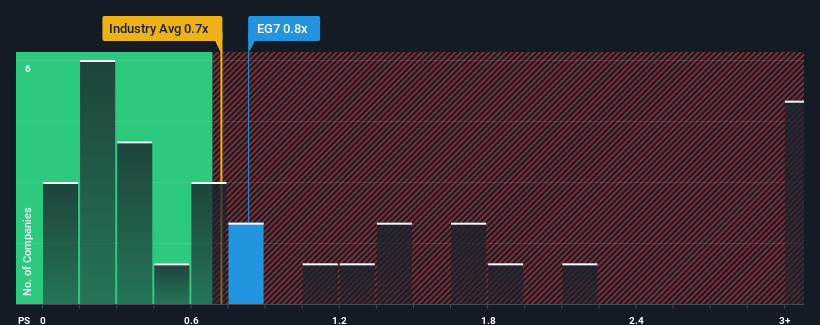

Although its price has surged higher, there still wouldn't be many who think Enad Global 7's price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S in Sweden's Entertainment industry is similar at about 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Enad Global 7

What Does Enad Global 7's Recent Performance Look Like?

With revenue that's retreating more than the industry's average of late, Enad Global 7 has been very sluggish. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Enad Global 7.Do Revenue Forecasts Match The P/S Ratio?

Enad Global 7's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 49% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 13% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 1.8%, which is noticeably less attractive.

In light of this, it's curious that Enad Global 7's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Enad Global 7's P/S Mean For Investors?

Enad Global 7 appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Enad Global 7's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Enad Global 7 (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Enad Global 7 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:EG7

Enad Global 7

Develops, publishes, markets, and distributes games in PC, console, and mobile platforms in Sweden, rest of Europe, North America, South America, Asia, Africa, and the Oceania.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success