- Sweden

- /

- Entertainment

- /

- OM:EG7

Enad Global 7 AB (publ)'s (STO:EG7) 28% Share Price Surge Not Quite Adding Up

Enad Global 7 AB (publ) (STO:EG7) shareholders have had their patience rewarded with a 28% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 36% over that time.

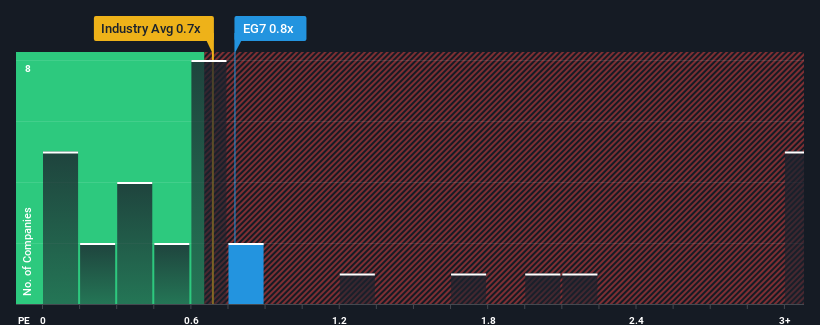

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Enad Global 7's P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Entertainment industry in Sweden is also close to 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Enad Global 7

How Has Enad Global 7 Performed Recently?

Enad Global 7 could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Enad Global 7.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Enad Global 7's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.9%. Even so, admirably revenue has lifted 142% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the sole analyst covering the company are not good at all, suggesting revenue should decline by 8.8% over the next year. The industry is also set to see revenue decline 3.8% but the stock is shaping up to perform materially worse.

With this information, it's perhaps strange that Enad Global 7 is trading at a fairly similar P/S in comparison. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Enad Global 7's P/S?

Enad Global 7's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Enad Global 7's analyst forecasts have revealed that its even shakier outlook against the industry isn't impacting its P/S as much as we would have predicted. It's not unusual in cases where revenue growth is poor, that the share price declines, sending the moderate P/S lower relative to the industry. In addition, we would be concerned whether the company can even maintain this level of performance under these tough industry conditions. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Enad Global 7 that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Enad Global 7 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EG7

Enad Global 7

Develops, publishes, markets, and distributes games in PC, console, and mobile platforms in Sweden, rest of Europe, North America, South America, Asia, Africa, and the Oceania.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success